Quick Take

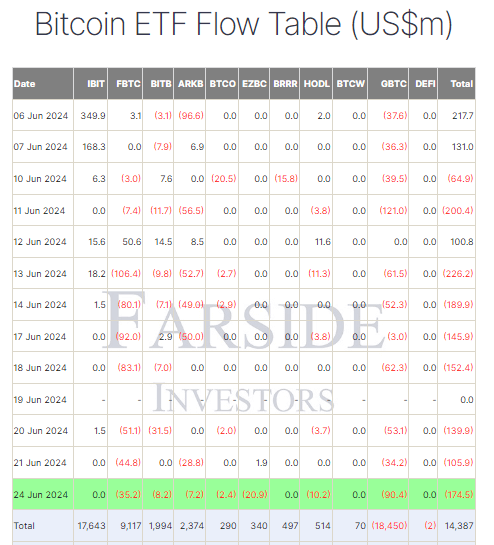

Data from Farside indicates that Bitcoin (BTC) exchange-traded funds (ETFs) experienced a significant $174.5 million outflow on June 24, marking the ninth outflow in the last ten trading days. Among the 11 spot ETFs monitored, seven reported net outflows.

Grayscale’s GBTC led the decline with a $90.4 million withdrawal, elevating its total outflow to $18.5 billion. Meanwhile, Fidelity’s FBTC recorded a $35.2 million outflow, though it maintains a cumulative inflow of $9.1 billion. Franklin Templeton also witnessed a $20.9 million outflow, with their total net inflow now standing at $340 million. The ETFs have experienced a total net inflow of $14.4 billion, according to data from Farside.

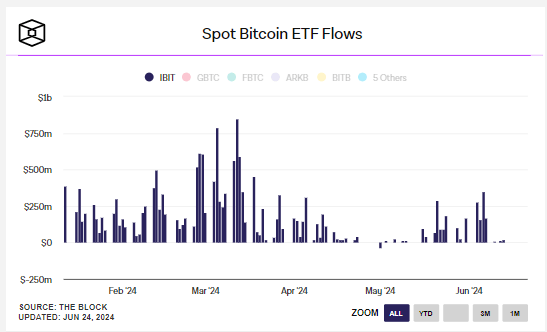

According to data from both The Block and Farside, BlackRock’s IBIT ETF remained stable with no recent inflows or outflows; it has experienced only one outflow since launch on May 1, coinciding with Bitcoin’s price bottoming out at roughly $56,000 during this drawdown period.

In the broader digital assets market, Bitcoin’s value dipped below $60,000 on June 24 but has since rebounded, now trading just above this level.

The post BlackRock’s IBIT only outflow marked local Bitcoin bottom indicating key signal appeared first on CryptoSlate.