Bitcoin exchange Mt. Gox has reportedly begun repaying its users, providing a glimmer of hope for those affected by the exchange’s infamous hack over a decade ago.

The trustee of Mt. Gox confirmed the verification process for eligible repayment clients three months ago, and now users are seeing actual payments being made. However, the repayment process raises concerns about the potential impact on the Bitcoin market.

Mt. Gox Users Receive Payments, But Challenges Persist

Users of the social media site Reddit have reported receiving payments from Mt. Gox, as the trustee added specific amounts and completion dates to their claim accounts.

While some users expressed satisfaction with the repayment process and the absence of fees, others faced challenges such as failed transfers and extended deadlines.

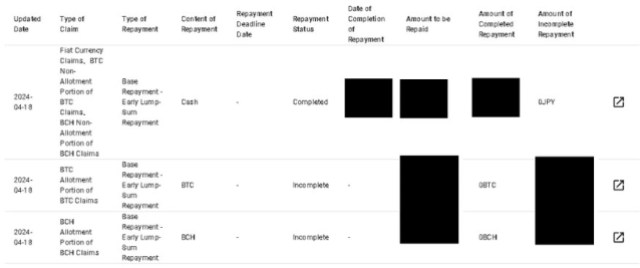

As seen in the image below, the trustee has been regularly updating the redemption tables to provide transparency on progress. However, users and customers of the defunct exchange remain concerned about the fees incurred during the redemption process.

As noted in the image, the payments made so far have been cash redemptions, leaving BTC and Bitcoin Cash payments pending. If users decide to sell the tokens they received, this is expected to impact the prices of both cryptocurrencies further.

200,000 BTC To Be Release And Bitcoin Price Outlook

With over 10 years passing since the hack that resulted in the loss of 809,000 BTC, the release of 200,000 BTC to users could potentially impact the cryptocurrency’s price.

Additionally, Mt. Gox still holds 143,000 BCH and 69 billion Japanese yen, adding further complexity to the situation. The potential selling of the received BTC by users waiting for their funds for years might dampen Bitcoin’s bullish sentiment and the ongoing price recovery.

While the amount of cash refunded has not been disclosed, it has come to light that users are being paid in Circle’s USDC stablecoin. This leaves Mt. Gox users who requested to be paid in BTC or Bitcoin Cash as key players in the market, as they could play a significant role in the current market conditions.

The timing of the repayment and the users’ strategy toward holding or selling their BTC and Bitcoin Cash are critical factors determining the long-term effects on Bitcoin’s price.

Currently, BTC is trading at $65,900, showcasing a 1.9% surge within the last 24 hours. The $60,000 mark has emerged as a crucial threshold for BTC bulls striving to establish a strong consolidation above this level.

On the other hand, Bitcoin Cash (BCH) is trading at $510, reflecting a 2.1% increase over the past 24 hours and an impressive 8.5% growth over the past month.

Featured image from Shutterstock, chart from TradingView.com