The winds of change are blowing in the Bitcoin market, bringing a fresh wave of short-term traders while veteran holders remain steadfast in their convictions.

A recent report by Bitfinex Alpha reveals a fascinating dichotomy in investor behavior, with new players chasing quick profits and seasoned hodlers (hold on for dear life) accumulating for the long haul.

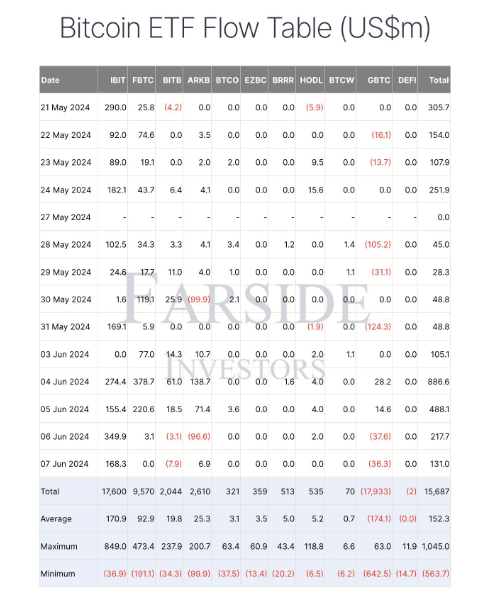

Short-Term Surge Fueled By ETF Frenzy

Spot Bitcoin ETFs, financial instruments that mirror Bitcoin’s price, have emerged as a game-changer. These easily accessible options are attracting a new breed of investor, one with a keen eye for short-term gains.

This influx is evident in the significant rise of short-term holders (those holding Bitcoin for less than 155 days). Their holdings have skyrocketed by nearly 55% since January, indicating a surge in speculative activity.

It looks like we still have overhang from last cycle.

Short term holders realized price is steadily rising as new players enter the market and Buy #Bitcoin. Hedge funds, Pension Funds, Banks etc.

But the price isn’t taking off because older coins are being distributed.

We… pic.twitter.com/VxaXozgANT

— Thomas | heyapollo.com (@thomas_fahrer) June 12, 2024

However, this newfound enthusiasm comes with a caveat. Short-term investors, by their very nature, tend to be more reactive to price fluctuations. A sudden market correction could trigger a sell-off, causing price volatility. The report highlights this vulnerability, emphasizing the need for caution amidst the current “greed” sentiment in the market (as measured by the Fear & Greed Index).

Long-Term Holders: Diamonds In The Rough

While the short-term scene buzzes with activity, long-term holders continue to display unwavering faith in Bitcoin’s potential. These digital veterans, who weathered previous market cycles, have shown a remarkable buying spree after initially offloading some holdings at Bitcoin’s all-time high in March.

The report further underscores this bullish sentiment by pointing out the minimal amount of Bitcoin held by long-term investors that was purchased above the current price point. This signifies a “hodling” mentality, where investors are confident that the current price represents a good entry point for future gains.

Additionally, Bitcoin whales (large investors holding significant amounts) are mirroring their pre-2020 bull run behavior by aggressively accumulating Bitcoin, indicating a potential repeat of the previous market upswing.

Navigating The Crosscurrents

The current Bitcoin market presents a unique situation. On one hand, the influx of short-term investors injects fresh energy and liquidity. However, their presence also introduces the risk of increased volatility. On the other hand, long-term holders continue to be the bedrock of the market, providing stability and confidence.

Bitcoin Price Forecast

The Bitfinex Alpha report coincides with a technical analysis-based prediction, forecasting a potential rise in Bitcoin’s price by 29.51%, reaching $87,897 by July 13, 2024.

However, the report also acknowledges the mixed sentiment in the market, with a Fear & Greed Index hovering at “Greed” territory. This indicates a need for caution, as investor optimism can sometimes precede price corrections.

Featured image from VOI, chart from TradingView