On Tuesday, the US Department of Justice announced criminal charges against the global crypto exchange KuCoin and two of its founders, Chun Gan (also known as “Michael”) and Ke Tang (also known as “Eric”). The charges, related to conspiring to operate an unlicensed money transmitting business and violations of the Bank Secrecy Act, have stirred concerns among users and investors about the future of the Seychelles-based exchange, echoing fears reminiscent of the FTX collapse.

Is KuCoin The Next FTX?

According to the official press release by the Southern District of New York, the indictment accuses KuCoin and its founders of deliberately failing to implement an adequate anti-money laundering (AML) program. This negligence allegedly facilitated the use of the platform for money laundering and terrorist financing activities.

Moreover, the exchange is accused of not maintaining necessary procedures to verify customer identities and failing to report any suspicious activities.

Despite these serious allegations, CryptoQuant CEO Ki Young Ju provided a contrasting view, focusing on the exchange’s operational and financial stability. Through a statement on X, Ju highlighted that, from an on-chain perspective, KuCoin’s Bitcoin (BTC) and Ethereum (ETH) reserves seem unaffected by the surge in withdrawals, primarily by retail users.

Ju remarked, “On-chain wise, Kucoin is fine. BTC and ETH withdrawals surged, driven mainly by retail users, with a small impact on the overall reserve. They appear to not commingle customers’ funds and have sufficient reserves to process user withdrawals.”

This reassurance comes at a crucial time when the memory of FTX’s downfall, triggered by liquidity issues and allegations of misusing customer funds, still lingers in the minds of the crypto community. Ju made a clear distinction between the reserve management practices of KuCoin and FTX, underscoring the organic nature of KuCoin’s BTC and ETH reserves in contrast to the problematic handling of funds by FTX.

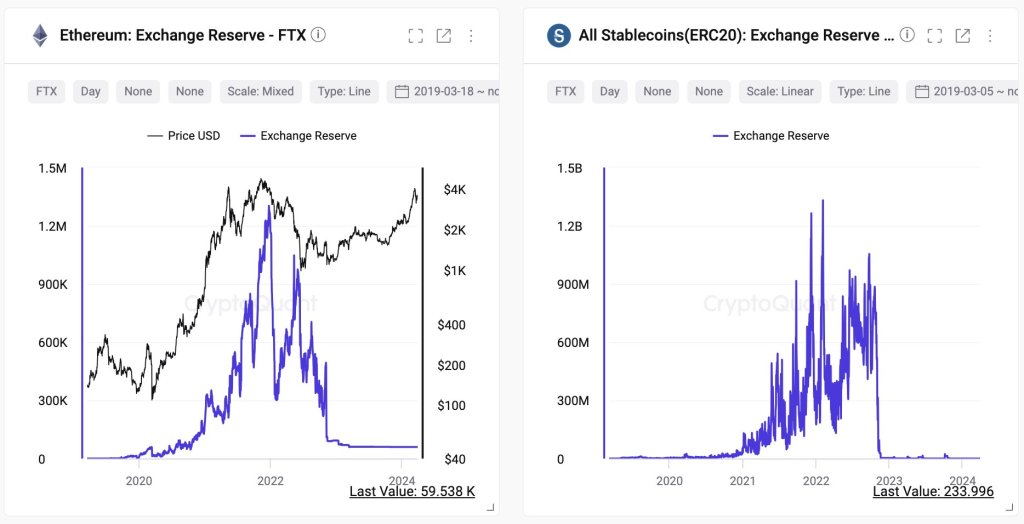

“Kucoin’s BTC and ETH reserves appear organic, unlike those of FTX. They don’t commingle customers’ funds,” Ju stated and shared the Bitcoin and Ethereum exchange reserves charts by CryptoQuant.

Ju contrasted these charts with the one’s from FTX, noting “Here are FTX reserves for comparison. FTX commingled customers’ funds with their funds; you can see a lot of bulk deposits/withdrawals in the charts. It doesn’t look organic.”

As of now, KuCoin hold 5.949 BTC and 99.358 ETH, according to CryptoQuant’s data. The total balance of KuCoin’s portfolio across multiple chains is valued at $4.764 billion, according to Scopescan data.

At press time, the KuCoin token (KCS) traded at $11.42, down -20% since the news broke.