Quick Take

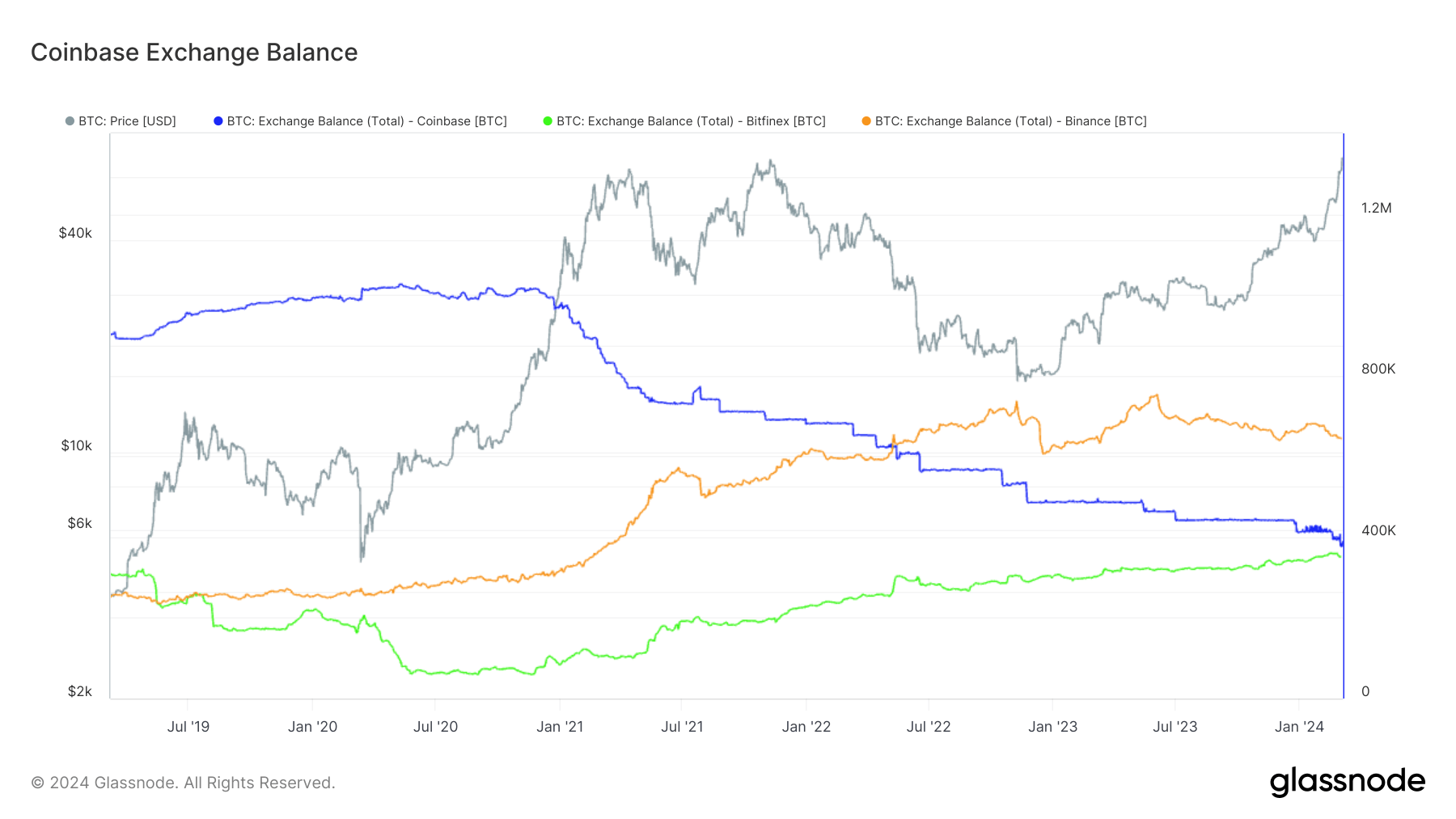

Substantial outflows of Bitcoin from exchanges have been a hallmark trend on Coinbase since March 2020. Notably, Coinbase, once the leading Bitcoin holder of exchanges, has experienced a significant decrease in its Bitcoin reserves. In the wake of colossal outflows on Feb. 19 and March 1, each equalling roughly $1 billion, Coinbase is set to become the third-largest Bitcoin holding exchange, according to Glassnode.

Providing a snapshot of this change, Glassnode data indicates a reduction of approximately 633,000 Bitcoin since March 2020. While Coinbase previously held just over a million Bitcoin, it now reportedly maintains a reserve of around 385,000 BTC.

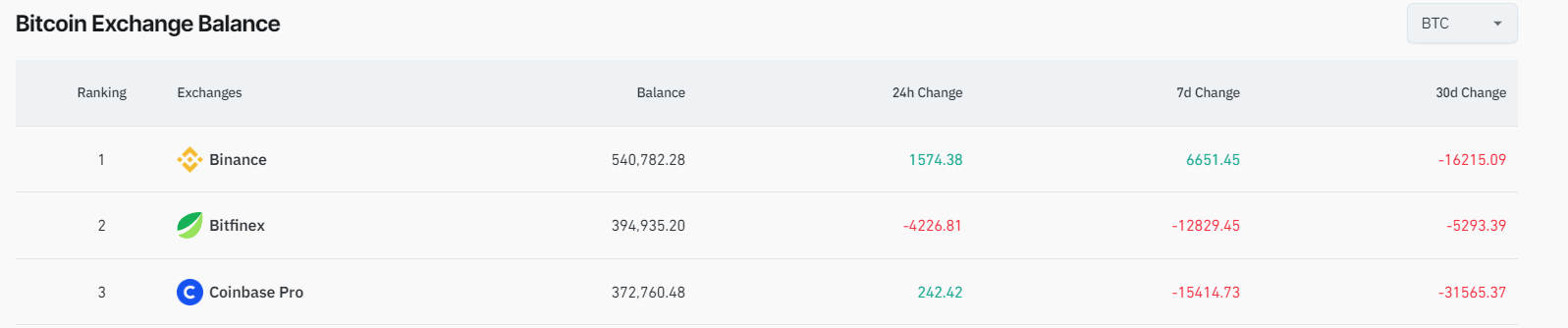

CoinGlass reports Coinbase’s Bitcoin holdings at approximately 373,000, ranking it third. CoinGlass notes Bitfinex as holding the second-largest amount, around 395,000 BTC. Binance leads in Bitcoin holdings, with a discrepancy in reports between Glassnode and CoinGlass, indicating a range between 640,000 and 540,000 BTC, amounting to a difference of about 100,000 BTC.

Disclaimer:

Coinbase offers three distinct services: Coinbase, Coinbase Custody, and Coinbase Prime. This insight focuses solely on the Coinbase exchange, tailored for individual retail investors.

In addition, tracking all wallets associated with exchanges poses significant challenges, leading to discrepancies from data providers. However, CryptoSlate focuses on monitoring long-term trends over extended periods to ensure accuracy.

The post Coinbase slips to third in Bitcoin reserves following massive outflows – CoinGlass appeared first on CryptoSlate.