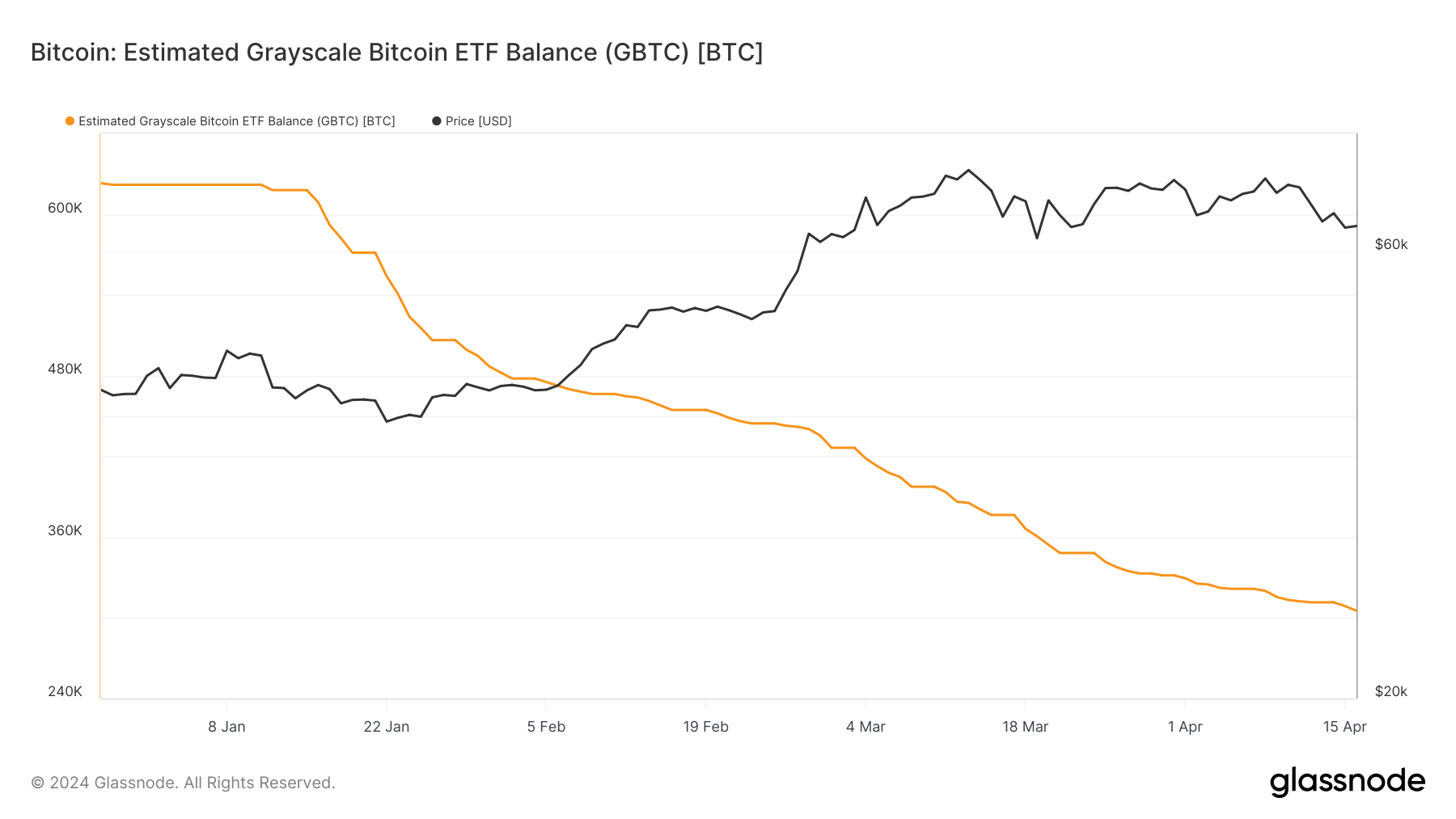

Grayscale’s Bitcoin ETF continues to record steady outflows and has now fallen to half of the Bitcoin it held at the point of the trust’s conversion to a spot Bitcoin ETF. Unless Grayscale sees unprecedented inflows, it will see a halving of both its assets and Bitcoin block rewards this week.

When the spot Bitcoin ETFs were approved in January, Grayscale held around 640,000 BTC under management. It now has roughly 308,000 BTC valued at around $19.7 billion.

While the amount of Bitcoin held under management has fallen by 51%, the value of its assets under management has fallen just 29% due to Bitcoin’s climb from $42,000 to $63,000.

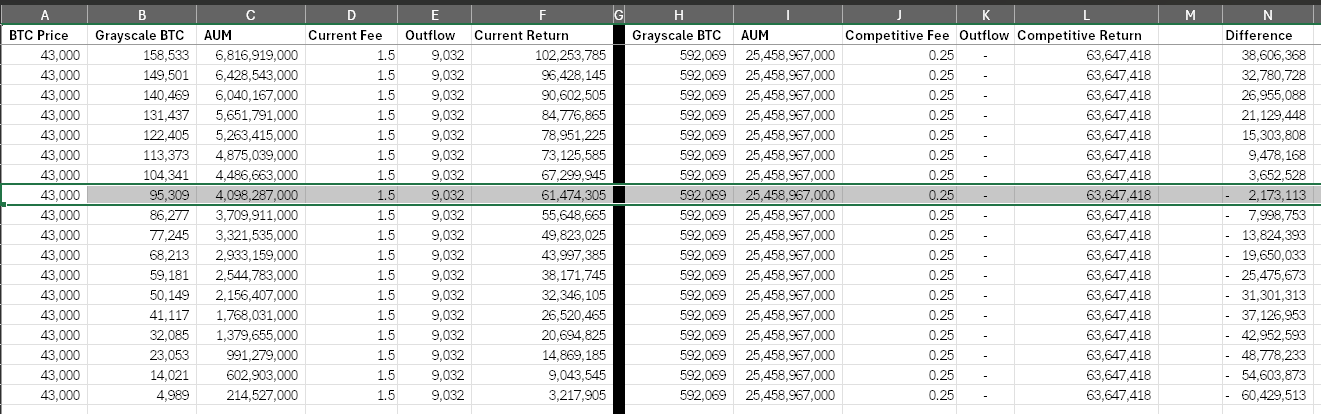

Compared with the Newborn Nine ETFs, the outflow has been chiefly attributed to the outsized fees charged by Grayscale. While Grayscale has been able to continue to garner significantly higher revenues by retaining its higher fee structure, it is now approaching a tipping point whereby lowering its fees may be a viable option.

A study I conducted at the end of January showed that even at 95,000 BTC under management, it would still generate over $60 million in revenues annually from fees alone. These fees would still put it near the top of the revenue generation leaderboard.

The post Grayscale witnessing a double halving as Bitcoin holdings fall to 310k appeared first on CryptoSlate.