Bitcoin Lightning Network liquidity provider LQWD Technologies has partnered with Amboss Technologies to establish further institutional liquidity on Lightning. The collaboration positions LQWD to contribute liquidity to Amboss’s marketplace, enabling the fulfillment of market demand for Lightning Network liquidity while generating a yield on LQWD’s Bitcoin holdings.

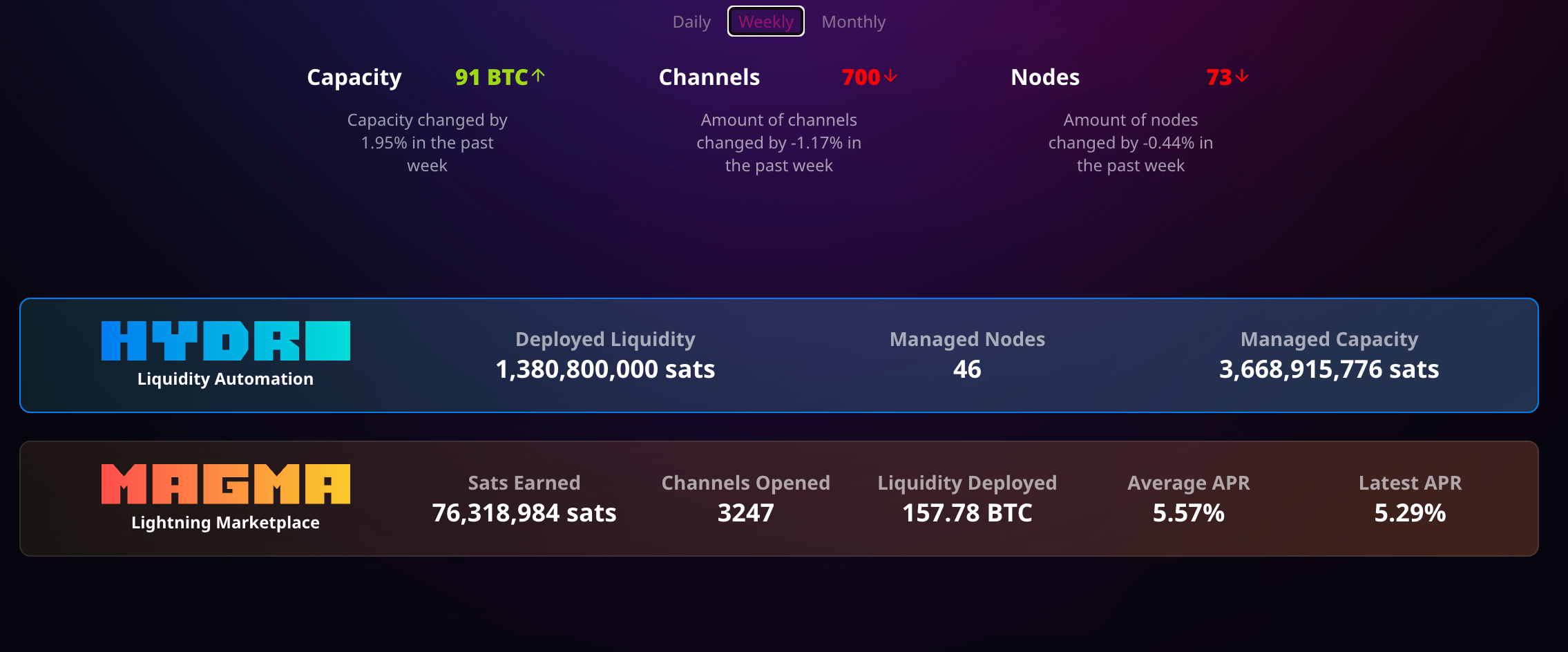

Amboss, a provider of data analytics solutions and payments operations on Lightning, offers specialized products such as Magma, a liquidity marketplace, and Hydro, an advanced liquidity automation tool. These products aim to create an orderly market and facilitate payments on the Lightning Network. As a liquidity provider, LQWD will launch an initial tranche of Bitcoin to Amboss, with plans to deploy additional Bitcoin throughout the partnership.

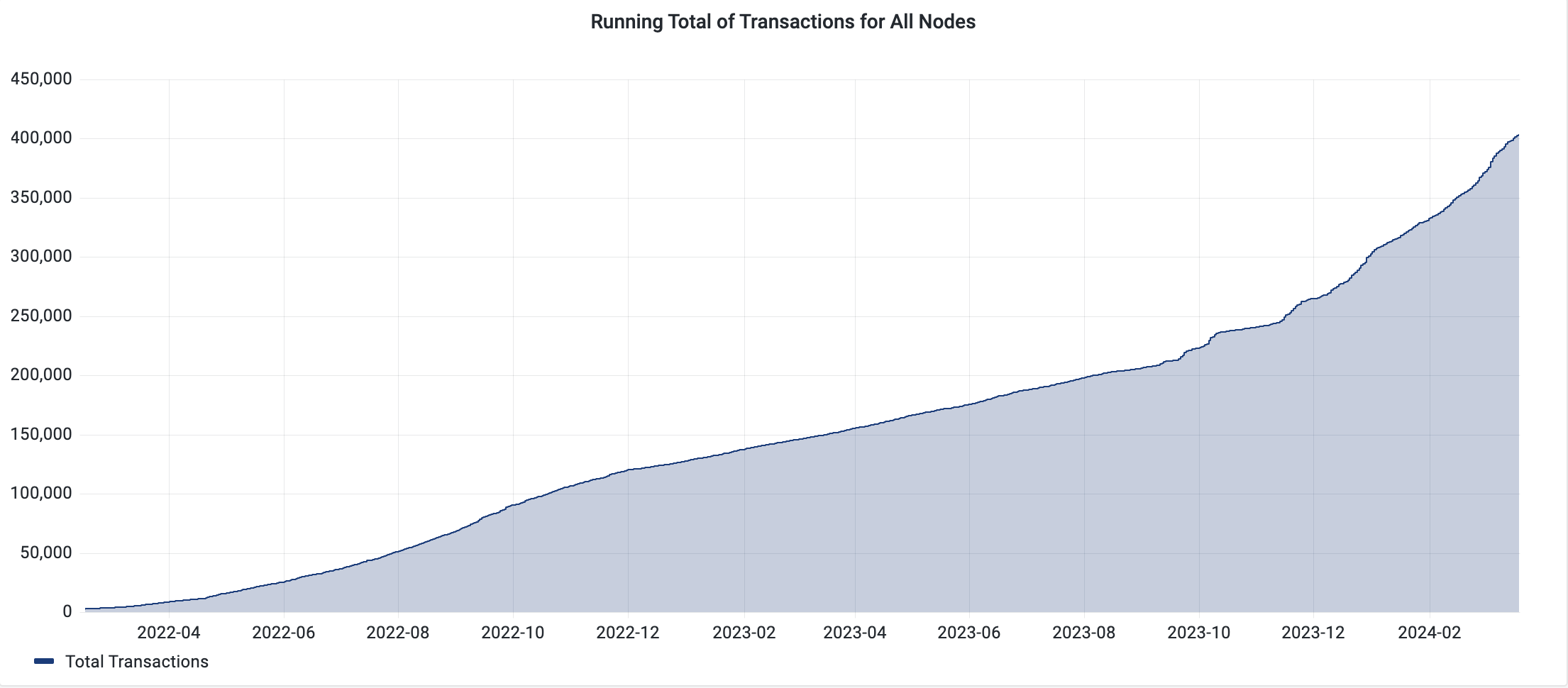

LQWD has seen consistent growth in its Lightning Network transactions since 2022, recently surpassing 400,000, according to self-reported data.

Amboss clients will acquire liquidity from LQWD, allowing the latter to earn initial and routing fees for transactions over the Lightning Network. Shone Anstey, CEO of LQWD, emphasized the significance of the partnership, stating, “This strategic alliance signifies a significant step forward for both LQWD and Amboss as we work together to enhance liquidity and efficiency within the Bitcoin Lightning Network ecosystem.”

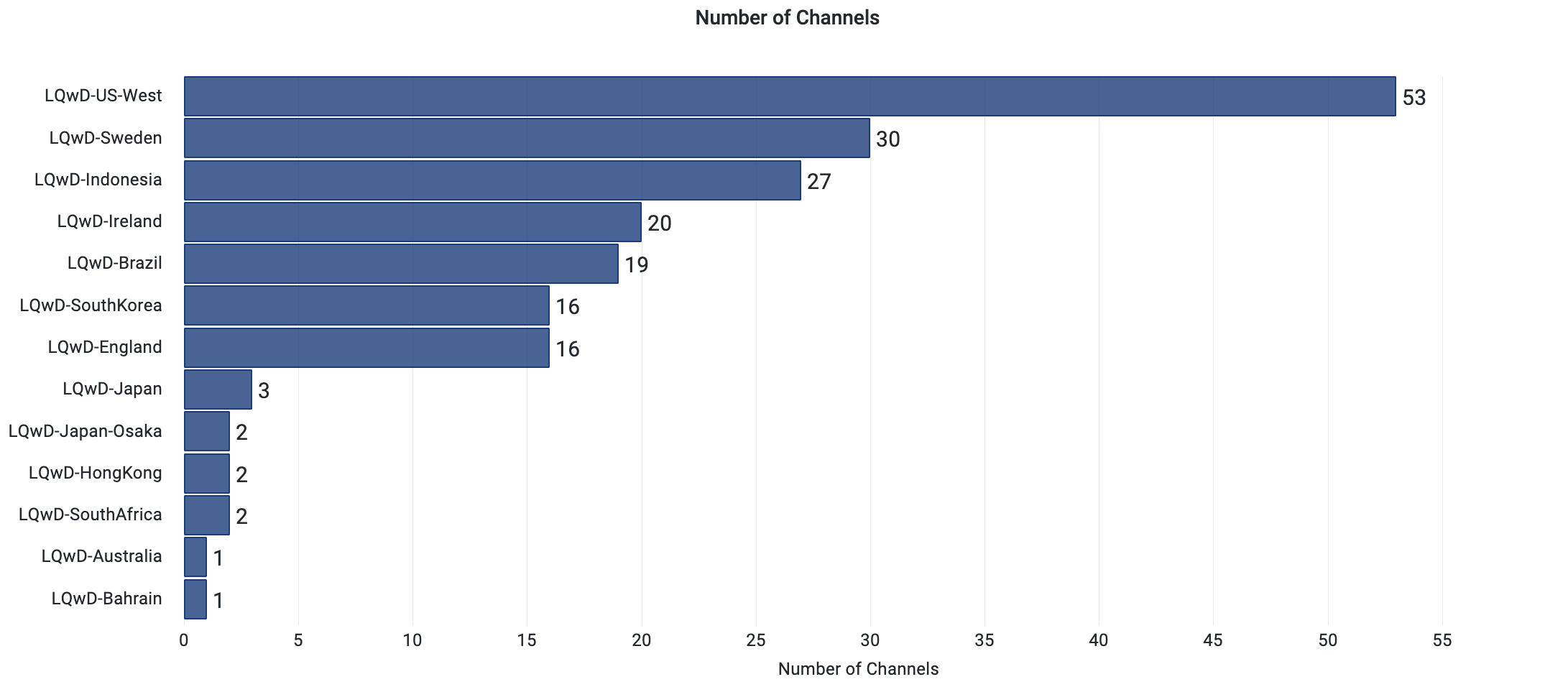

LQWD also offers Lightning channels in several geographies, with the majority being on the West Coast of the US. Interestingly, after the US, Sweden, Indonesia, Ireland, and Brazil have the most active channels.

The partnership enables LQWD to deploy its company-owned Bitcoin while potentially capturing significant transaction volume and generating yield on its holdings. Importantly, LQWD maintains full sovereignty and custody throughout the process, aligning with its focus on developing payment infrastructure and solutions accelerating Bitcoin adoption through the Lightning Network.

Amboss’ marketplace currently offers a 5.57% APR on Bitcoin deployed through Lightning Channels with total liquidity of 157 BTC, roughly $10 million as of press time.

Jesse Shrader, Co-Founder and CEO of Amboss, highlighted the benefits of the collaboration, stating,

“Partnering with LQWD ensures that Amboss’s global customers have direct access to institutional-grade liquidity for Bitcoin payments, allowing LQWD to generate additional yield through their nodes on the Lightning Network. Additionally, this partnership increases the supply side of Amboss’s liquidity marketplace.”

LQWD also uses its own Bitcoin as an operating asset to establish nodes and payment channels on the network. With the partnership between LQWD and Amboss, both companies are looking to contribute to the growth and efficiency of the Bitcoin Lightning Network ecosystem, providing enhanced liquidity solutions for businesses and consumers alike.

The post Institutions looks to deploy Bitcoin as liquidity to Lightning Network to earn yield appeared first on CryptoSlate.