Quick Take

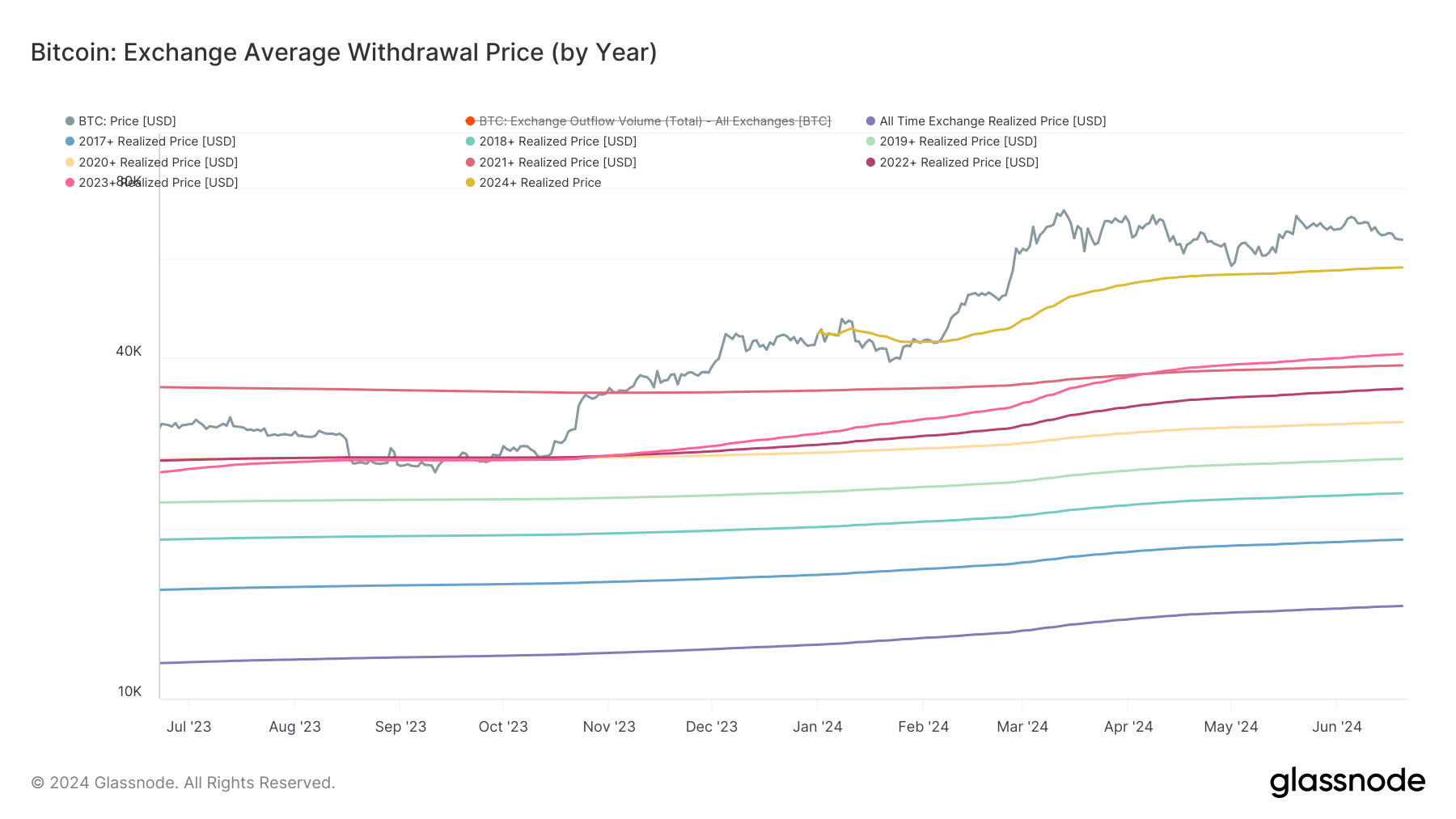

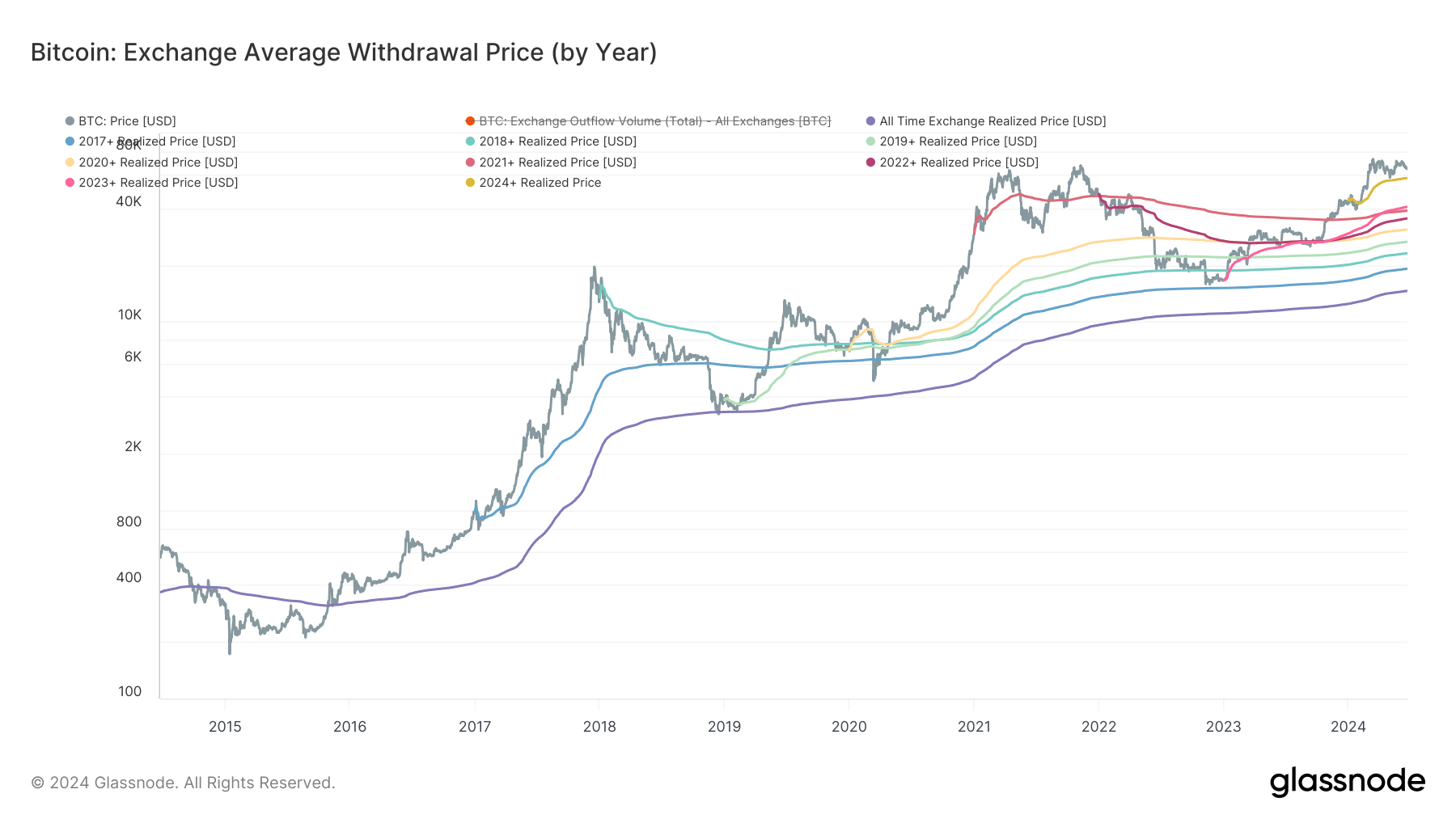

Analyzing moving averages such as the 200-day and 200-week moving averages can provide insights into Bitcoin’s support and resistance levels. Another critical trend to monitor is the realized price by the year, which helps estimate the market-wide cost basis by tracking the average price at which coins are withdrawn from exchanges each year. By examining these average withdrawal prices for different cohorts based on the year, we can gauge market sentiment and potential price movements.

According to the latest Glassnode data, Bitcoin buyers from all years are currently theoretically in a profit based on their cost basis. However, the 2024 buyer cohort, many of whom purchased the US ETFs launched on Jan. 11, is at a critical juncture. These ETF buyers have a cost basis of $57.9k, indicating they are still profitable but could face pressure if prices fall below this level.

Jim Bianco, head of Bianco Research, highlights that these ETF buyers are mainly retail investors, referred to as “retail degens,” who might panic and sell if Bitcoin’s price falls below their cost basis. Therefore, $57.9k becomes a critical level to watch, as it may influence market stability and investor behavior.

The post $57.9k Bitcoin threshold: A make-or-break point for ETF investors appeared first on CryptoSlate.