Quick Take

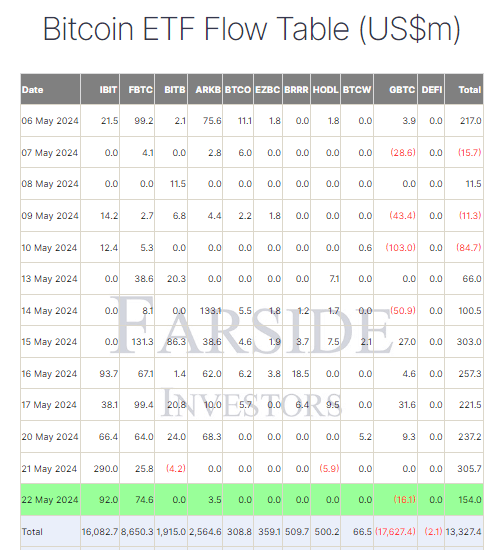

On May 22, Bitcoin (BTC) exchange-traded funds (ETFs) experienced significant activity, bringing in a total of $154.0 million, according to Farside data. However, the breadth of these inflows was limited, with only three ETF issuers recording positive inflows.

Leading the pack once again was BlackRock’s IBIT, which attracted $92.0 million in inflows, boosting its total net inflow to an impressive $16.1 billion. Fidelity’s FBTC also saw substantial inflows, with $74.6 million, bringing its total net inflow to $8.7 billion. In contrast, Grayscale’s GBTC experienced an outflow for the first time since May 14, amounting to $16.1 million, increasing its total net outflows to $17.6 billion. Overall, the total net inflows of Bitcoin ETFs now stand at $13.3 billion, according to Farside data.

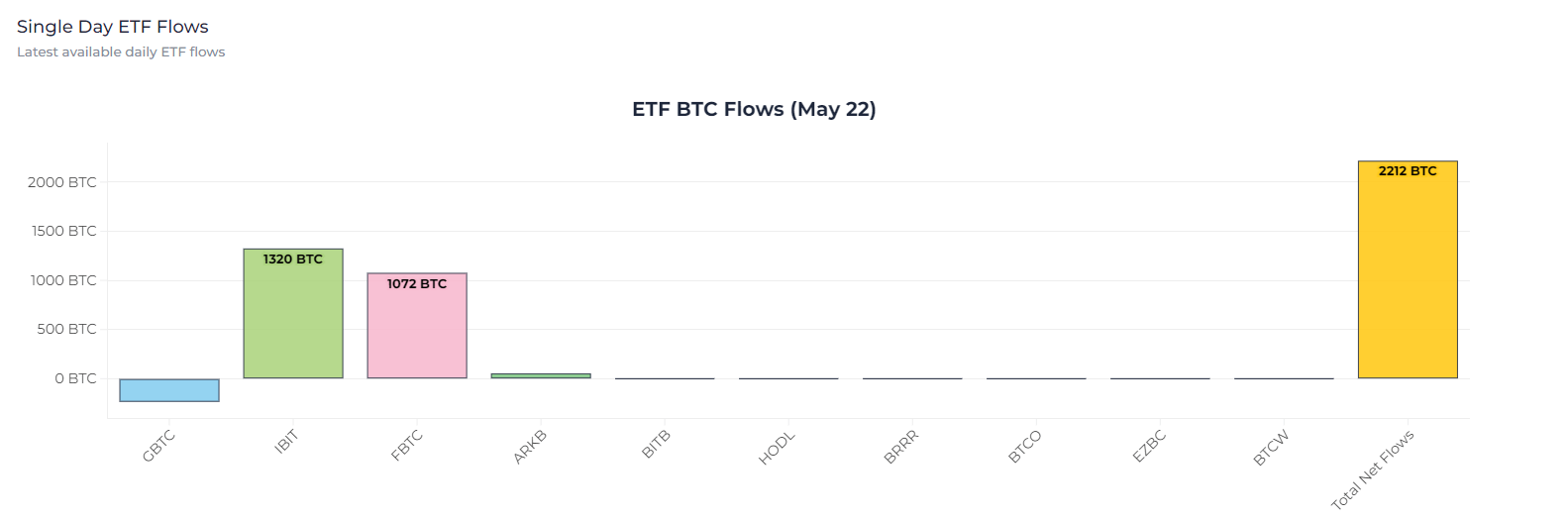

Additionally, Heyapollo reported that the inflows for U.S. ETFs on May 22 amounted to 2,212 Bitcoin.

The post U.S. Bitcoin ETFs amass 2,212 BTC in a day, led by BlackRock’s IBIT and Fidelity’s FBTC appeared first on CryptoSlate.