Quick Take

The distribution of Bitcoin’s total supply among different cohorts provides valuable insights into investor behavior and market sentiment. Glassnode categorizes holders who have held Bitcoin for less than 155 days as Short Term Holders, while those holding for longer than 155 days are considered Long Term Holders.

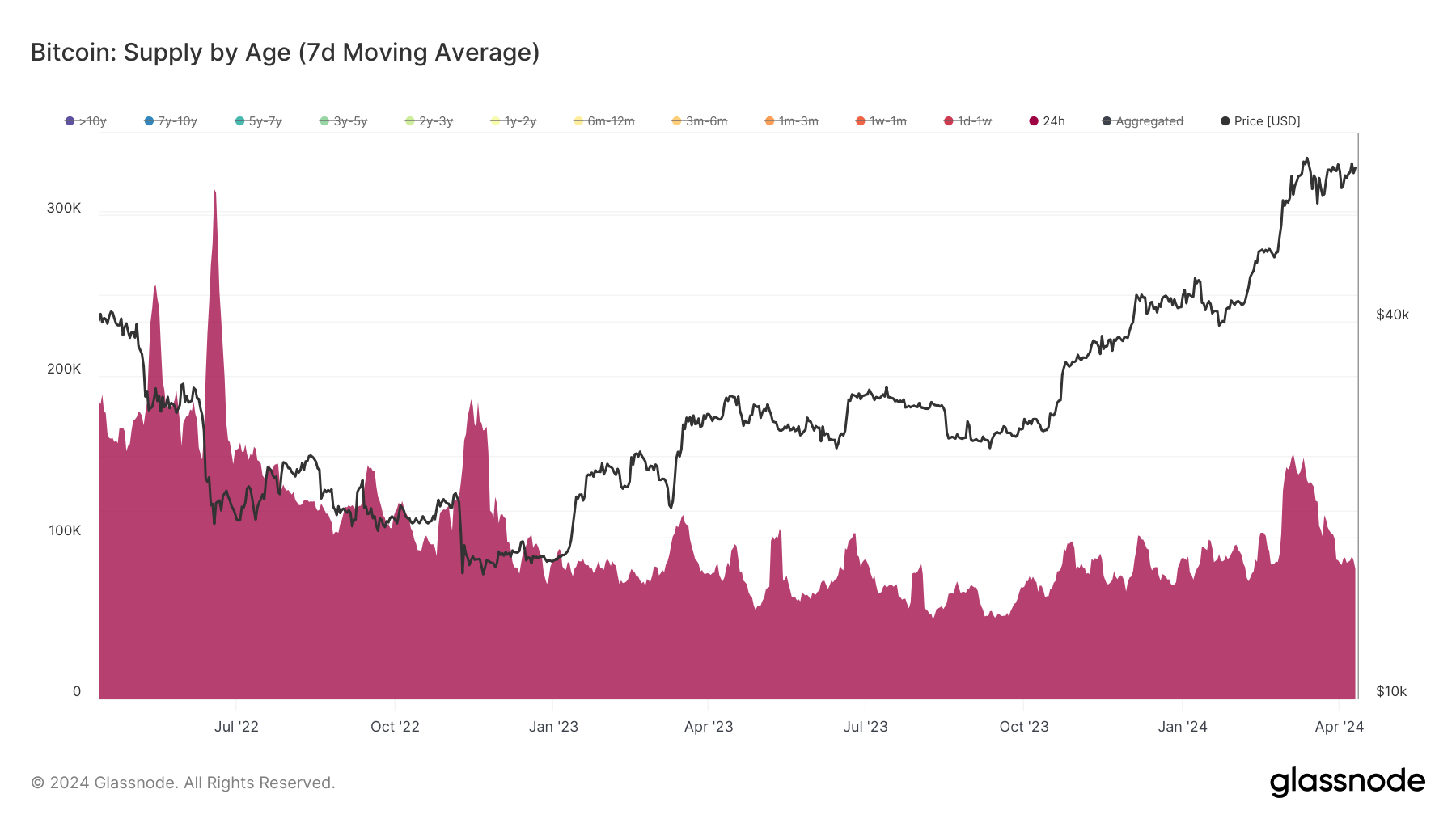

Recent data from Glassnode shows that the 24-hour supply by age has been consistently around 80,000 Bitcoin per day for the past week, indicating a higher average compared to the past year and suggesting increased investor interest. Notably, when Bitcoin reached its all-time high in March, the 24-hour supply hit roughly 150,000 Bitcoin, the highest since the cycle low in November 2022, signaling extreme interest in the asset.

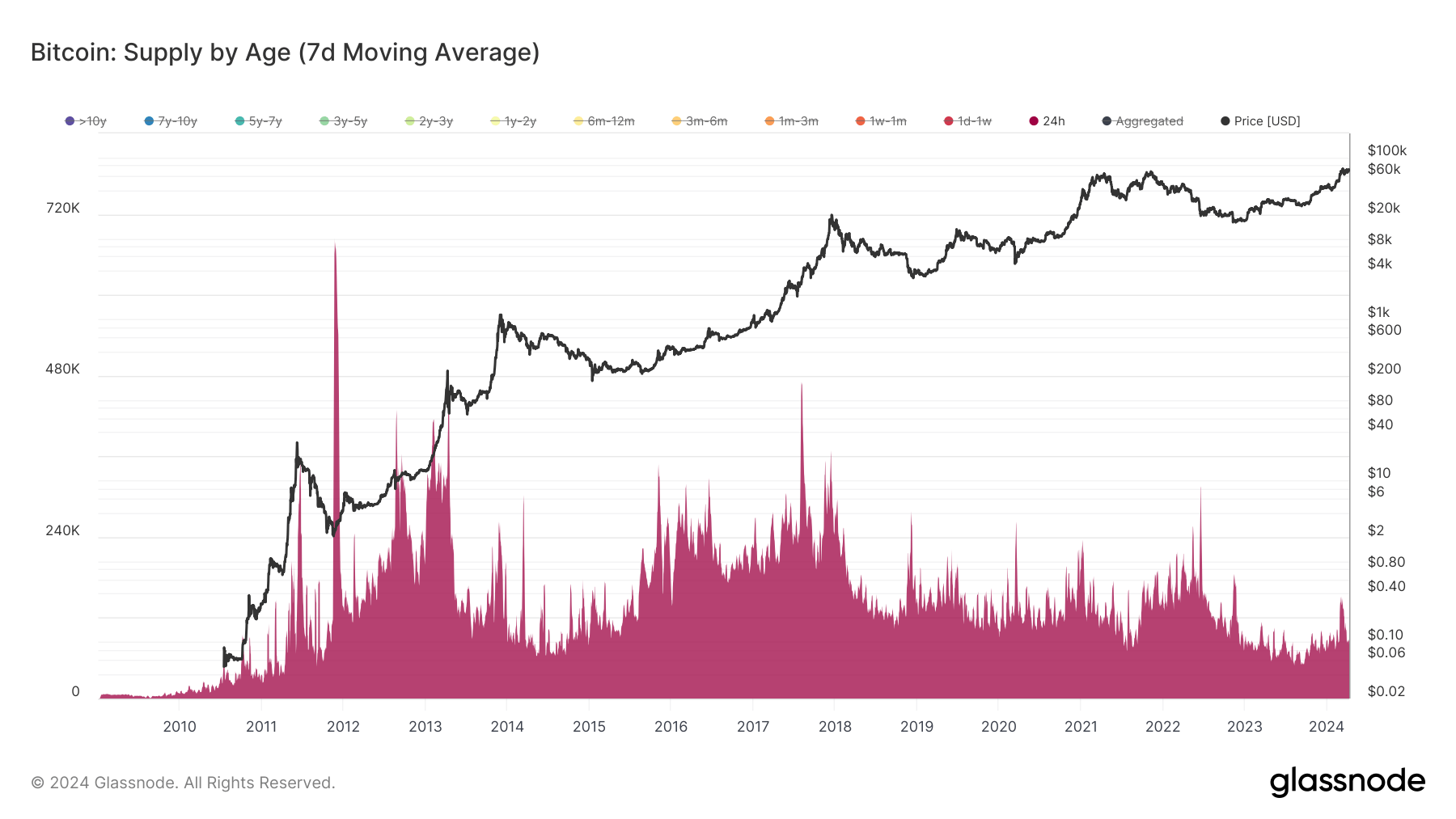

However, zooming out reveals that the current 24-hour supply is relatively calm compared to previous cycle highs, which saw supply levels between 200,000 and 400,000 Bitcoin, according to Glassnode. This suggests that the market is not yet in the greed or euphoria stage of the cycle.

The majority of the Bitcoin supply is held by a cohort of holders with a tenure of 10 years or more. These holders control approximately 3,192,835 Bitcoin, which accounts for roughly 16% of the circulating supply. With 19.7 million Bitcoin in circulating supply, understanding the distribution among different cohorts provides a clearer picture of market forces.

| Timeframe | BTC | Supply |

|---|---|---|

| 24h | 88,827 | 0.45% |

| 1d-1w | 274,444 | 1.39% |

| 1w-1m | 1,049,825 | 5.33% |

| 1-3m | 1,697,163 | 8.62% |

| 3-6m | 1,199,852 | 6.10% |

| 6-12m | 1,611,983 | 8.19% |

| 1-2y | 2,570,483 | 13.06% |

| 2-3y | 2,285,214 | 11.61% |

| 3-5y | 2,699,235 | 13.72% |

| 5-7y | 2,018,134 | 10.26% |

| 7-10y | 991,169 | 5.04% |

| > 10y | 3,192,835 | 16.22% |

| Circulating Supply | 19,679,165 | 100.00% |

Source: Glassnode

The post Bitcoin supply analysis exposes a calm before the speculative storm appeared first on CryptoSlate.