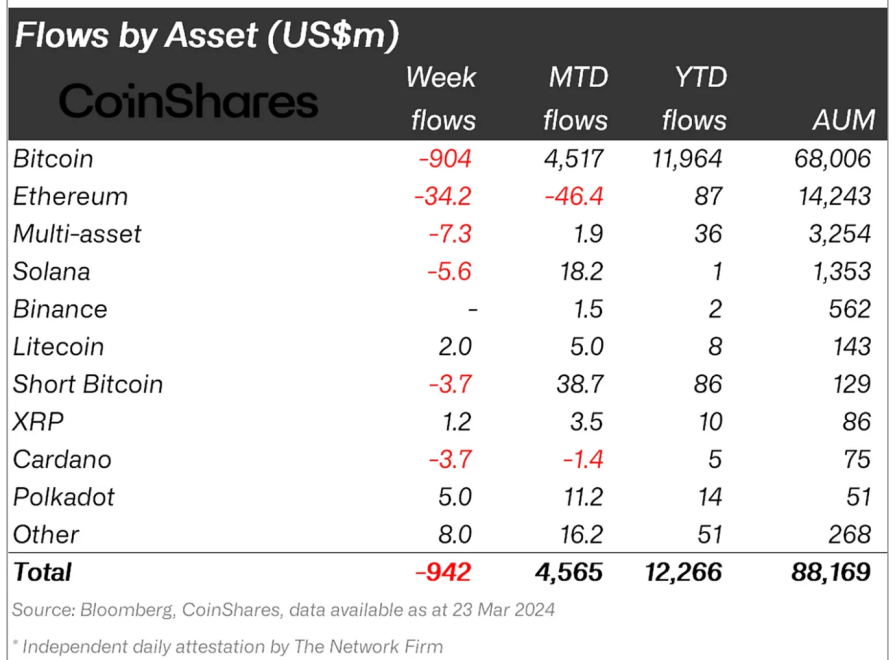

After seven consecutive weeks of inflows totaling $12.3 billion, the cryptocurrency market saw a significant shift. CoinShares reported roughly $942 million in outflows in its latest report, marking the first outflow following the notable inflow streak.

In addition, despite trading volumes remaining high at $28 billion for the week, it represents a substantial decline compared to the prior week, according to the report.

Investors Show Reticence Amid Price Declines

According to Coinshares Head of Research, James Butterfill, the recent price correction from the overall crypto market led to a decrease of $10 billion in total assets under management (AuM). However, they still exceed previous cycle highs, reaching $88 billion.

James Butterfill noted:

We believe the recent price correction led to hesitancy from investors, leading to much lower inflows into new ETF issuers in the US, which saw US$1.1bn inflows, partially offsetting incumbent Grayscale’s significant US$2bn outflows last week.

Notably, this hesitancy was not confined to the US alone, as countries like Sweden, Switzerland, Hong Kong, and Germany also experienced outflows. However, Brazil and Canada saw modest inflows of $9 million and $8.4 million, respectively.

Meanwhile, despite the broader market trend, altcoins such as Polkadot, Avalanche, and Litecoin saw notable inflows, totaling $16 million. However, major cryptocurrencies like Bitcoin, Ethereum, Solana, and Cardano experienced significant outflows, with Bitcoin alone witnessing $904 million.

Crypto Market Performance And Institutional Adoption

It is worth noting that the price performance of Ethereum, Solana, and Cardano mirrored their outflows, with declines of approximately 10.9%, 17.6%, and 20.3%, respectively, over the past week.

However, recent price movements indicate a potential recovery, with Bitcoin and altcoins showing signs of upward momentum over the past 24 hours. Bitcoin has surged roughly 2.5% in the past 24 hours, with a current trading price of $66,538.

This uptick in performance comes as Hong Kong provisionally approved asset managers to initiate spot Bitcoin and Ethereum exchange-traded funds.

Meanwhile, despite Coinshares’ report of a decline in Bitcoin spot ETF inflows, recent SEC filings via Form 13F have revealed that several prominent Wall Street firms and US banks have initiated the purchase of Bitcoin ETFs. Julian Fahrer, CEO of the Bitcoin-centric app Apollo Sats, emphasized the significance of the revelation.

Fahrer underscored the diverse nature of these filings, involving investment managers and family offices with assets under management ranging from $200 million to $10 billion, indicating a widening scope of institutional acceptance.

Specifically, Fahrer highlighted American National Bank’s investment in Ark’s ETF, characterizing it as “significant for breaking the seal on banks buying ETFs.”

BREAKING: 13F SEC Filings show US Banks are buying #Bitcoin pic.twitter.com/BzSkUrURFi

— Julian Fahrer (@Julian__Fahrer) April 10, 2024

Featured image from Unsplash, Chart from TradingView