Last week, the crypto investment landscape witnessed a significant exodus of capital from global crypto funds. A recent report from CoinShares highlighted nearly $1 billion net outflow from these funds, marking a historic departure from a 7-week inflow streak that had cumulatively amassed $12.3 billion.

A Closer Look At The Outflows

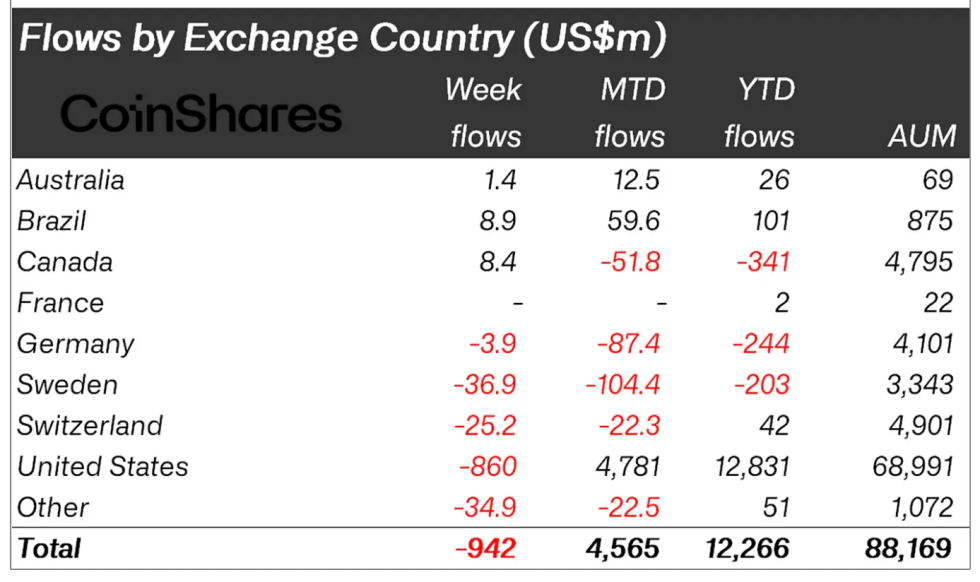

The magnitude of these outflows at roughly $942 million is particularly notable, almost doubling the previous record of $500 million witnessed towards the end of January.

Major players in the asset management space, including BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, felt the brunt of this wave of withdrawals, according to CoinShares.

The timing of these outflows coincided with a notable correction in the prices of underlying cryptocurrencies, which erased $10 billion from the fund’s assets under management (AUM). However, the combined AUM of $88 billion still hovers above prior cycle highs.

Notably, these outflows have pronounced impacted trading volumes and asset valuations within the crypto investment product sector. Last week’s trading volume plummeted by a third to $28 billion amidst a price correction that significantly diminished the AUM of these funds.

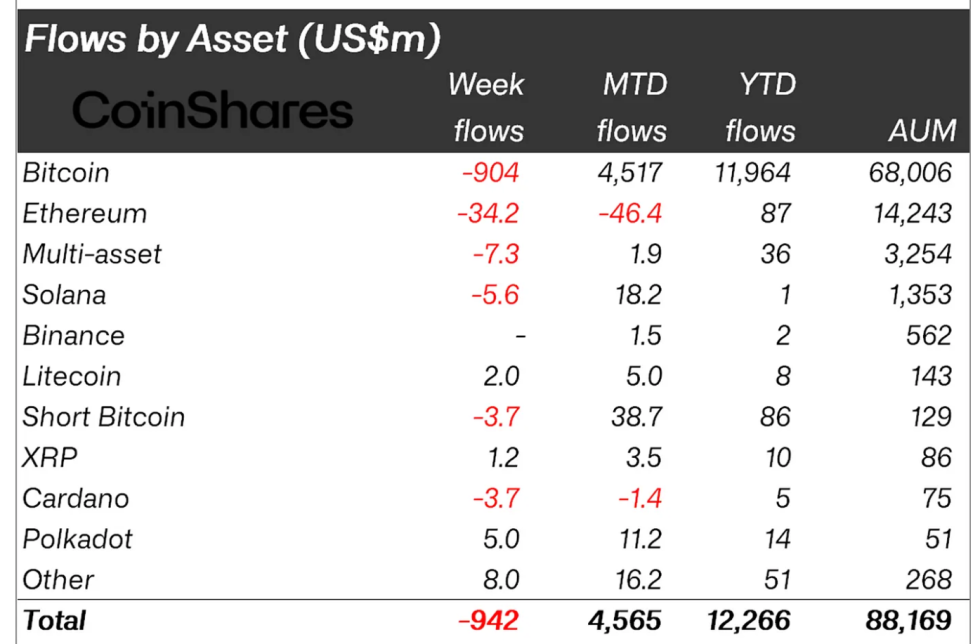

The US market, particularly new spot Bitcoin ETFs, witnessed over $1 billion in inflows, which were insufficient to offset the nearly $2 billion outflows from Grayscale’s GBTC fund conversion.

According to CoinShares Head of Research James Butterfill, the “recent price correction” resulted in “hesitancy from investors, leading to much lower inflows into new ETF issuers in the US, which saw US$1.1bn inflows, partially offsetting incumbent Grayscale’s significant US$2bn outflows last week.”

Global Crypto Sentiment And Market Responses

Meanwhile, last week’s sentiment was not solely concentrated on US-based funds or Bitcoin. Investment products in Sweden, Hong Kong, Switzerland, and Germany also experienced outflows, though Brazil and Canada-based funds recorded inflows, showcasing a mixed global investor sentiment.

Additionally, Ethereum, Solana, and Cardano-based products faced outflows, underscoring the broad impact of the market’s downturn. In contrast, other altcoin funds like Polkadot, Avalanche, and Litecoin saw net inflows, indicating selective investor interest in the altcoin sector.

This period of market recalibration has also sparked a dialogue among industry leaders about the role and accessibility of Bitcoin ETFs in fostering broader market integration.

Bivu Das of Kraken UK and Daniel Seifert of Coinbase UK have both advocated for the UK market’s access to Bitcoin ETFs, citing the importance of such investment products in establishing a comprehensive crypto ecosystem.

As reported, by offering indirect exposure to Bitcoin’s price movements, these instruments propose a regulated and possibly more accessible avenue for investors, contributing to the diversification and maturity of the investment landscape in the digital currency market.

ICYMI: Kraken UK Managing Director Bivu Das says he’d “absolutely” like to see a #Bitcoin ETF in the UK, providing regulated access to crypto exposure currently lacking and boost UK’s crypto hub ambitions, and legitimize bitcoin for institutions.

— AP Crypto (@AP_Crypto_) March 23, 2024

Featured image from Unsplash, Chart from TradingView