Quick Take

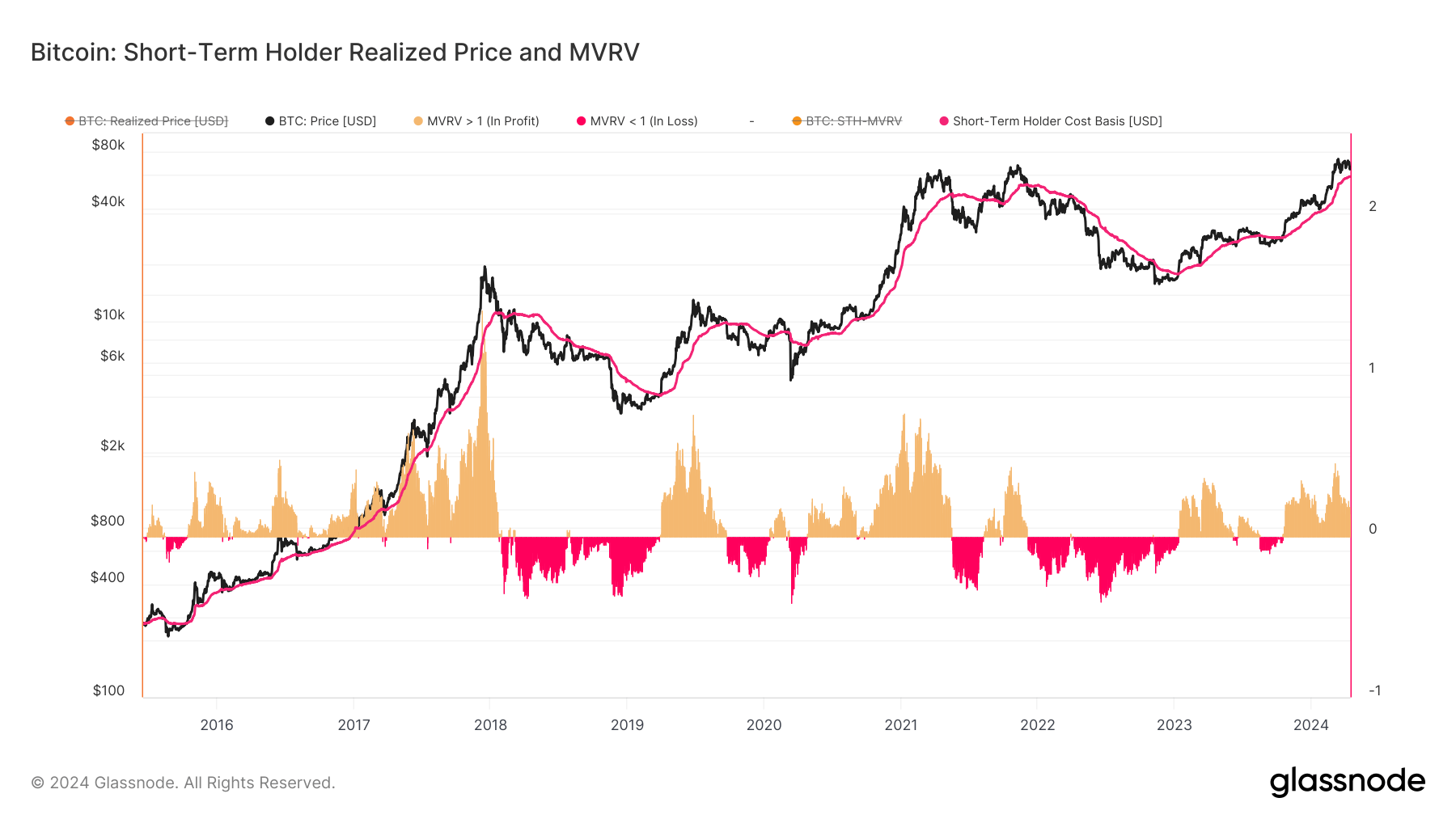

The short-term holder realized price (STH RP) is a crucial metric for short-term Bitcoin investors, reflecting the average price at which each coin last transacted on-chain within the past 155 days. This metric acts as the ‘on-chain cost basis’ for recent investors.

In tandem, the short-term holder MVRV ratio (STH MVRV Ratio) compares the market value to the realized value, clearly visualizing this cohort’s unrealized profitability. A value of 2.0 indicates substantial profits, while 1.0 represents a break-even point, and 0.85 indicates a 15% loss.

CryptoSlate’s analysis highlights the critical role of the STH RP metric as a support level during bull market uptrends. Currently, the STH RP hovers over $58.8k, according to Glassnode, with the price holding above $60,000 during the weekend drop.

The STH MVRistands at 0.11, indicating a slight unrealized profit for short-term holders. Maintaining the price above the STH RP level is crucial, as evidenced during the 2021 bull market when a dip below the STH RP signaled the beginning of a bear market, as identified by CryptoSlate.

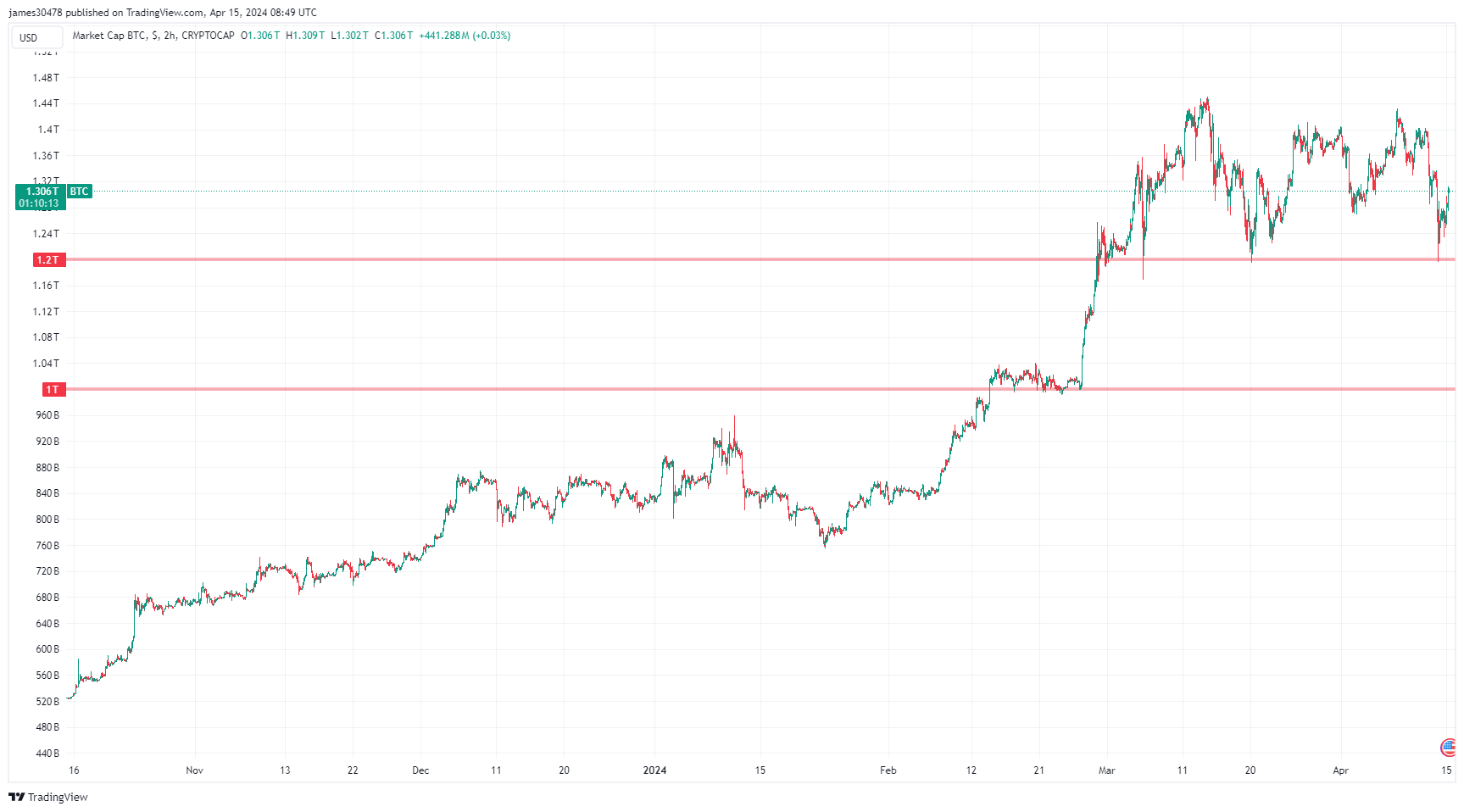

Sustaining the STH RP keeps Bitcoin’s market cap comfortably above $1 trillion, underscoring its significance in evaluating Bitcoin market health.

The post Short-term holder realized price holds steady despite weekend Bitcoin drop, uptrend persists appeared first on CryptoSlate.