Quick Take

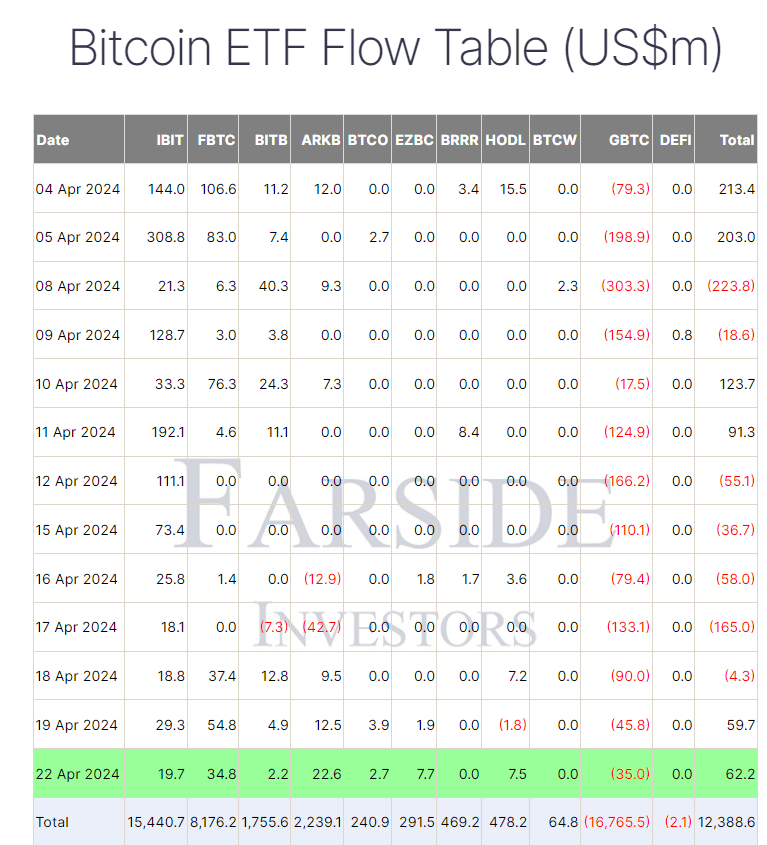

According to Farside data, Bitcoin (BTC) exchange-traded funds (ETFs) saw a net inflow of $62.2 million on April 22. This marks back-to-back net inflows for the first time since April 11. Grayscale GBTC recorded a $35 million outflow, its smallest outflow since April 10. This could be influenced by their plans to create a mini-trust ETF with competitive fees of 0.15%. This development could be a contributing factor to the reduced outflow.

BlackRock IBIT experienced a net inflow of $19.7 million, solidifying its position in the top 10 consecutive inflows for US ETFs with an impressive 70-day streak. The breadth of net inflows continues to be encouraging, with 7 out of 11 ETFs experiencing net inflows. In total, the ETFs have now seen a net inflow of $12,388.6 billion.

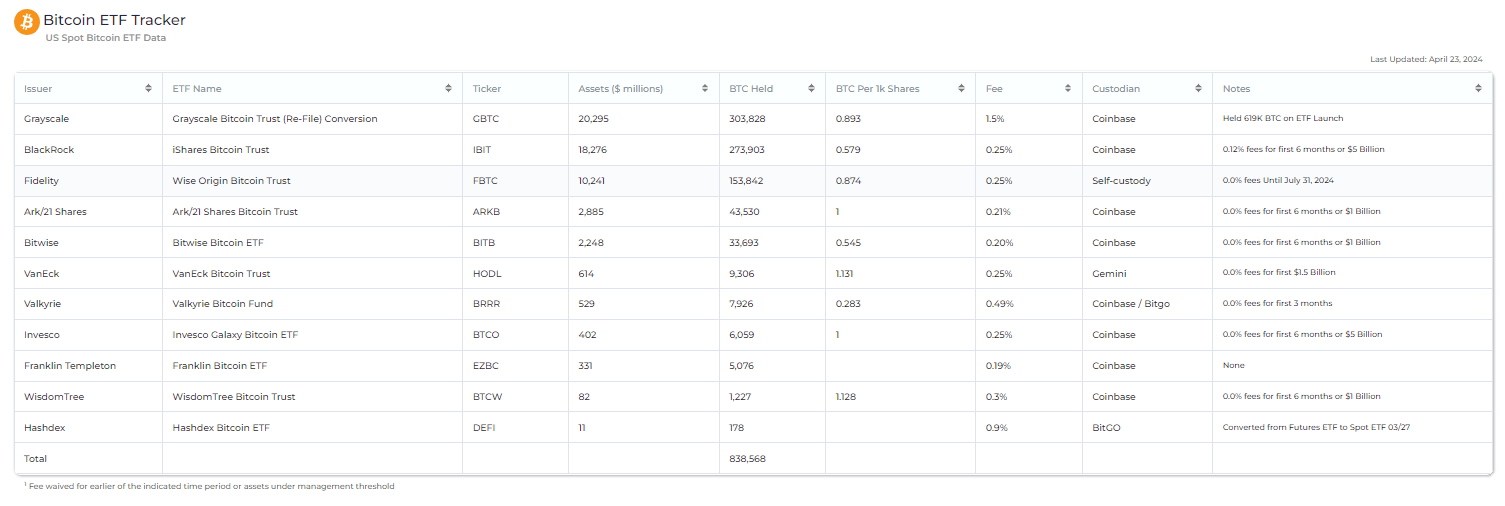

According to Heyapollo data, the aggregate BTC holdings of the ETFs currently stand at 838,568 BTC. Specifically, GBTC holds 303,828 BTC, while IBIT holds 273,903 BTC, revealing a marginal difference of 29,925 BTC between them.

The post BlackRock Bitcoin ETF enters elite top 10 continuing a 70-day positive run of inflows appeared first on CryptoSlate.