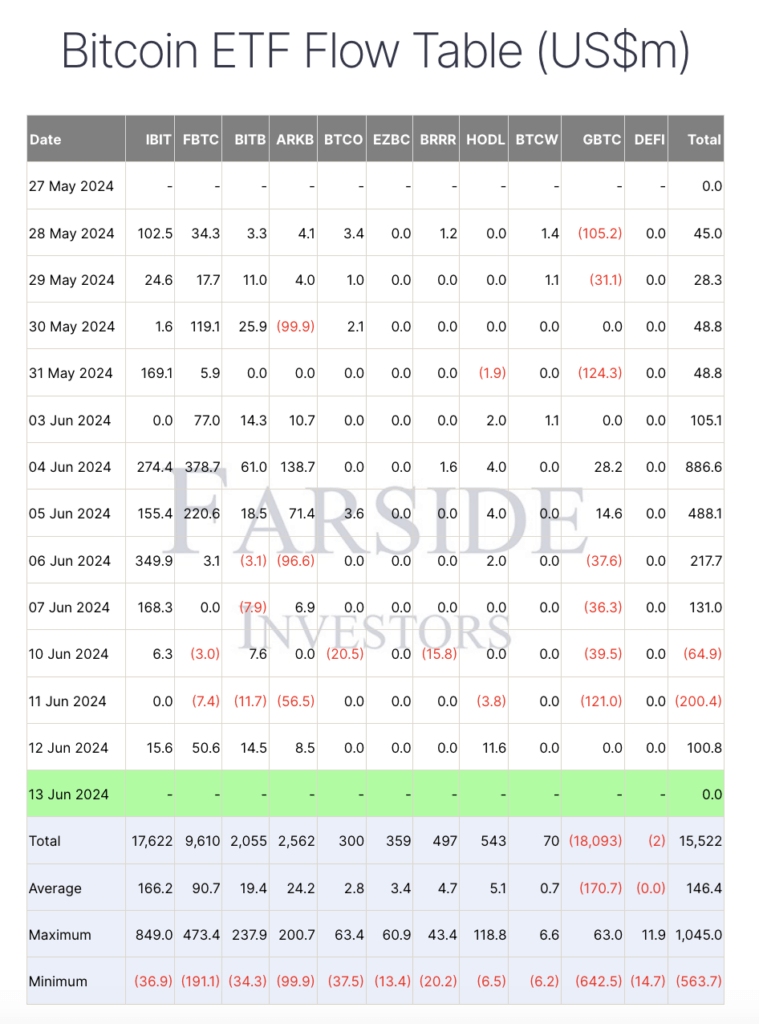

Bitcoin ETFs saw a significant turnaround on June 12, recording a $100.8 million inflow. This marks a notable recovery from two consecutive days of outflows. While inflows exceeding $100 million haven’t been a rarity for spot Bitcoin ETFs, these inflows are especially significant as they come after a substantial outflow of $200.4 million on June 11.

Data from Farside showed Fidelity’s FBTC led the inflows with $50.6 million. BlackRock’s IBIT ranked second with $15.6 million in inflows, followed closely by Bitwise’s BITB ETF and its $14.5 million inflow. BITB has reversed the outflow it saw on June 11, when $56.5 million left the ETF. Valkyrie’s HODL recorded an inflow of $11.6 million.

In contrast, the previous two days saw high outflows, particularly from Grayscale’s GBTC. On June 11, GBTC saw $121 million in outflows and $39.5 million on June 10. Other ETFs, such as ARKB and BITB, also experienced outflows on those days, contributing to the negative sentiment.

The substantial inflows seen on June 12 indicate renewed optimism in the market. This shift in momentum can be attributed to the recent surge in Bitcoin’s price, which briefly surpassed $69,000 following better-than-expected US CPI data. Although the spike was short-lived, it managed to inject the market with optimism. Cooling inflation figures seem to have also bolstered investor confidence in the broader market.

The post Bitcoin ETFs rebound with $100.8M in inflows appeared first on CryptoSlate.