Quick Take

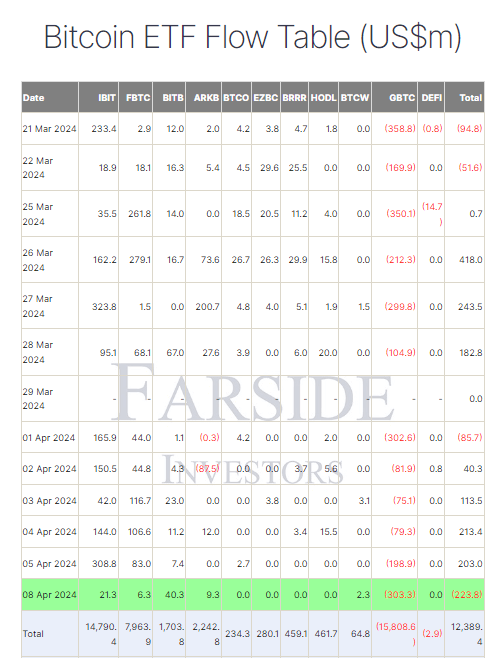

Farside data reports that the Bitcoin ETF market experienced a notable shift on Apr. 8, with the overall sector recording its first net outflow day since Apr. 1, totaling $223.8 million. The primary driver of this change was a significant $303.3 million outflow from the Grayscale Bitcoin Trust (GBTC), its largest outflow since March 25, which has now seen a total of $15,808.6 billion in outflows.

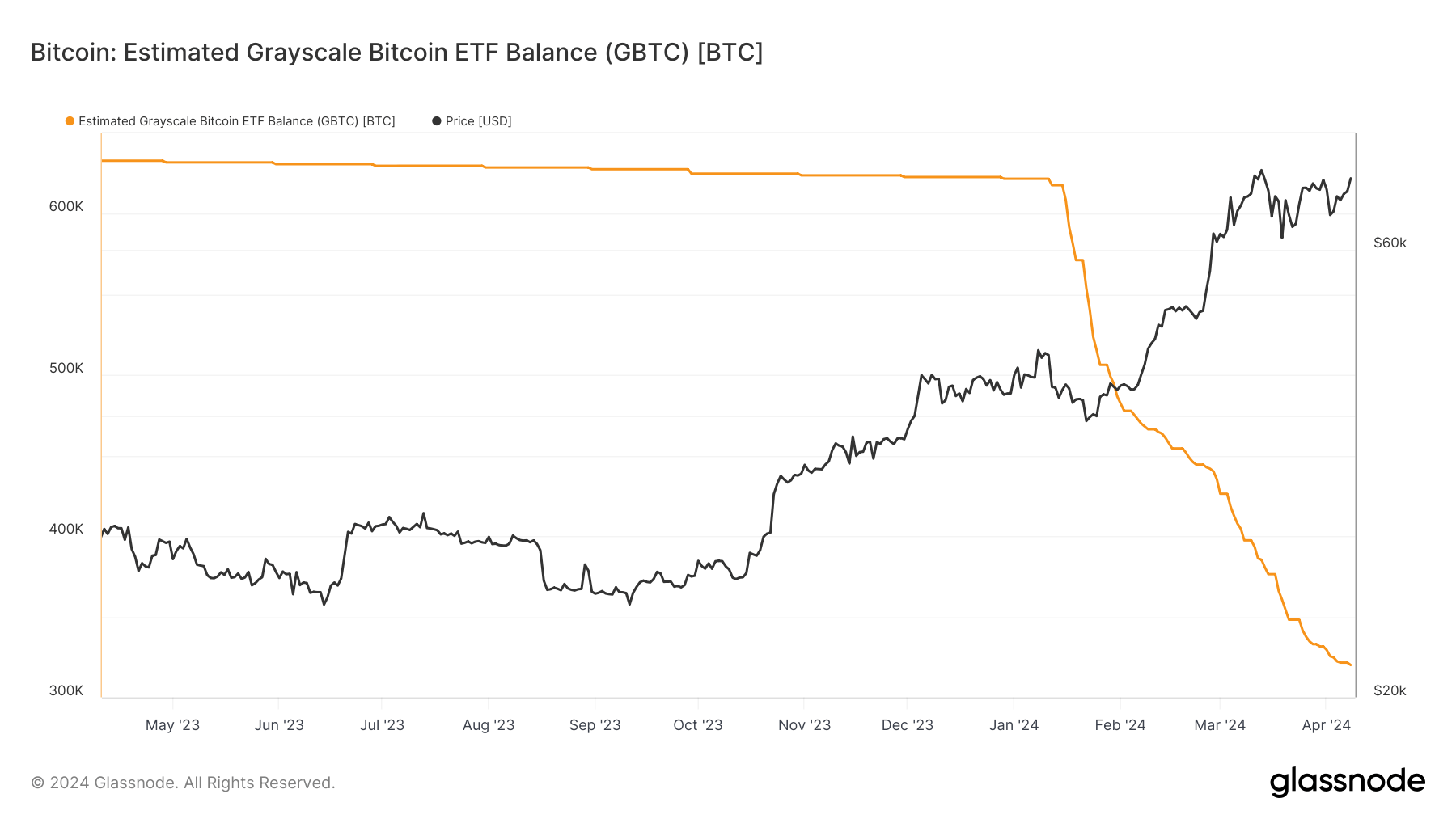

This outflow has resulted in GBTC’s Bitcoin holdings dropping from 621,000 to just 320,000 over the past three months, a decrease of 300,000 BTC, according to Glassnode.

In contrast, other spot Bitcoin ETFs saw relatively muted inflows, with Bitwise BITB leading the pack at $40.3 million, bringing their total inflow to $1,703.8 billion. BlackRock IBIT saw a $21.3 million inflow, bringing their total inflow to $14,790.4 billion, while Fidelity FBTC saw a $6.3 million inflow, bringing their total to $7,963.9 billion, according to Farside.

Farside data reveals that despite this minor decline, the total net inflow to the spot ETF market remains at a healthy $12,389.4 billion.

The post Grayscale Bitcoin trust sheds roughly 300,000 BTC since ETF launch appeared first on CryptoSlate.