In this week’s edition of “This Week In Crypto” we delve into pivotal developments and key data releases that are set to shape the crypto landscape in the last week of May. From crucial inflation data influencing Bitcoin’s trajectory to significant governance votes and strategic collaborations in the blockchain sector, each event carries the potential to significantly impact market dynamics.

#1 The Bitcoin And Crypto Markets Await US PCE Data

The Bitcoin and crypto market is on high alert as the US Bureau of Economic Analysis prepares to release the Personal Consumption Expenditures (PCE) Price Index data for April on May 31. This indicator, vital for assessing inflation, influences the Federal Reserve’s policy decisions directly affecting market dynamics.

Analysts from Talkingmacro highlight that while the Consumer Price Index (CPI) and Producer Price Index (PPI) provide earlier signals, “PCE data, though lagging, remains a critical indicator for gauging sustainable economic trends.”

This week, expectations are set for the PCE inflation to moderate to +0.2% month-on-month from the previous +0.3%, aligning the year-on-year rate to +2.6%, slightly down from +2.7%. This data point is crucial as it skirts just above the Fed’s 2% target, suggesting that inflation may be cooling. “While a significant deviation could spur volatility, the markets have largely priced in the current trajectory towards the Federal Reserve’s target,” analysts from Talkingmacro noted.

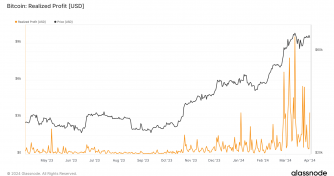

Bitcoin’s sensitivity to Federal policies means that any unexpected shift in inflation expectations could sway crypto prices significantly. “Crypto has been highly sensitive to the pricing of Fed policy or ‘forward guidance,’ so it pays to pay attention to this data and macroeconomic trends,” the analyst from Talkingmacro wrote. With Bitcoin currently fluctuating below $69,000, the market can anticipate some volatility.

#2 Uniswap (UNI) – Vote To Enable Fee-Sharing Mechanism

The decentralized finance (DeFi) sector is set to witness a pivotal development as Uniswap Foundation gears up for a governance vote on May 31 to implement a fee-sharing mechanism for UNI token holders. This proposal aims to modify the protocol’s governance to allow the collection and pro-rata distribution of protocol fees to stakers and voters.

Erin Koen, governance lead at the Uniswap Foundation, explained, “Maintaining this lead [in the market] is only going to get more difficult. […] To survive & thrive in a credibly neutral way, Uniswap Governance needs to use its reputational, financial & technical capital for good.”

When announced in February, UNI experienced a sharp 40% price increase, indicating strong market approval. The approval of this proposal could mark a significant shift towards more sustainable economic incentives within the Uniswap ecosystem, potentially setting a precedent for other DeFi platforms.

#3 SEI – Sei V2 Goes Live

Today marks the launch of Sei V2, an ambitious upgrade that converts the Sei blockchain into a high-performance, parallelized Ethereum Virtual Machine (EVM). This upgrade, governed by SEI token holders, involves multiple phases: initial governance approval, alpha launch for stability, and final implementation once all systems are deemed stable and efficient.

The introduction of Sei V2 aims to “address scalability and performance bottlenecks faced by conventional blockchains, paving the way for more robust consumer-grade applications,” according to Sei Labs engineers. The upgrade process, planned to minimize risks and optimize performance, is expected to significantly enhance the blockchain’s throughput and reduce transaction latency.

Sei v2 is a proposed upgrade to a live blockchain. The launch is planned to be divided into three phases:

Phase 1: Governance

Phase 2: v2 Alpha: Stability and Infrastructure Deployment

Phase 3: v2 Beta Live

Learn more here: https://t.co/jZ8igrE8UU pic.twitter.com/BlUlyqs0jh

— Sei

(@SeiNetwork) May 15, 2024

#4 LINK – Chainlink & SWIFT Discuss Tokenization

Chainlink’s collaboration with SWIFT, the global provider of secure financial messaging services, is set to take center stage at the Consensys 2024 conference in Austin, Texas. Speculation is rife that this partnership could lead to another major announcement.

On Thursday, May 30, a session titled “How Swift and Chainlink Are Working Together to Unlock Tokenized Assets At Scale” will take place on the Mainstage, featuring Jonathan Ehrenfeld, Head of Securities and Digital Assets Strategy at SWIFT, and Sergey Nazarov, do-founder of Chainlink. It will explore how integrating SWIFT’s extensive financial network with blockchain technology via Chainlink can facilitate a scalable, secure on-chain financial system for tokenized assets.

The previous collaboration experiments conducted in June 2023, which involved major banks like BNP Paribas and BNY Mellon, demonstrated SWIFT’s capability to facilitate cross-blockchain token transfers. It also underscored the potential for Chainlink to be a pivotal building block in the future of finance.

At press time, BTC traded at $68,602.