Perpetual futures are a type of derivatives contract unique to the crypto market. Unlike traditional futures, which have a set expiration date, perpetual futures never expire, allowing traders to hold their positions indefinitely.

To make this type of contract financially viable, the market employs a mechanism called the funding rate. Funding rates are periodic payments that either long or short traders pay to one another to keep the price of the perpetual futures contract in line with the underlying spot price of the asset.

If the funding rate is positive, long traders pay short traders, which indicates that the demand to buy is stronger than the demand to sell. A negative funding rate means that short traders pay long traders, showing a bearish sentiment where the pressure to sell outweighs the interest in buying.

This essential characteristic of perpetual futures makes them particularly sensitive to short-term market movements and a very useful tool for understanding market sentiment and trader behavior. A quick and sharp change in funding rates comes with intense volatility. The change’s intensity and longevity can help us gauge how a very sophisticated and liquid part of the market is handling it.

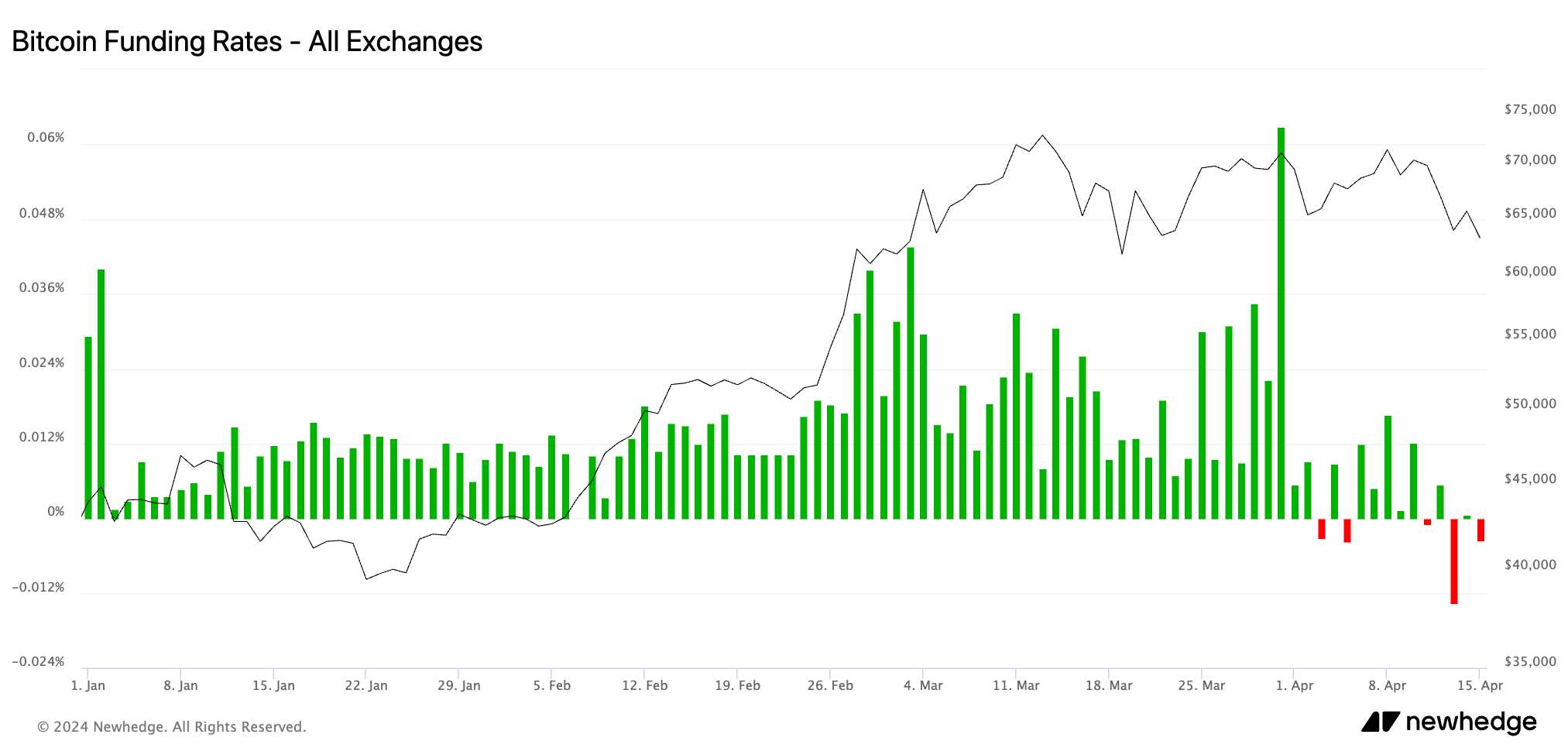

After over a year of consistently positive Bitcoin funding rates, they turned negative on April 13, dropping from 0.00546% to -0.01351%. It briefly flipped positive on April 14 but reverted to negative on April 15, standing at -0.00358%.

This sharp drop in funding rates followed significant volatility in Bitcoin’s price. Ongoing geopolitical turmoil in the Middle East shocked the market during the weekend, pushing BTC below $70,000. This drop brought an uncharacteristic bearish sentiment to the market, which has been flying high in the past two months as Bitcoin broke new all-time highs.

While the drop in funding rate between April 12 and April 15 might not seem that significant, it represents a massive decrease from the three-year high of 0.06294% it established on March 31. The peak in funding rates the market saw at the end of March was a culmination of the bullish sentiment that has been dominant since February.

Buyer confidence was high, accumulation was seen among all cohorts, and there was little downward volatility in prices. However, such a sharp plunge into negative territory signals an aggressive plunge towards a bearish sentiment.

The currently negative funding rate shows sellers are expecting further price declines and are willing to pay to maintain their positions.

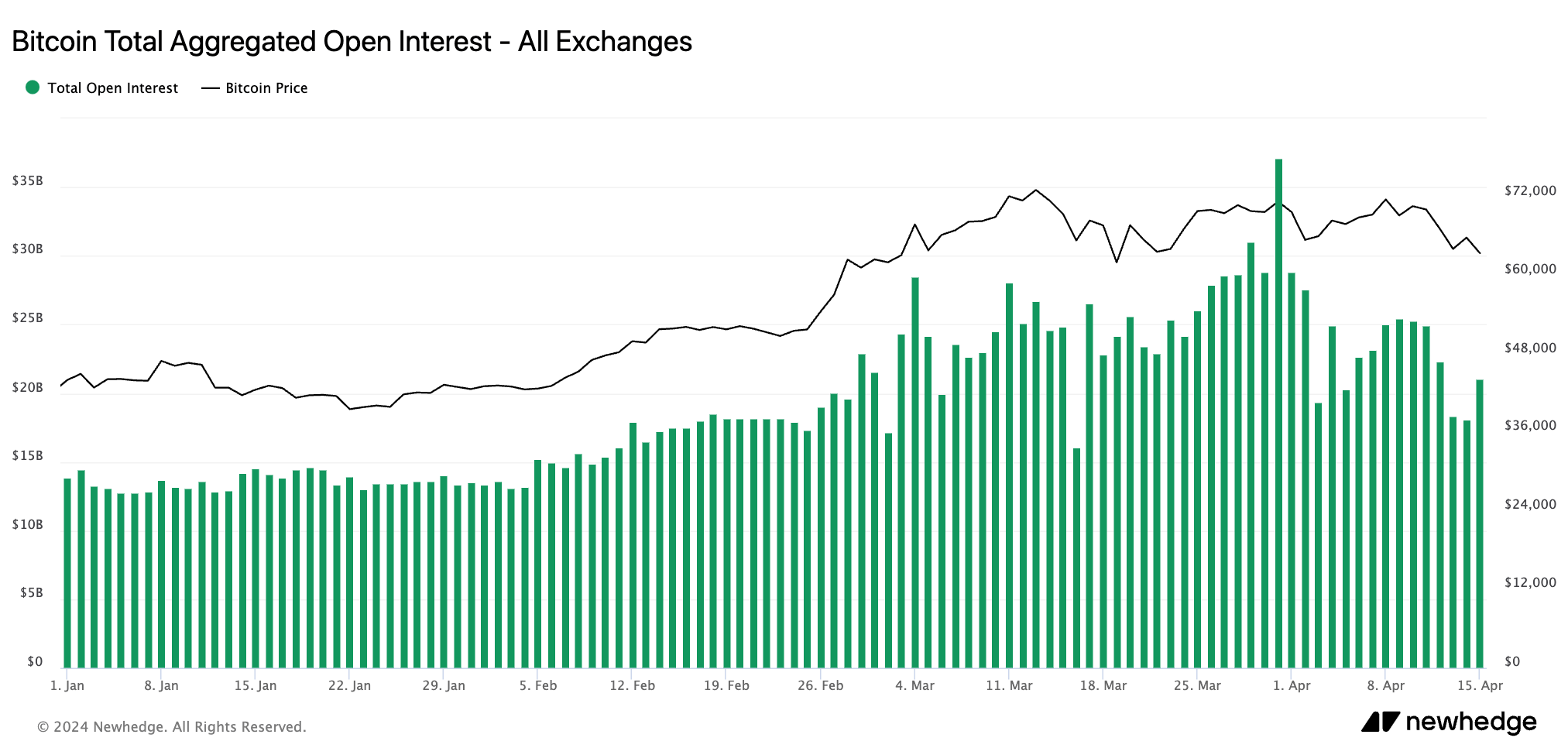

This bearish turn was also seen in open interest. Open interest, representing the total number of outstanding derivative contracts that have not been settled, dropped significantly from $37.112 billion on Mar. 31 to $21.047 billion on Apr. 15.

A decrease in open interest alongside falling prices and negative funding rates typically indicates that traders are closing their positions either to cut losses or take profits, leading to reduced liquidity and increased volatility.

The post Funding rate turns negative as Bitcoin drops below $64k appeared first on CryptoSlate.