Bitcoin has been struggling even though spot exchange-traded funds (ETFs) have been bought. Here’s why, according to this analyst.

Bitcoin Has Been Seeing A Rise In “Paper BTC” Recently

In a new thread on X, analyst Willy Woo has talked about why BTC has seen bearish momentum recently despite the buying pressure from spot ETFs and institutional entities.

First, the analyst has explained a source of spot selling pressure: the long-term holders (LTHs). The LTHs refer to the HODLers of the market, who tend to keep their coins dormant for long periods.

These investors rarely sell, and the timing of when they participate in selling appears to have followed a pattern throughout history. Below is a chart that shows the data for the Coin Days Destroyed (CDD) metric that reveals this trend.

The CDD keeps track of the number of coins that investors are moving on the blockchain daily and weighs it against the age of said coins. This means that when the CDD spikes, many dormant coins have just broken their silence.

As is visible in the graph, the Bitcoin CDD had seen a huge spike earlier in the year when the asset’s price had set a new all-time high (ATH). Naturally, this suggests that the LTHs potentially took part in a large amount of selling during this rally.

It’s also apparent in the chart that similar spikes in the indicator had also occurred in the middle of the 2017 and 2021 bull runs. Thus, this latest selloff from the LTHs isn’t something out of line with what has historically been observed.

The other culprit behind why the asset’s recent run has slowed down could be paper Bitcoin. “Paper BTC” basically refers to the derivatives products that don’t involve the investor owning real tokens of the cryptocurrency.

As the analyst notes:

In the old days, BTC would go on an exponential run because the only sellers was a trickle from the OGs and an even smaller amount from miners with their newly mined coins. Today the magic of paper BTC is what you want to watch.

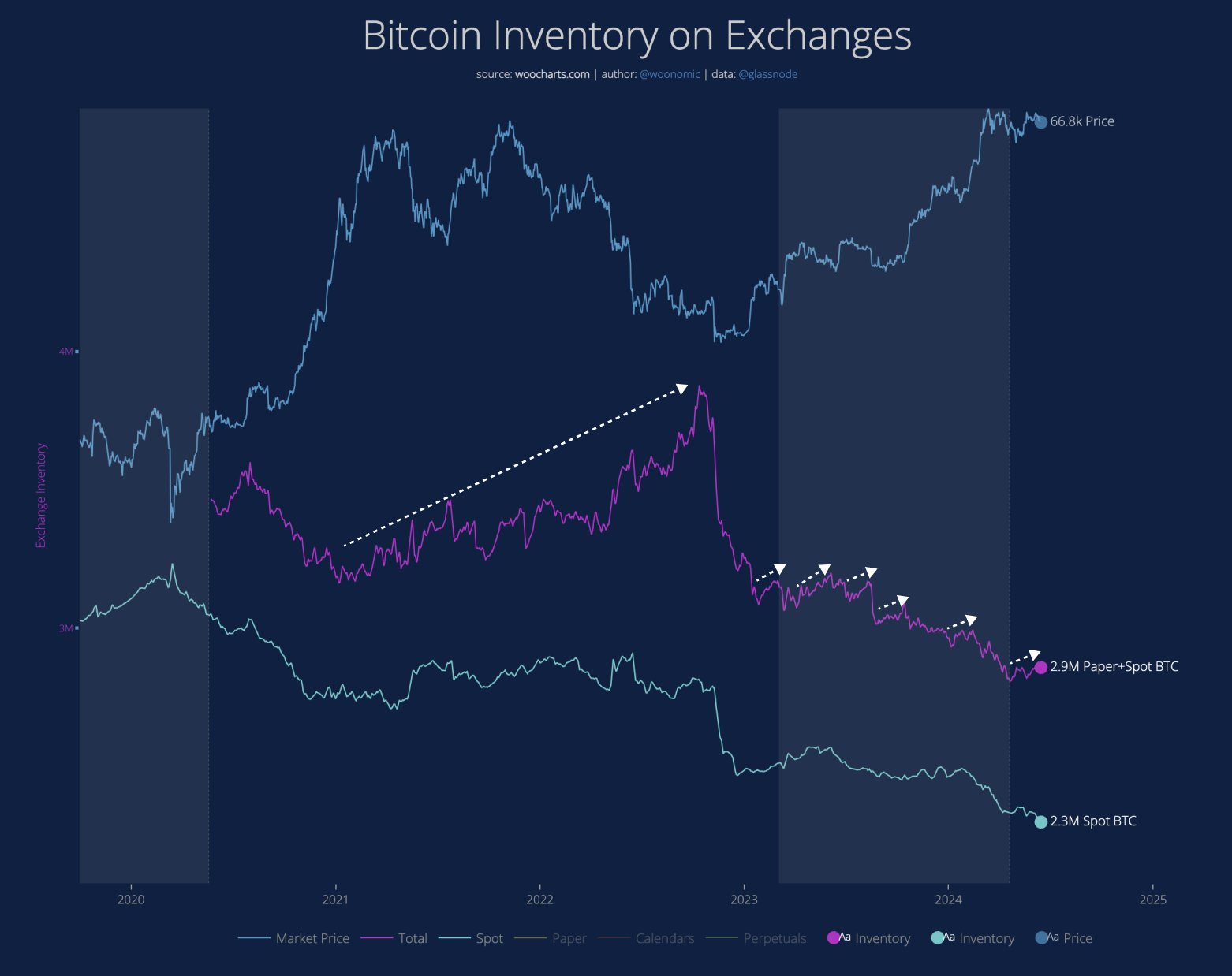

The chart below shows the Bitcoin inventory sitting on exchanges in recent years.

As is visible in the above chart, the spot inventory of the asset has only shown phases of downward and sideways trends during the last few years, meaning that the exchanges have not been receiving any significant net deposits.

However, the spot plus paper BTC inventory did see a rise during the 2022 bear market. This increase implied that paper BTC was being minted rapidly, as the spot inventory was only consolidating in the same period. Woo notes that this suggests paper BTC dictated the bear market.

The analyst has marked the instances where paper BTC rose during this current bull market in the graph. It seems that every time paper BTC has gone up, the rally has slowed.

The inventory of paper BTC has been increasing again recently, which may explain why Bitcoin has been unable to establish bullish momentum.

BTC Price

Bitcoin recovered above the $66,000 mark during the weekend, but the asset has retreated today as its price is down to $65,300.