Quick Take

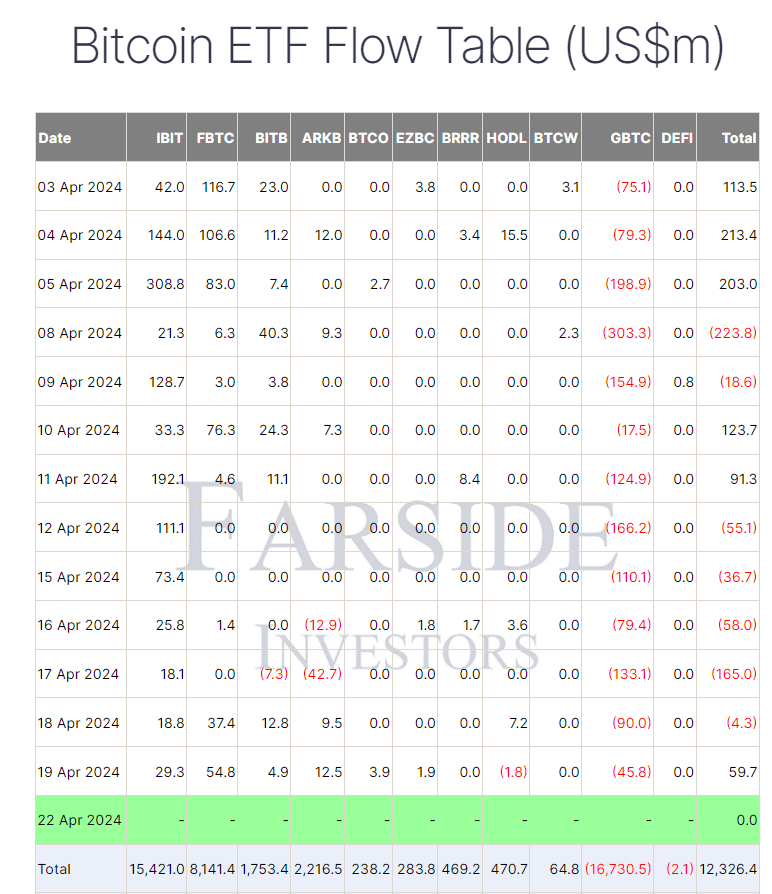

Data from Farside shows that Bitcoin (BTC) exchange-traded funds (ETFs) recorded a net inflow of $59.7 million on April 19 after five consecutive trading days of net outflows. Six of the 11 ETFs saw net inflows for the day, indicating a broad recovery.

Data from Farside shows that Fidelity’s FBTC led the pack with a net inflow of $54.8 million, the largest since April 10, taking its total net inflows to $8,141.4 billion. BlackRock’s IBIT followed closely, attracting $29.3 million in net inflows, the highest since April 15, bringing its total to $15,421.0 billion.

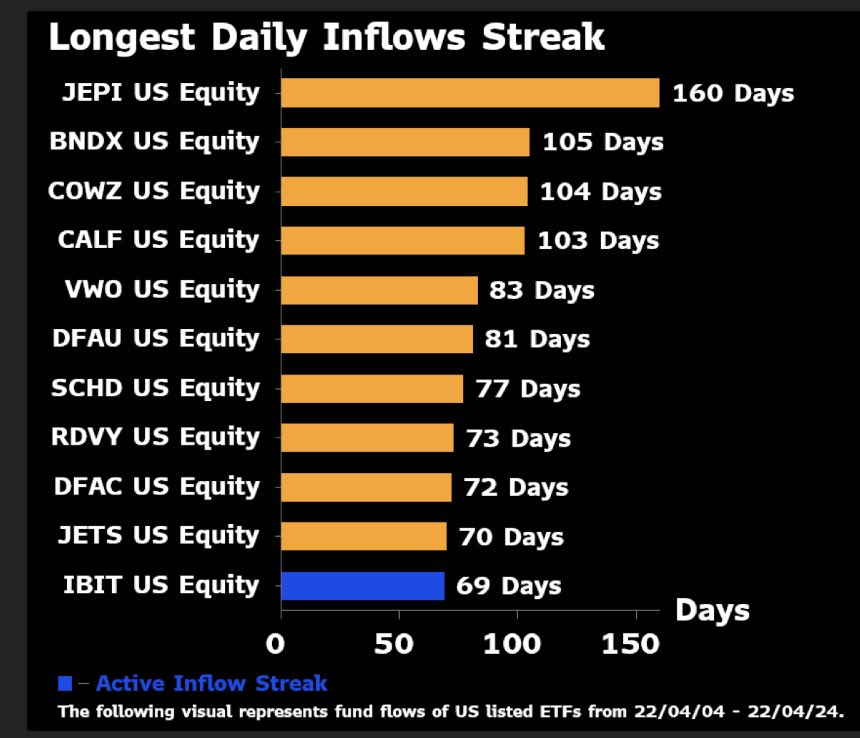

IBIT has now experienced inflows for 69 consecutive trading days. According to senior Bloomberg ETF analyst Eric Balchunas, if this trend continues on April 22, it will secure a spot among the top 10 US ETFs with the longest daily inflow streak.

Grayscale’s GBTC saw a $45.8 million outflow, the smallest net outflow since April 10, bringing its total net outflows to $16,730.5 billion. The Van Eck HODL ETF experienced a small outflow of $1.8 million, its first since March 4, taking its total net inflows to $470.7 million; the combined total net inflows of all Bitcoin ETFs now stand at $12,326.4 billion, according to Farside data.

The post BlackRock’s IBIT only 1 day away from top 10 status with unbroken inflow streak appeared first on CryptoSlate.