Bitcoin is dumping when writing, cooling off from May highs of nearly $72,000. Down roughly 10% from all-time highs, there could be more losses on the way, at least looking at the candlestick arrangement in the daily chart.

Now, Willy Woo, a Bitcoin on-chain analyst, thinks the drop is primarily because of the ongoing “miner capitulation.” Woo notes that the network is now actively “culling” out weak miners, forcing them to shut down their operations.

As they exit, they sell their BTC holdings, running into thousands, if not tens of thousands, of the coin.

Bitcoin Network “Culling” Weak Miners

Because of market dynamics, the higher the supply, the lower the prices; Bitcoin is flushing lower, squeezing out even more miners. It remains to be seen for how long this will continue, but the impact of Halving is now increasingly evident.

In Woo’s assessment, miner capitulation is necessary. Moreover, weak miners’ forced liquidation of BTC will only make the network more resilient. This is because the “cull” will eliminate less efficient players from the network, ultimately leading to a more robust system.

On April 20, the Bitcoin network Halved miner rewards from 6.25 BTC to 3.125 BTC. Since miners depend on rewards as their primary income source, their revenue was slashed by 50%.

If they choose to continue operating, they must not only compete with larger mining firms, most of which are public, like Riot Blockchain and Mara Digital, but they must also be very efficient, using modern gear for a higher hash rate.

Staying efficient is a primary challenge, and rather than competing with public miners, some, as it appears, are folding and choosing to exit the business.

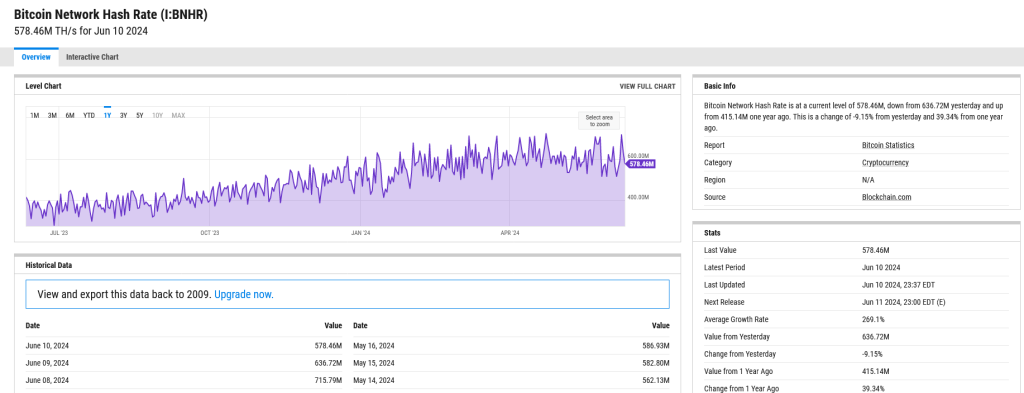

Interestingly, even as “weak” miners shut down operations, the network hash rate–a measure of the total computing power–is still at near record highs. According to YCharts, the hash rate is 578 EH/s, down from 721 EH/s registered on April 23.

Will BTC Prices Recover If Speculative Bets Are Purged?

Woo also thinks there is a need to “purge the degen open interest in futures bets.” The analyst says excessive leverage trading on perpetual platforms like Binance, OKX, and Bybit must drop. The spike in degen trading has driven up the “paper Bitcoin,” or speculative bets.

Woo explains that following the collapse of FTX in November 2022, speculative bets were wiped, allowing for a swift recovery in BTC prices in the following months.

If the coin is to recover and reject the current attempts for lower lows, the clearance of the current “paper Bitcoin” overhang will be required for a sustained leg up.

Whether the “cleansing” of weak miners and speculative bets will help drive up prices remains to be seen for now. Bitcoin is trickling lower, confirming the losses of June 6.

The immediate support lies at $66,000. If this level is lost, BTC could flash crash to $60,000 or even May 2024 lows of $56,500.