A bull flag recently formed on the Bitcoin chart, raising the possibility of a trend reversal soon enough as the flagship crypto makes significant moves to the upside. This crypto analyst suggests that the crypto could rise to as high as $100,000 when it makes that move.

Bitcoin’s Bull Flag Suggests More Upside

Denis Baca, Head of Product at Zivoe Finance, noted that the bull flag formation on Bitcoin’s daily chart historically suggests that the crypto token is primed for more upsides. He added that the bullish pattern is “shaping up nicely” and that Bitcoin could potentially shoot up towards $100,000 once the declining volume picks up.

However, Baca further suggested that Bitcoin could drop below $60,000 before it makes such a parabolic move. He alluded to how the crypto token historically retests the support level of the 20-week SMA (small moving average) in May. This could cause Bitcoin to drop to $56,000, he claimed.

Baca opined that such price dips could be “healthy” for Bitcoin before it experiences a reversal. He elaborated that these dips “offer solid buying opportunities,” which could help spark Bitcoin’s move to record highs.

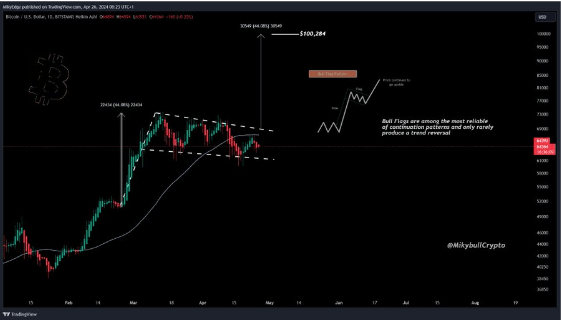

Crypto analyst Mikybull Crypto also shared his thoughts on what this bullish pattern could mean for Bitcoin. On his part, he suggested that the formation further proves the continuation of Bitcoin’s bull run and that a bearish reversal was unlikely.

#Bitcoin on a daily chart forming a bull continuation pattern.

According to Wyckoff’s law of cause and effect “the longer the consolidation, the more explosive the markup will be” pic.twitter.com/ArH0lNnyc2

— Mikybull

Crypto (@MikybullCrypto) April 26, 2024

He also hinted that the next leg up could be massive as he alluded to Wyckoff’s law of cause and effect, which states that “the longer the consolidation, the more explosive the markup will be.”

Bitcoin Needs A Catalyst To Spark This Upward Trend

Andrey Stoychev, Head of prime brokerage at Nexo, remarked that any potential price rise for Bitcoin is unlikely to be realized without a catalyst. He noted that the flagship crypto token has managed to build resilient support at $64,000, but without any catalyst, it will merely continue to trade around the $67,000 range.

It is worth noting that the Spot Bitcoin ETFs, which previously served as a major catalyst to Bitcoin’s price surges, have recently suffered from declining demand. They have also experienced significant net outflows this month, leading to a wave of Bitcoin sell-offs from the fund issuers to fulfill redemptions.

Despite this, Stoychev is positive that Bitcoin won’t drop below $60,000. He predicts that the only thing that can cause Bitcoin to retrace to such a level is if high interest rates are maintained longer than expected, as this can affect sentiment toward crypto assets.

At the time of writing, Bitcoin is trading at around $62,900, down over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pixabay, chart from TradingView