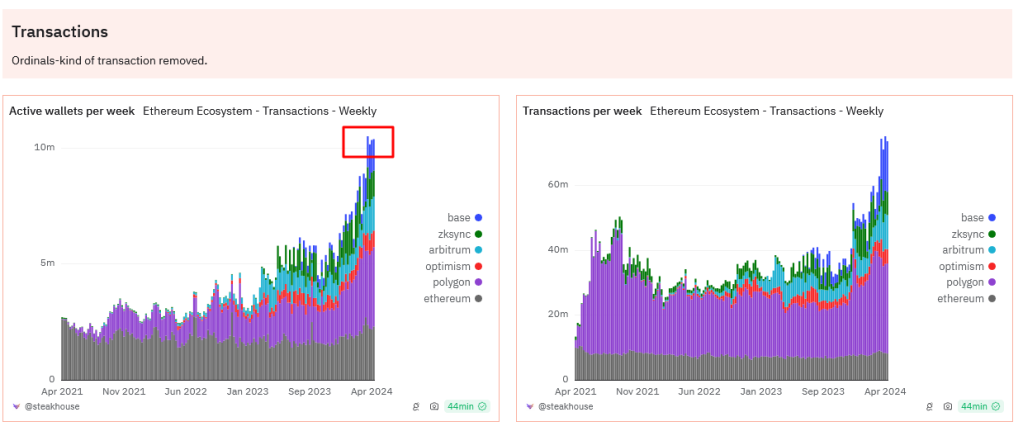

There has been a noticeable uptick in network activity in the broader Ethereum ecosystem. According to Dune Analytics, excluding Ordinals-related addresses, there are over 10 million wallets actively engaging with the mainnet and Ethereum layer-2 solutions like Base, Optimism, and Arbitrum.

Ethereum Ecosystem Vibrant: Record 10 Million Active Wallets

This milestone is a direct result of the successful implementation of the Dencun Upgrade in mid-March 2024. The update, one of the many other upgrades set for Ethereum, has effectively addressed pressing challenges, particularly those related to scalability and gas fees.

With the surge in active wallets connecting to various protocols deployed on the mainnet, sidechain, or off-chain rails, one analyst on X is upbeat, predicting the number to expand from 10 million to 100 million in the upcoming bull cycle. This spike will be accelerated partly by the enhancements brought by Dencun, which made layer-2 transactions using rollups cheaper.

To do this, Dencun uses “blobs,” a new transaction type, to store data not processed by the Ethereum Virtual Machine (EVM). Blobs can be considered new data storage channels within a block that help streamline block verification. Notably, it does this without compromising data availability—a massive boost for Ethereum layer-2 solutions integrating Dencun.

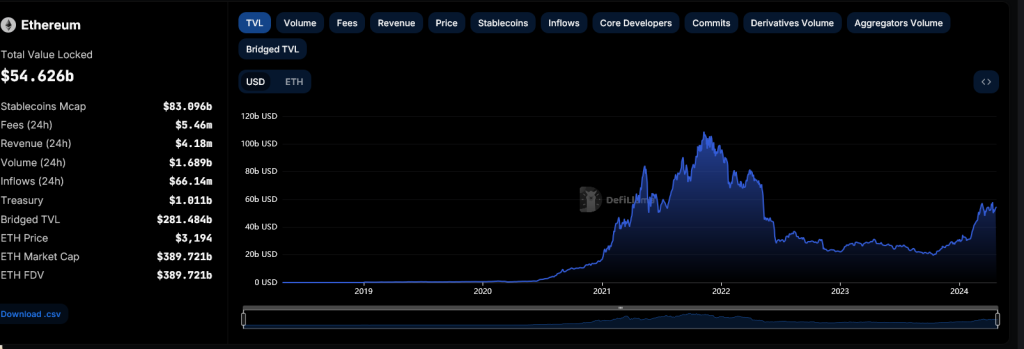

TVL Across Layer-2 And DeFi Protocols Fast Rising

With falling gas fees and more efficient layer-2 platforms, Dencun has helped attract new users, revitalizing the broader Ethereum ecosystem. The increasing total value locked (TVL) across layer-2 portals and the mainnet reflect this.

According to L2Beat, on average, the top leading layer-2 platforms like Arbitrum and Optimism have seen double-digit increases in the past week. So far, all layer-2 platforms manage over $39 billion in assets. Parallel data from DefiLlama also underlines this growth. Over the last six months, the TVL of leading decentralized finance (DeFi) protocols has increased from around $20 billion to over $54 billion at press time.

Despite these advancements, challenges remain. Ethereum is fragile and can’t scale efficiently whenever usage spikes. Therefore, it is highly likely that gas fees will rise in the next bull run, especially if ETH prices rally, breaking above $4,000 and all-time highs.

Additionally, users—mainly meme coin deployers—could prefer using alternatives like Solana or Avalanche, dampening activity.

Nonetheless, Ethereum supporters remain positive. As crypto prices stabilize and likely align with gains of Q1 2024, more users will be keen to explore some of the top protocols launched on the mainnet or via layer-2 platforms.