The Bitcoin ETF market has entered a new phase of intense competition as asset managers and issuers strive to attract clients and expand their assets under management (AUM).

Amid this fee war, digital asset manager Grayscale Investments has announced its consideration of a spin-off for its spot Bitcoin exchange-traded fund (ETF), the Grayscale Bitcoin Trust (GBTC). Lagging behind its peers in recent months, GBTC’s higher fees have been a significant factor driving investors towards rival ETFs, according to a Reuters report.

Grayscale’s GBTC Faces $11B Exodus As Rivals Attract Billions

Since January, GBTC has witnessed capital outflows amounting to $11.05 billion, as crypto research firm BitMEX Research reported. This occurred even as the price of BTC reached an all-time high (ATH) and competing funds experienced inflows over the same period.

To execute the spin-off, Grayscale has filed to list shares of a new investment product called the “Grayscale Bitcoin Mini Trust.” Under this arrangement, a certain amount of Bitcoin held by GBTC will be transferred to the Mini Trust, while existing GBTC shareholders will receive stock in the Mini Trust.

However, the fees to be charged by the Mini Trust are yet to be determined, as stated in the filing. Following the spin-off, both GBTC and the Mini Trust will operate independently.

Grayscale’s victory in a legal battle with the Securities and Exchange Commission (SEC) resulted in the approval of spot Bitcoin ETFs in January. Competitors such as BlackRock’s iShares Bitcoin ETF and Fidelity Wise Origin Bitcoin Fund have since recorded substantial inflows of $10.59 billion and $6.37 billion, respectively.

VanEck’s Zero-Fee Bitcoin ETF

In a similar move, asset manager VanEck has temporarily reduced the management fee to zero for its spot Bitcoin ETF, HODL, as its assets have fallen behind its competitors.

In a recent post on social media platform X (formerly Twitter), VanEck said it plans to maintain this fee waiver until March 31, 2025, unless the fund reaches $1.5 billion in assets.

The asset manager clarified that if the Trust’s assets exceed $1.5 billion within the mentioned time frame, a sponsor fee of 0.20% will be charged on assets beyond that threshold. This revised fee structure applies uniformly to all investors.

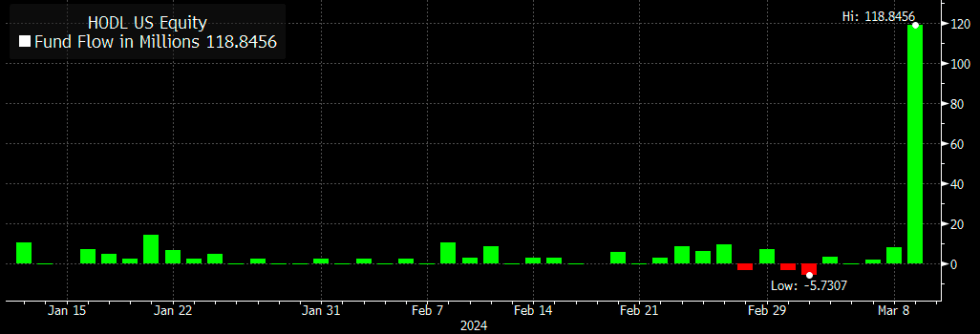

According to Bloomberg’s ETF expert Eric Balchunas, VanEck’s fee waiver announcement has already yielded significant results, with its HODL ETF seeing a record-breaking inflow of $119 million.

This notable surge, combined with substantial inflows of $1 billion on the previous day, has surpassed the outflows experienced by GBTC, which amounted to $494 million. Collectively, the assets in the ten Bitcoin ETFs are on the verge of reaching $60 billion.

Overall, the ongoing fee competition in the Bitcoin ETF market, exemplified by Grayscale’s contemplated spin-off and VanEck’s fee reduction, underscores the industry’s determination to attract investors and optimize its offerings.

As the battle for dominance in the digital asset space continues, market participants and investors eagerly await further developments in the evolving landscape of cryptocurrency investment vehicles.

Bitcoin, the leading cryptocurrency, is trading at $72,200, slightly below its recent ATH of $72,600 set on Monday. Over the past 30 days, BTC has experienced a consistent upward trend, resulting in a remarkable gain of nearly 50%. Year-to-date, the cryptocurrency is up an impressive 254%.

Featured image from Shutterstock, chart from TradingView.com