In a significant development within the cryptocurrency community, Roger Ver, an early investor in Bitcoin, has been indicted by the US Department of Justice (DOJ) on multiple charges, including mail fraud, tax evasion, and filing false tax returns.

Roger Ver’s Alleged Tax Evasion Unveiled

According to the indictment, Ver owned and operated companies such as MemoryDealers.com Inc. and Agilestar.com Inc., which specialized in selling computer and networking equipment.

Ver is accused of acquiring Bitcoin for himself and his companies in 2011, amassing a significant fortune in the cryptocurrency.

To evade taxes, Ver allegedly renounced his US citizenship in 2014 through a process known as expatriation, subsequently obtaining citizenship in St. Kitts and Nevis. However, US law required him to disclose and pay taxes on capital gains from his global assets, including the Bitcoin he held.

US Prosecutors Pursue Extradition

The indictment further alleges that Ver provided false or misleading information to his legal representatives and appraisers, understating the value of his companies and Bitcoin holdings. Consequently, he is accused of filing false tax returns that significantly undervalued his assets, evading substantial tax obligations.

Prosecutors claim that Roger Ver’s actions caused a loss of at least $48 million to the IRS. Despite no longer being a US citizen, he was legally obligated to report and pay taxes on certain distributions, including dividends, from his US-based companies.

However, Ver allegedly concealed his receipt and sale of Bitcoin held by his businesses, failing to report the associated gains and pay the required taxes.

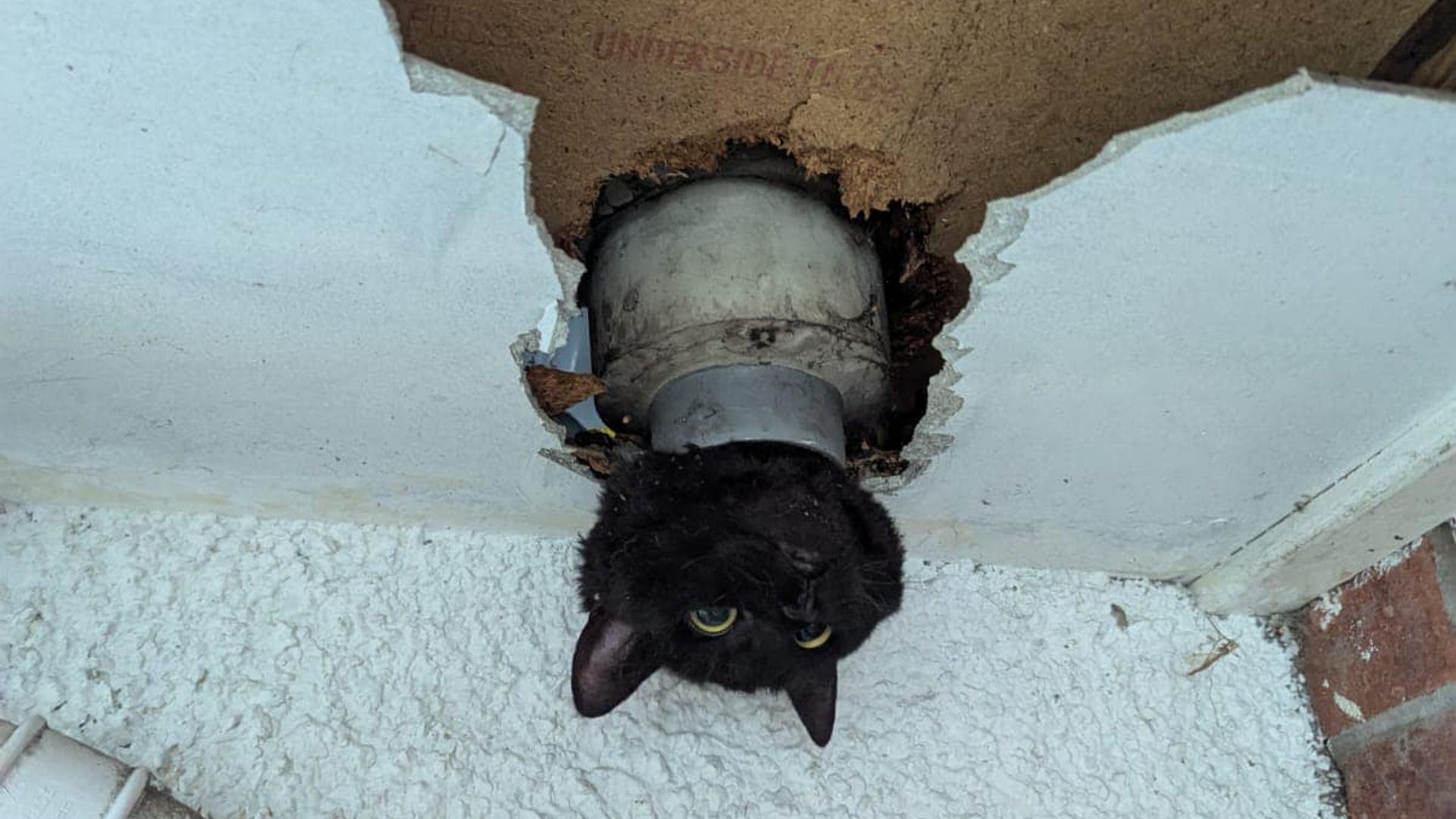

Roger Ver, the “Bitcoin Jesus,” has been taken into custody in Spain, where he was arrested on the above charges. As a result, the US is seeking his extradition to stand trial.

Featured image from Bloomberg, chart from TradingView.com