Quick Take

We are now 33 days into the current miner capitulation, with the average duration being 41 days. This indicates that some miners are still facing significant financial pressure due to the previous halving, which has rendered their operations unprofitable. The hash rate has dropped over 12% from its peak on May 26, with the next difficulty adjustment scheduled for June 20 expected to be slightly positive, according to Newhedge.

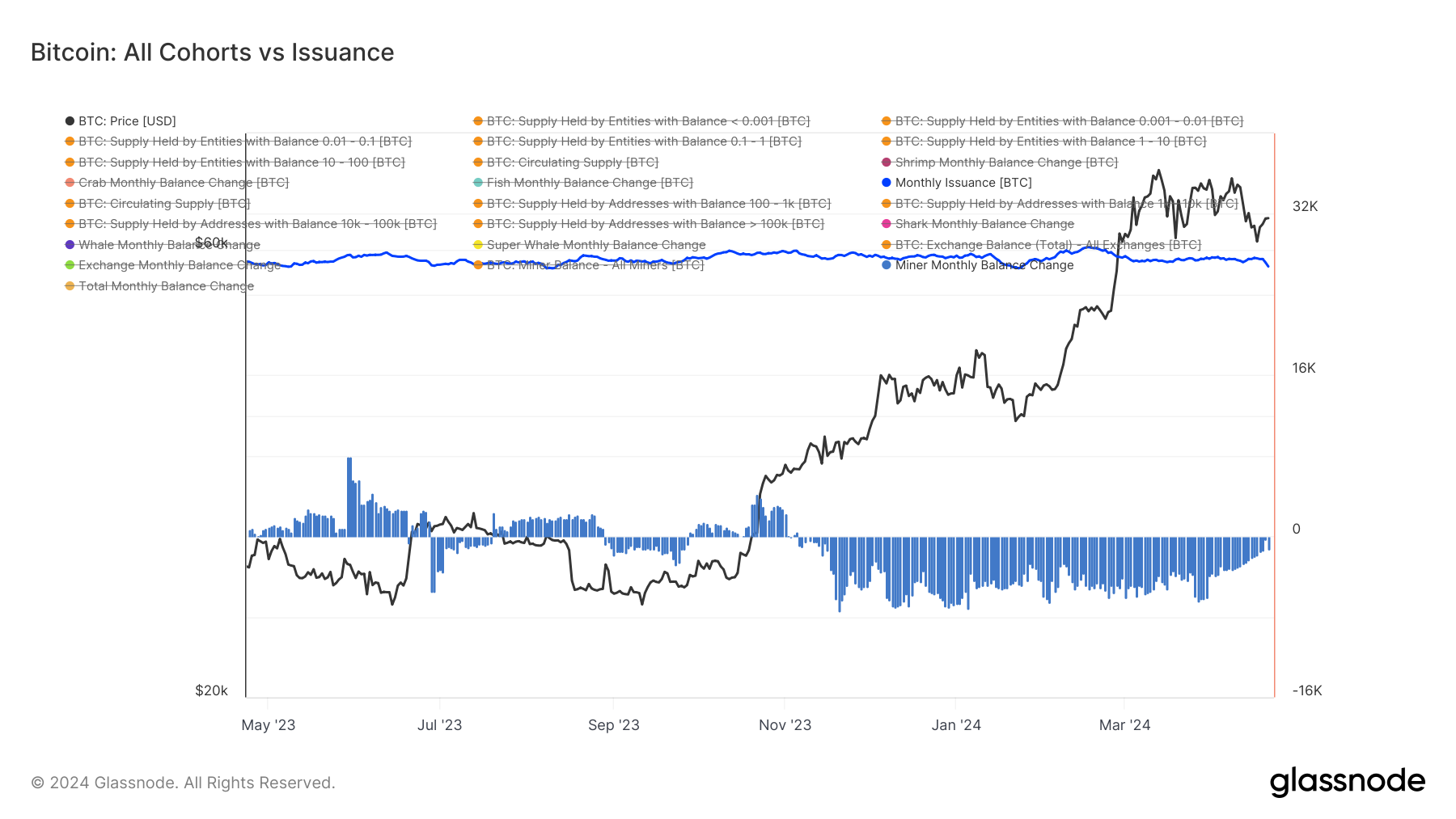

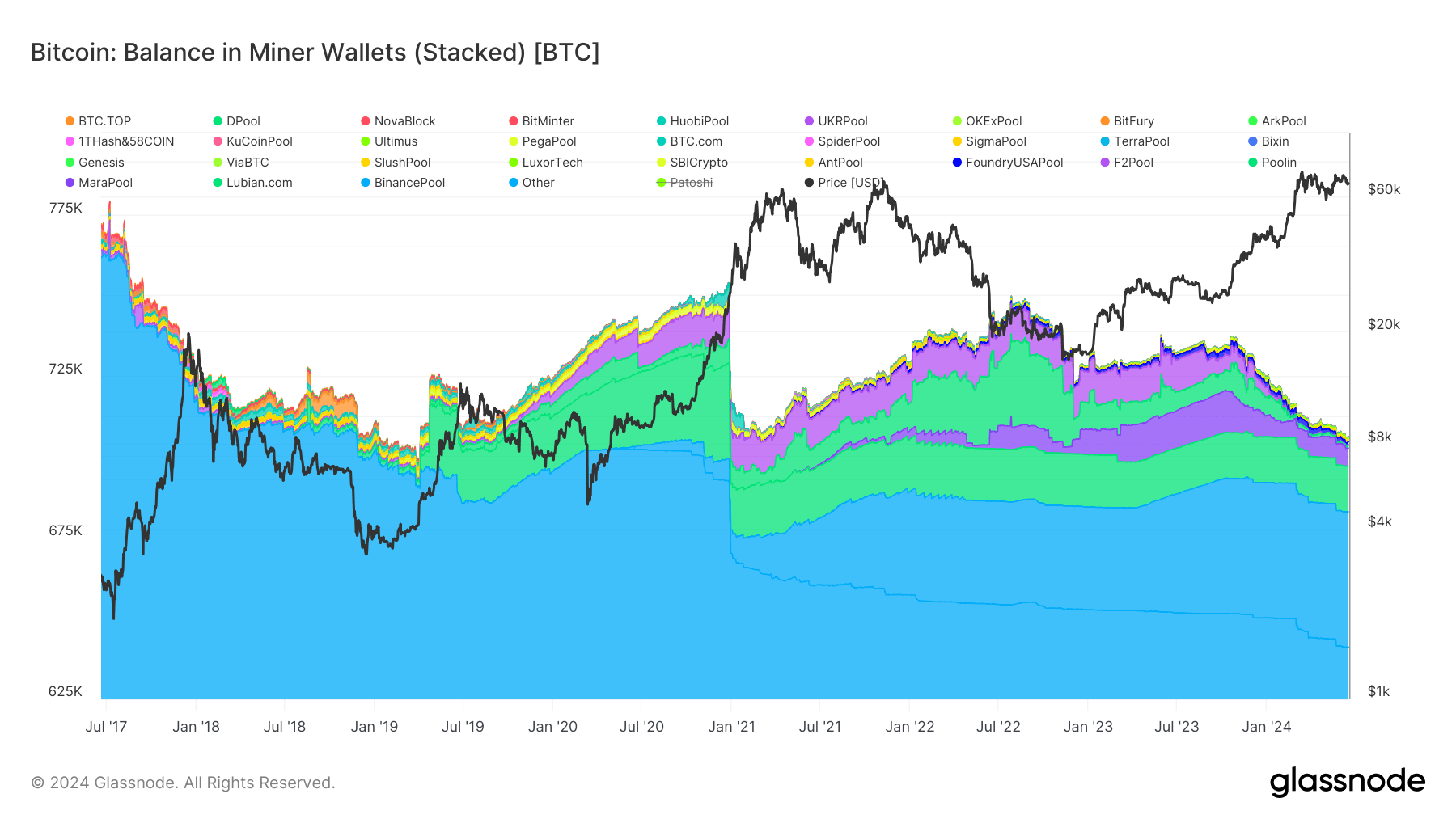

However, the hash rate’s decline has not reached the anticipated 25% post-halving drop, demonstrating unexpected resilience. This resilience can be attributed to two factors: elevated transaction fees driven by Runes and Inscriptions and miners’ strategic financial planning. Miners have built up reserves and are offloading Bitcoin to sustain their operations. Over the past 30 days, more than 3,000 BTC has been distributed by miners, continuing a trend of significant distribution since December 2023, unmatched since the 2017-2018 period, according to Glassnode data.

Glassnode data shows that miner balances have decreased by approximately 30,000 BTC since October 2023, now standing at 1.8 million BTC.

This ongoing distribution poses a significant headwind for Bitcoin, adding selling pressure to the market and affecting its price dynamics.

The post Miners continue to offload Bitcoin amid 33-day capitulation appeared first on CryptoSlate.