Billions have been channeled to spot Bitcoin exchange-traded funds (ETFs) after the United States Securities and Exchange Commission (SEC) gave the green light in mid-January. However, on-chain analysis indicates that some of these spot ETF investors might, after all, be less experienced than initially assumed.

Spot Bitcoin ETF Investors Acting Like “Noobs”?

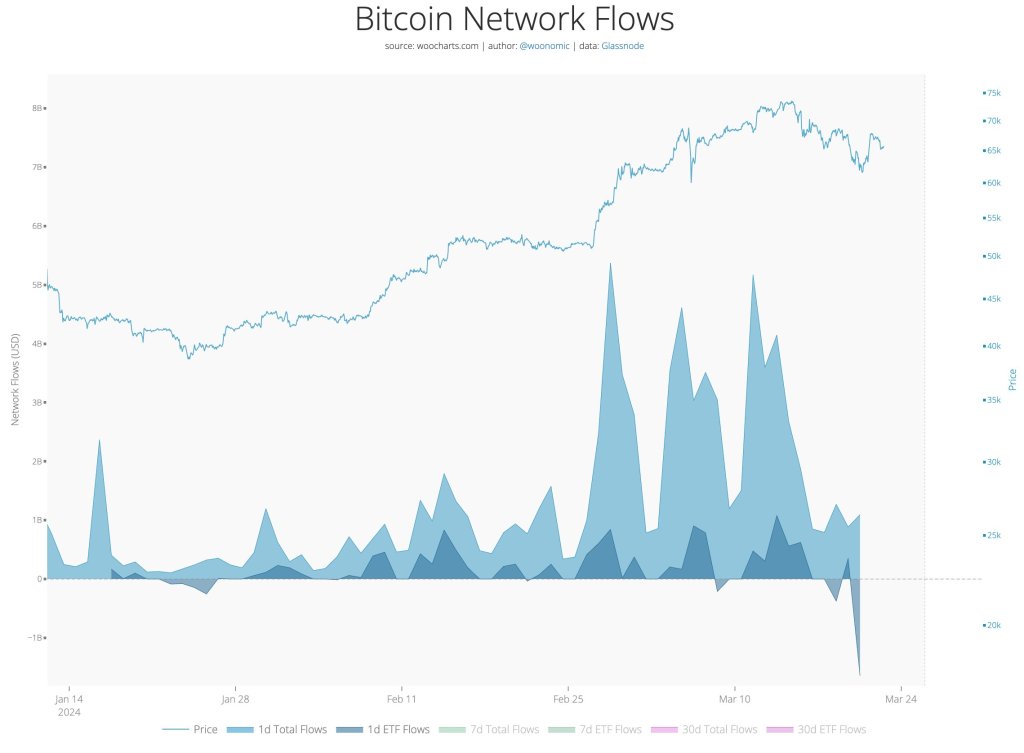

Taking to X, Willy Woo, an on-chain analyst, shared the Bitcoin Network Flows data and picked out crucial leads to suggest that some spot Bitcoin ETFs are shaken out too quickly by the market.

In a post, Woo pointed to a $1.6 billion outflow from spot Bitcoin ETFs when prices crashed on March 5. During this dip, the network had inflows worth $1.1 billion. This outflow from spot Bitcoin ETFs and a marked influx of cash to the mainnet could mean that some investors choose to redeem and get hold of the underlying coin, explaining the capital injection.

Spot Bitcoin ETFs offer a simple and accessible route to Bitcoin investment. Unlike futures-based ETFs, which speculate on future prices, spot Bitcoin ETFs track the price of Bitcoin directly. This means investors can gain exposure to Bitcoin without the complexities of buying and holding the coins themselves.

All they need to do is purchase shares of spot Bitcoin ETFs from issuers like BlackRock. A specific amount of Bitcoin backs each purchase.

However, as on-chain data shows, by redeeming their shares when prices fell, investors choose to self-custody their coins instead of allowing the issuer, through its partners, to control their coin’s private keys. United States SEC filings show that most ETF issuers rely on Coinbase Custody as their primary custodian.

This regulated third party safeguards billions worth of Bitcoin backing each share of spot Bitcoin ETF in circulation.

Grayscale Outflows Increasing, BTC Facing Headwinds

The apparent shakeout and inflow directly into the mainnet as Woo shares appear to confirm previous studies. In a report, CoinDesk noted that a big chunk of early spot Bitcoin ETF demand was likely driven by retailers.

Their investigation found that the average trade size for one ETF hovered around $13,000. This finding reinforces the “retail investor” narrative. Even so, the actual purchasers of spot Bitcoin ETFs will be confirmed when made public.

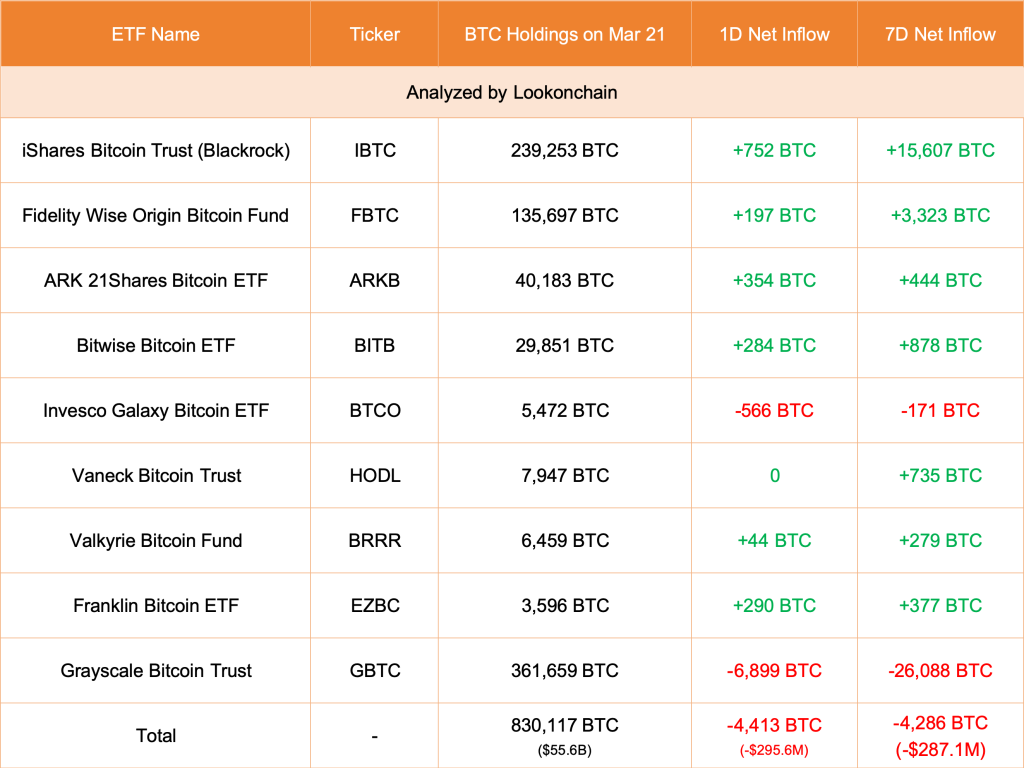

For now, there is no fresh capital going into spot Bitcoin ETFs. According to Lookonchain data on March 21, Grayscale and the other issuers reduced over $700 million from their holdings. CoinMarketCap data shows that BTC remains below $70,000 and is under pressure.