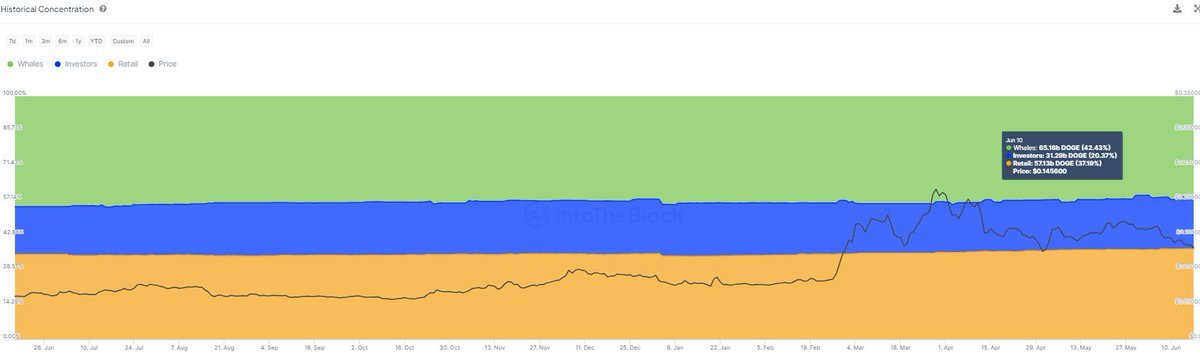

As the crypto market endures another tumultuous period, Dogecoin has seen significant changes in its ownership structure. Recent data from IntoTheBlock reveals a notable shift, with major Dogecoin whales—those holding more than 0.1% of the total supply—reducing their stakes.

Dogecoin Redistribution: Who Is In Charge Now?

IntoTheBlock data indicates that this position reduction from these whales has been ongoing for the past year. Specifically, the share of Dogecoin controlled by these large holders has decreased from 45.3% to 41.3%.

This trend suggests a possible decentralization of ownership or a strategic shift in the holdings of larger investors, perhaps in response to market conditions or broader cryptocurrency trends.

Simultaneously, this decrease among major holders has been accompanied by increased ownership among retail and mid-sized investors. These smaller investors have seized the opportunity to accumulate more Dogecoin, raising their collective stake in the total supply.

This redistribution of Dogecoin holdings could indicate a growing democratization in the investment landscape of this particular cryptocurrency.

As more individuals and smaller investors become significant stakeholders, the dynamics of market reactions to news and events could shift, potentially leading to increased market stability or different volatility patterns based on these new majority holders’ trading behaviors.

Price Dips: Traders Suffer, Analysts Remain Optimistic

Meanwhile, the decentralization of Dogecoin holdings contrasts with the current market conditions, where the price of Dogecoin has fallen nearly 10% in the last 24 hours to $0.211.

This decline is part of a broader downturn that saw the cryptocurrency shed 12.5% of its value over the past week, bringing its market capitalization below $18 billion.

This downward trend in Dogecoin’s price is impacting traders significantly. According to Coinglass, the last 24 hours have seen 165,199 traders liquidated, contributing to $459.04 million in total market liquidations.

Dogecoin traders alone have faced about $61.89 million in losses. Liquidation in the crypto market refers to the forced closure of leveraged positions due to a partial or total loss of the trader’s initial margin. This happens when they cannot meet the margin requirements for their leveraged position.

Despite the prevailing bearish trends, the sentiment isn’t universally negative. Santiment reports a decrease in crowd sentiment towards Dogecoin, suggesting that the current low prices might offer a buying opportunity for patient investors.

This perspective aligns with observations from market analysts who see the potential for recovery. Particularly, Trader Tardigrade, a renowned crypt analyst on X, describes a “Ladle Pattern” in Dogecoin’s price movements, indicating a potential bullish trend.

$DOGE has been forming Ladle Pattern in each cycle.

The bowl is ready

Are you ready for the shaft??

Ride on it#Dogecoin pic.twitter.com/zJQBnWuoSv

— Trader Tardigrade (@TATrader_Alan) June 15, 2024

Meanwhile, Crypto analyst Javon Marks predicts a significant upswing for Dogecoin, anticipating a price surge based on historical performance and projecting an optimistic future for the meme coin amidst its current lows.

Featured image created with DALL-E, Chart from TradingView