Filecoin (FIL), a decentralized data storage network, has experienced a recent surge in value, grabbing the attention of cryptocurrency analysts. The price increase, coupled with bullish analyst predictions, has ignited optimism for FIL’s future.

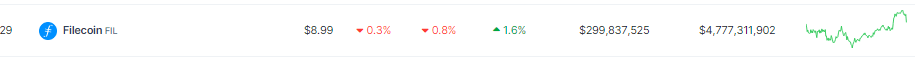

At the time of writing, FIL was trading at $8.99, down 0.8% in the last 24 hours, but managed to sustain a 1.6% increase in the last seven days, data from Coingecko shows.

Filecoin Price Poised For A Rally?

Technical analysis plays a crucial role in predicting cryptocurrency prices. Analysts like “World Of Charts” emphasize the importance of retesting key support levels. A successful retest, they argue, could pave the way for a significant bullish wave, with estimates ranging from 200% to 250% price increase for FIL.

$Fil#Fil Testing Key Support (Accumulation Zone) Real Move Can Start After Successful Retest Expecting 200-250% Bullish Wave Incase Of Successful Retest #Crypto pic.twitter.com/3n0BpklAxh

— World Of Charts (@WorldOfCharts1) April 7, 2024

In 2023, Filecoin experienced its peak performance, with FIL prices surging by 130% from $3.00 to $6.85. Conversely, 2022 marked its lowest point, witnessing a drastic drop of 90% from $34.20 to $3.05. Over the past five years, Filecoin has maintained an average yearly growth rate of 4.05%.

Typically, Filecoin tends to shine brightest in the first quarter, boasting an average gain of 190%, while its performance tends to falter in the second quarter, often resulting in a loss of 58%.

Analyst Shares His Views

This sentiment of World of Charts is echoed by other market observers. “Captain Faibik,” another analyst, encourages investors to capitalize on price dips, expressing confidence in FIL’s future appreciation. Such endorsements can significantly influence investor sentiment and contribute to the overall market dynamics for FIL.

$FIL #Filecoin Buy the dip Now, you’ll thank me later.

pic.twitter.com/9HLyZzteRu

— Captain Faibik (@CryptoFaibik) April 7, 2024

Will Filecoin Reach $20?

Meanwhile, analysis of Filecoin’s (FIL) potential ascent to $20 demands a comprehensive examination given its current dynamics. Despite FIL showcasing strengths like a 65% price surge over the past year and consistent trading above the 200-day simple moving average, several factors could hinder such a substantial climb.

Although FIL has seen 15 green days in the last month, indicating short-term bullish sentiment, it has been outpaced by 60% of the top 100 crypto assets, including leading ones like Bitcoin and Ethereum. Additionally, FIL remains -96% down from its all-time high, indicating a significant historical price decline.

Moreover, FIL faces challenges due to its high yearly inflation rate of 28.81%, despite its strong liquidity demonstrated by its market capitalization. Thus, while the $20 target for FIL isn’t out of reach, attaining it would likely necessitate a sustained positive market sentiment, improved performance relative to other assets, and effective management of inflationary pressures.

Featured image from Pixabay, chart from TradingView