Quick Take

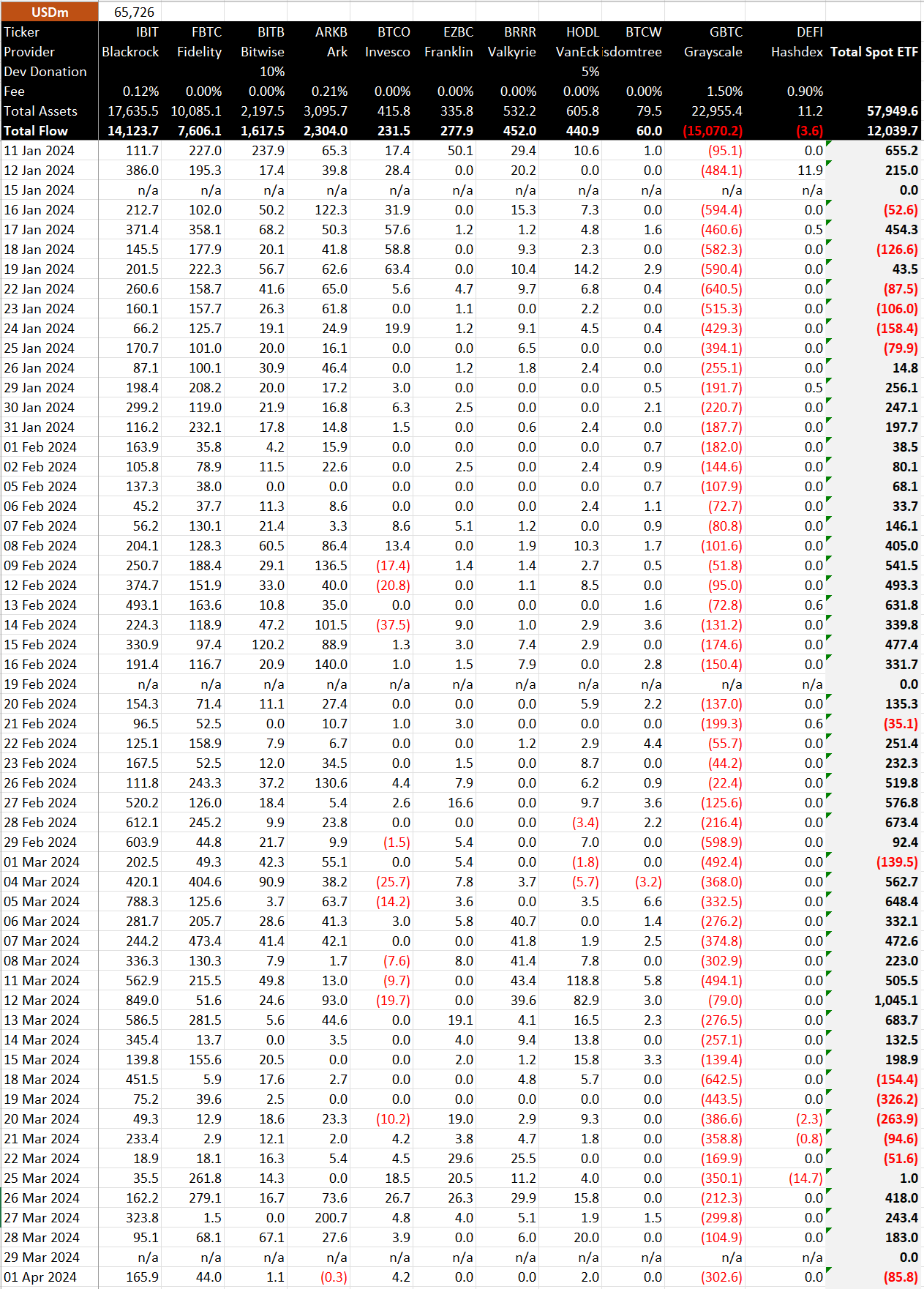

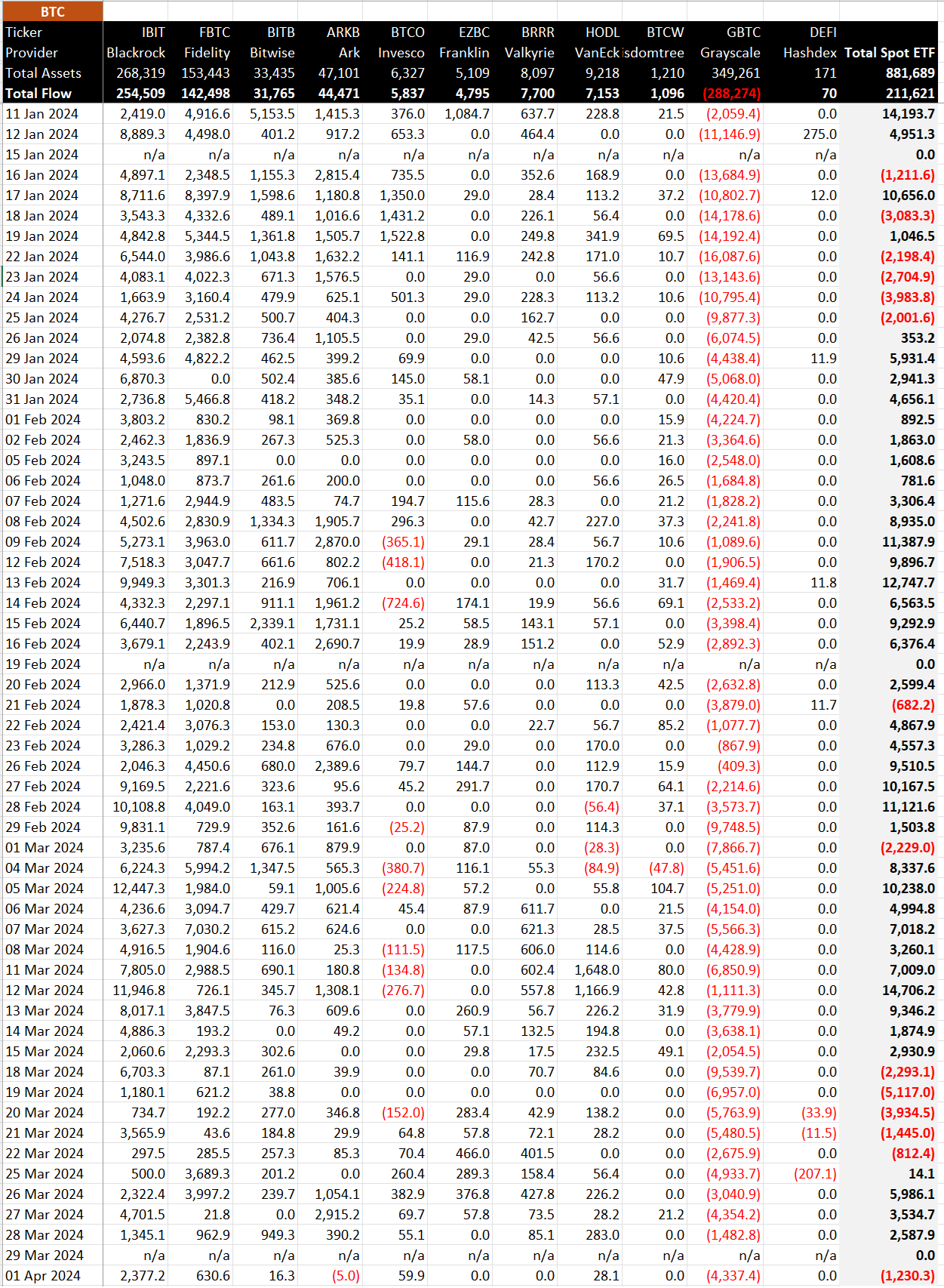

Data from BitMEX shows that the Bitcoin (BTC) exchange-traded funds (ETFs) saw a net outflow of $85.8 million, equivalent to 1,230.3 BTC, marking the first outflow since March 22.

Grayscale’s GBTC continued to dominate the outflows, with $302.6 million, equivalent to 4,337.4 BTC, being withdrawn. GBTC has now seen a staggering $15,070.2 billion of outflows, equivalent to 288,274 BTC, according to BitMEX.

On the other hand, inflows across the remaining ETFs remained relatively muted, with BlackRock’s IBIT being the notable exception. IBIT saw inflows of $165.9 million, equivalent to 2,377.2 BTC, bringing its total inflows to $14,123.7 billion, equivalent to 254,509 BTC. Ark’s ARKB ETF experienced its first day of outflows, albeit small, at $0.3 million, equivalent to 5 BTC. ARKB has now seen $2,304.0 billion of inflows, equivalent to 44,471 Bitcoin, according to BitMEX.

Overall, the ETFs have witnessed a total net inflow of $12,039.7 billion, equivalent to 211,621 BTC, according to BitMEX.

The post Bitcoin ETFs experience first outflow since March 22 at $85.8 million appeared first on CryptoSlate.