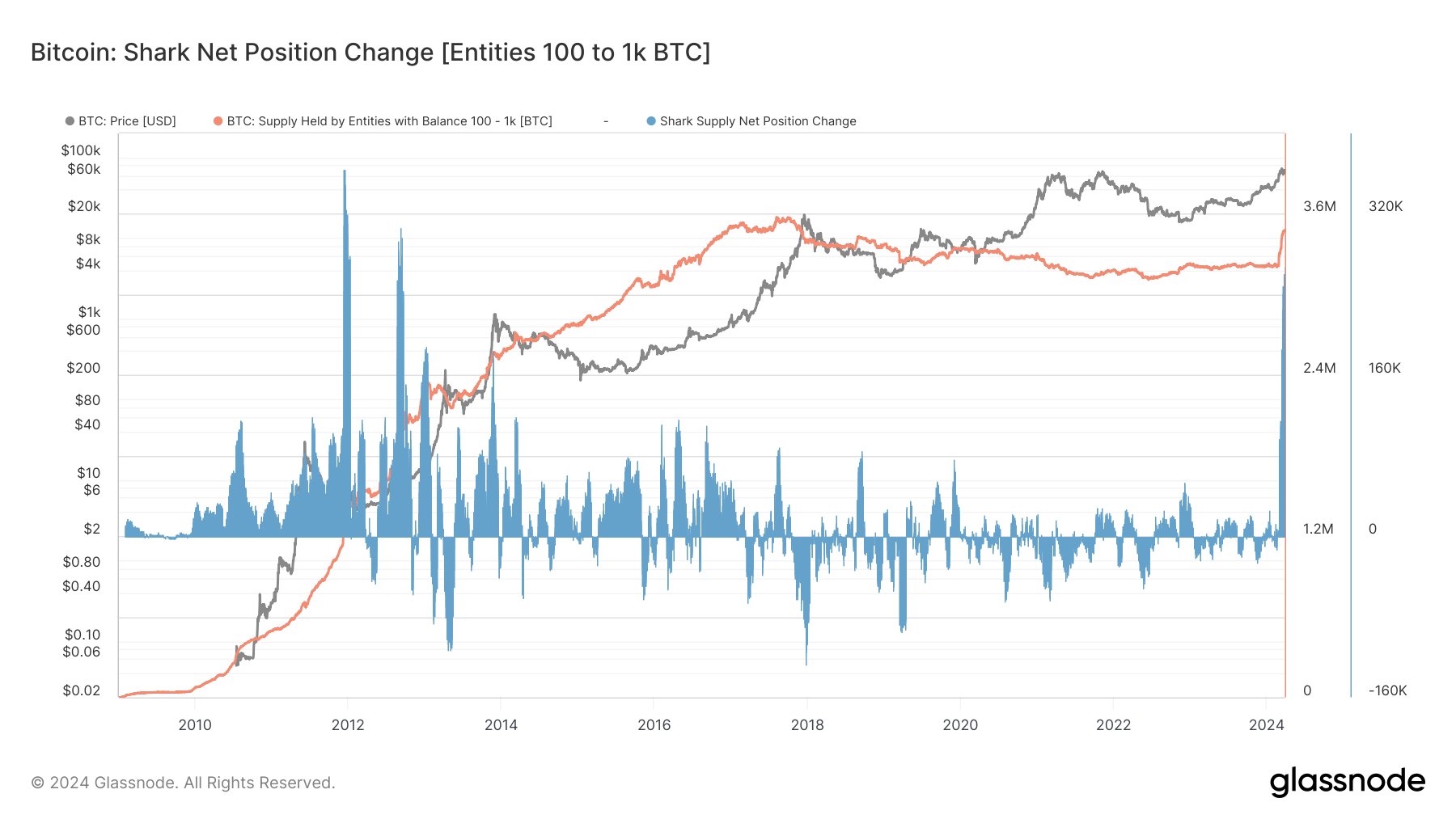

On-chain data shows the Bitcoin shark cohort has participated in its largest accumulation spree over the past month since 2012.

Bitcoin Sharks Have Purchased More Than 268,000 BTC In The Last Month

As analyst James Van Straten explains in a new post on X, Bitcoin entities holding between 100 and 1,000 BTC have made some large net buying moves in the past month.

An “entity” here refers to a collection of addresses owned by the same investor as determined through analysis by the on-chain analytics firm Glassnode.

The entities holding between 100 to 1,000 BTC are popularly known as “sharks.” At the current exchange rate of the asset, this range converts to about $6.93 million to $69.3 million.

Thus, the investors carrying these amounts are clearly quite big, meaning that they should have some significance for the market as a whole. However, these sharks are still smaller and less influential than the whales, who typically occupy the range above 1,000 BTC.

Given the relevance of the sharks, their behavior is naturally worth monitoring. One way to track this behavior is through the “net position change” of the cohort.

This on-chain metric keeps track of the net amount of supply that entered into or exited out of the wallets of the entities belonging to the shark group over the past month.

The chart below shows this indicator’s trend over the entire history of the cryptocurrency.

As the above graph shows, the Bitcoin shark net position change has been at highly positive levels recently. This would imply that these large investors have been adding a net number of coins to their wallets.

The sharks have made net purchases amounting to around 268,441 BTC in the last 30 days, which is currently worth almost $18.6 billion. This is a staggering amount and is the largest accumulation these holders have done since way back in 2012.

Back then, BTC’s price was a small fraction of what it is today so that the current shark accumulation would be the most impressive in the asset’s history based on the sheer amount of capital involved.

With such a high degree of accumulation, it’s no wonder that the past month has been a positive one for Bitcoin, where its price has reached new all-time highs.

Another positive development in the market recently is perhaps the outflows that the cryptocurrency exchange Coinbase has observed, as Straten has pointed out in another X post.

According to the analyst, $1.1 billion worth of the asset was taken off the platform’s wallets yesterday, the third biggest net outflow this year, with all of the top three occurring within the past month.

Exchange outflows can be a bullish sign for the cryptocurrency, as they suggest that investors prefer to go into self-custody, possibly to HODL onto their coins for extended periods.

BTC Price

Bitcoin’s price has gone a bit stale over the past few days as it has been unable to pick any direction. At present, BTC is trading at around $69,400.