Asset management firm and spot Bitcoin exchange-traded fund (ETF) issuer Grayscale has unveiled its latest offering, the “Dynamic Income Fund” (GDIF), designed to focus on investments in proof-of-stake tokens.

Grayscale Launches Dynamic Income Fund

This actively managed investment product seeks to optimize returns through staking rewards associated with proof-of-stake digital assets, according to the asset manager’s announcement on Friday.

Friday’s announcement also illuminates the fund’s key steps, which include raising capital from investors, allocating capital to a portfolio of proof-of-stake tokens using qualitative and quantitative factors, staking tokens to earn rewards, converting token rewards to cash on a weekly basis, and distributing cash to investors every quarter while rebalancing tokens as needed to maximize income.

Grayscale has hinted that the GDIF will initially include tokens such as Osmosis (OSMO), Solana (SOL), Polkadot (DOT), and other tokens to be announced.

However, the asset manager clarifies that the holdings are subject to change at the manager’s discretion, and the percentages allocated to each token may not sum up to 100% due to rounding.

To provide a deeper understanding of Grayscale’s new venture, staking involves investors actively validating blockchain network transactions and earning staking rewards in transaction fees for their services. To stake, investors commit a certain amount of their tokens to the network, enabling them to contribute to its security and governance.

Grayscale aims to simplify the complexities associated with staking and unstacking multiple tokens, as each token has its unique requirements and timelines for staking and unstacking.

It’s worth noting that GDIF is exclusively available to qualified clients, defined as individuals with assets under management of $1,100,000 or a net worth of $2,200,000.

Bitcoin ETF Market Shows Strong Rebound

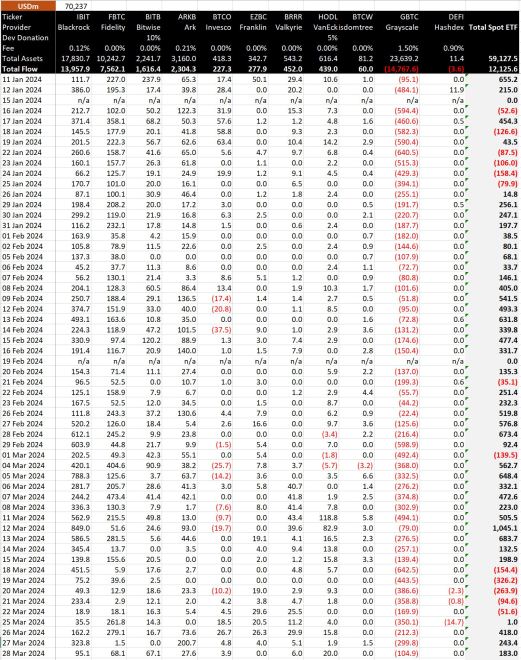

According to recent data from BitMEX research, the Bitcoin ETF market has witnessed significant developments in the past few days. Notably, the outflows of $887 million reported last week have nearly reversed, indicating a renewed investor interest.

Grayscale, one of the prominent players in the space with its GBTC ETF, saw minimal outflows of just $104.9 million on Thursday, the lowest since March 12, as shown in the chart below.

In contrast, Grayscale’s competitors have demonstrated strong performance, recording net inflows of $844 million in only four days. On March 28, Blackrock’s ETF IBIT emerged as the frontrunner, witnessing substantial gains with $95.1 million in inflows. Fidelity’s FBTC followed with $68 million in inflows on the same day.

However, it is worth noting that these figures are significantly lower than the best-recorded days for both asset managers. Blackrock’s ETF IBIT reached its peak on March 12, surpassing $849 million in total inflows. Similarly, Fidelity’s FBTC experienced its highest inflow on March 7, reaching $473 million.

BitMEX research data further reveals that the cumulative flow of the Bitcoin ETF market has approached $12.5 billion within just three months since trading commenced on January 11.

At present, the leading cryptocurrency in the market is trading at $69,500, experiencing a brief dip below the crucial $70,000 threshold

Featured image from Shutterstock, chart from TradingView.com