Quick Take

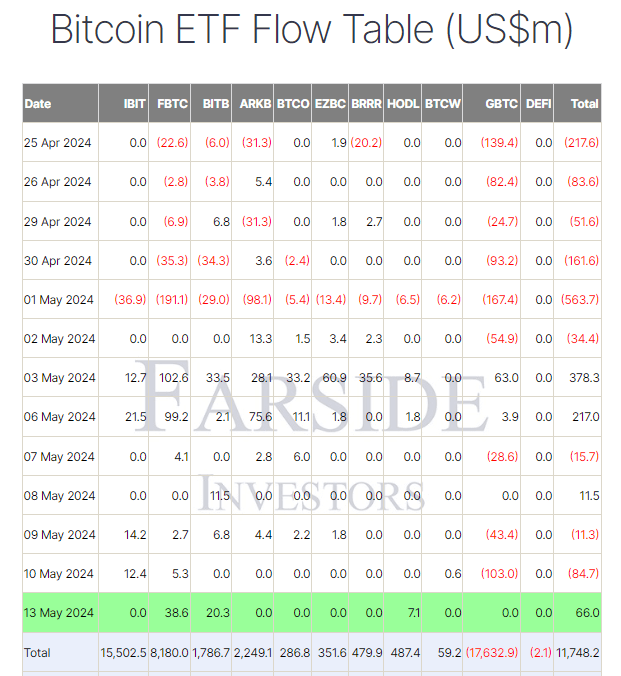

Farside data reports that US Bitcoin (BTC) exchange-traded funds (ETFs) recorded the biggest inflow since May 6, totaling $66.0 million.

Leading the charge was Fidelity’s FBTC, which saw a $38.6 million inflow, bringing its total net inflow to an impressive $8.2 billion. Bitwise’s BITB followed closely, attracting a $20.3 million inflow – its largest since May 3 – and taking its total net inflow to $1.8 billion. VanEck’s Hodl ETF also experienced a significant inflow of $7.1 million, its biggest since May 3, raising its total inflow to $487.4 million. Notably, Grayscale’s GBTC did not witness any outflows or inflows, marking only the second time this has occurred since its launch, according to Farside data.

According to farside data, the total net inflows for all US BTC ETFs now stand at an impressive $11.7 billion.

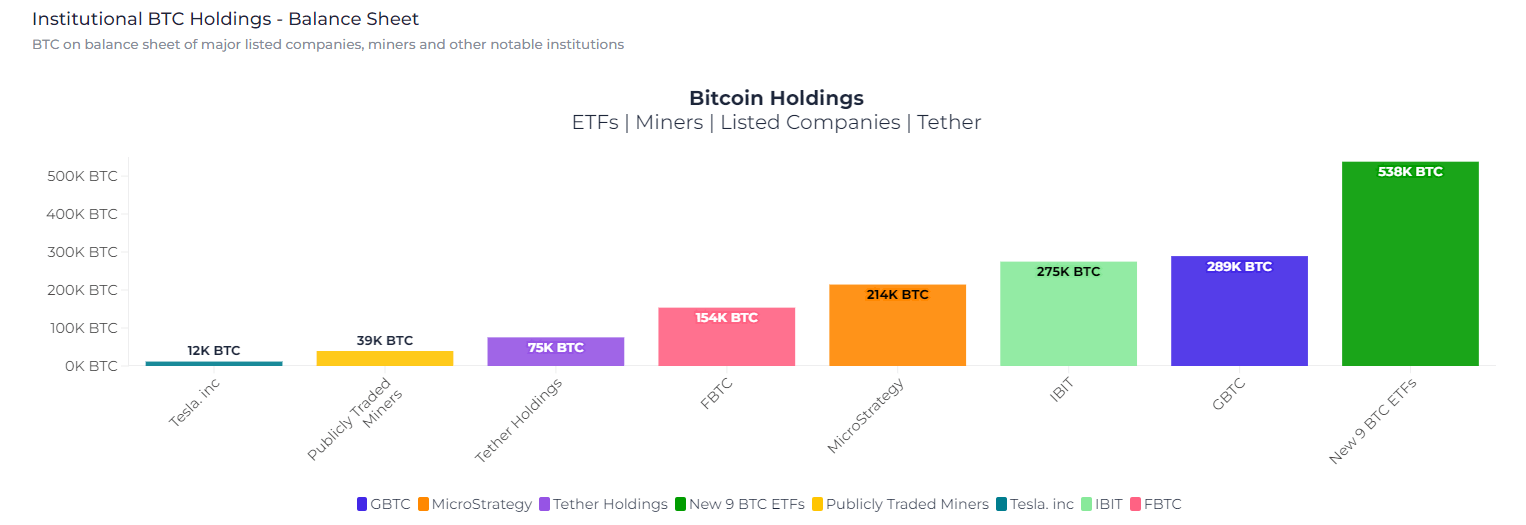

According to heyapollo, BlackRock IBIT is now 14,651 BTC behind GBTC, holding 274,836 BTC compared to GBTC’s 289,487 BTC. The new nine BTC ETFs collectively hold roughly 538,000 BTC.

The total net inflows for all US BTC ETFs now stand at an impressive $11.7 billion.

The post US Bitcoin ETFs see largest inflows since May 6 as GBTC outflow stops again appeared first on CryptoSlate.