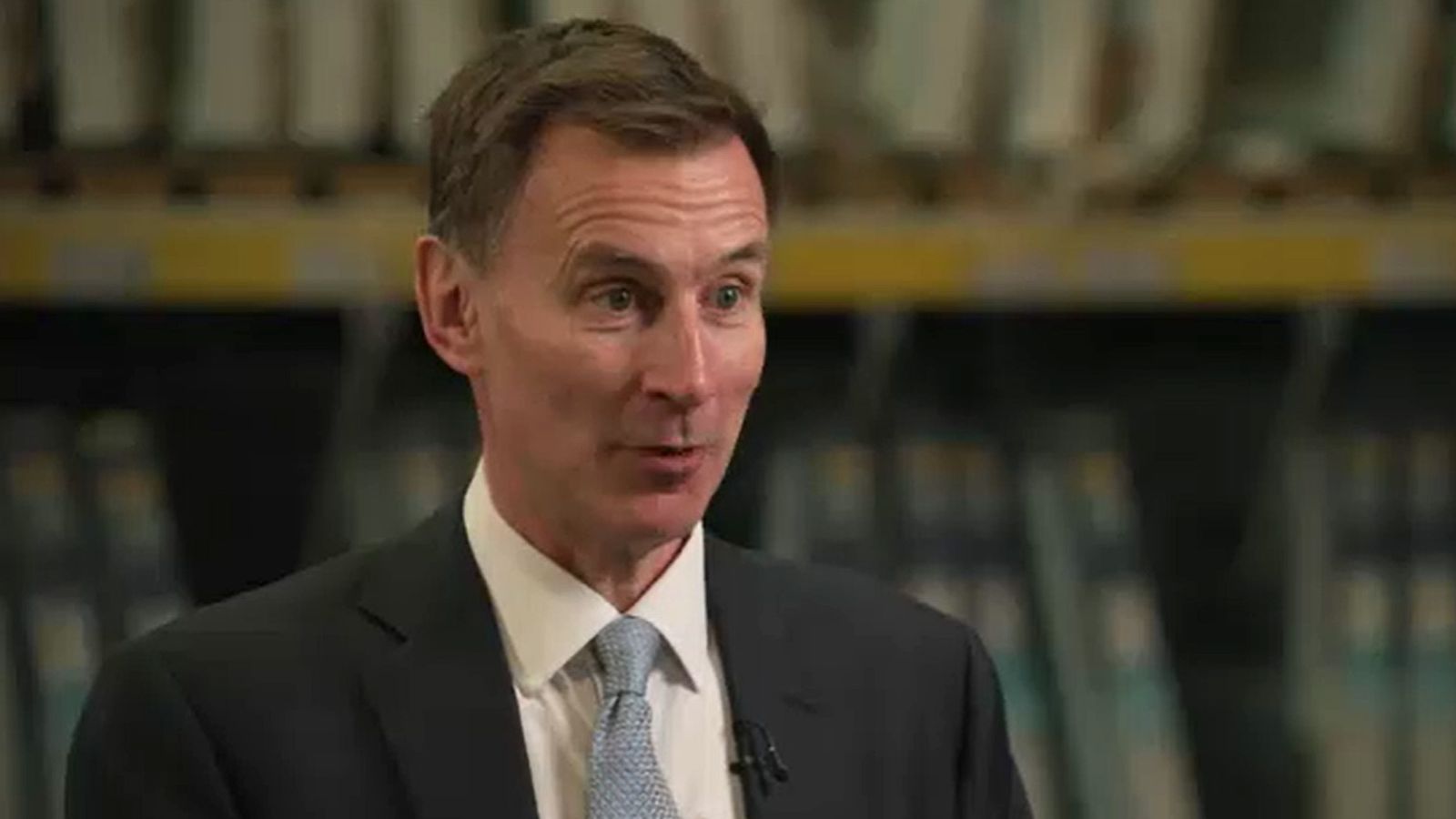

Jeremy Hunt has told Sky News his spring budget is “absolutely not” the last throw of the dice before a general election – as he refused to rule out another fiscal event before the country goes to the polls.

Speaking to political editor Beth Rigby, the chancellor said the “working assumption” in Downing Street is that the election will be held in the autumn.

Prime Minister Rishi Sunak has previously suggested this will be the case, but there was speculation he could call the vote earlier if major tax cuts in the spring budget were announced.

While Mr Hunt today confirmed a further 2p reduction to national insurance (NI), there was no “rabbit out of the hat” moment some Tory MPs were hoping for, such as a cut to personal income tax.

Asked if the budget was the “last throw of the dice” before an election, Mr Hunt said: “Absolutely not. We have produced today a budget that shows that we are turning a corner.”

Asked if Downing Street is working towards an autumn election, and potentially another fiscal event, he said: “That’s the working assumption. But in the end, it’s a choice the prime minister makes.”

As well as confirming a 2p cut to NI, Mr Hunt today announced the current system for non-dom tax status will be abolished, the freeze on fuel duty will be extended and a new duty on vaping products.

Budget latest: No rabbit out of the hat on income tax – but action on child benefit and non-dom status

Budget 2024: Chancellor raises child benefit threshold from £50k – and confirms national insurance will be cut by 2p

Budget 2024: The key announcements of Chancellor Jeremy Hunt’s speech

Some Tory MPs wanted him to go further and cut income tax or unfreeze tax thresholds to give them a fighting chance at the next election – with Labour currently around 20 points ahead in the polls.

The prime minister himself promised to cut income tax by 1p by the end of this parliament back when he was chancellor in 2022.

Please use Chrome browser for a more accessible video player

Mr Hunt told Sky News it was “important all politicians keep their promises”.

However, asked whether the income tax promise still holds, he pointed to his decision to reduce NI for workers instead, saying “that is what’s going to help to grow the economy”.

He added: “A lot of things have changed since 2022. I think the premise of what the prime minister was saying is if you stick to the plan, I will bring taxes down. And I think he is more than delivering that.”

The 2p cut to national insurance announced today comes on top of a 2p cut announced in the autumn statement and means workers will save on average £900 a year.

However, the overall tax burden is still set to rise to the highest level on record by the end of the decade because of the six-year freeze on personal tax thresholds dragging people into high tax brackets.

Read More:

Real pay for young graduates down by over £1,000 in three years

See whether you win or lose from tax and national insurance tweaks

The independent Resolution Foundation thinktank said the biggest net beneficiaries of the national insurance cut, combined with threshold freezes, are those earning £50,000, while those earning £19,000 or less will actually be worse off.

Labour accused Mr Hunt of using the budget to “give with one hand and take even more with the other”, calling it the “last desperate act of a party that has failed”.

Mr Hunt said taxes had to go up in previous years to fund support for people during the COVID pandemic and cost of living crisis, saying: “I don’t pretend otherwise”.

But he added: “We are now bringing down the tax burden in a way that will make a big difference, particularly to families on lower income.”