Onchain Highlights

DEFINITION: The crypto market behavior is very emotional. People tend to get greedy when the market is rising, which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction to seeing red numbers.

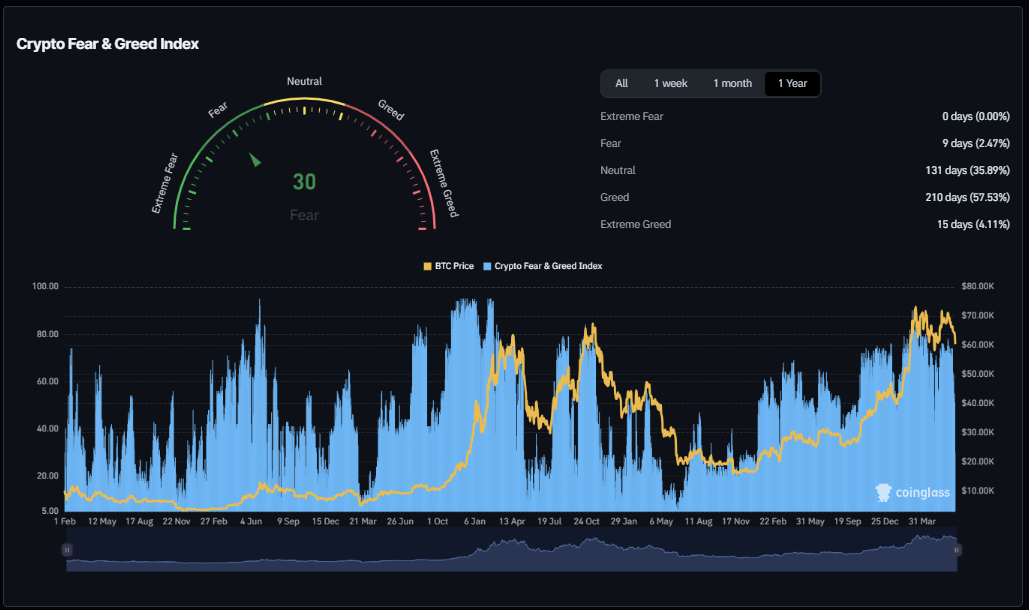

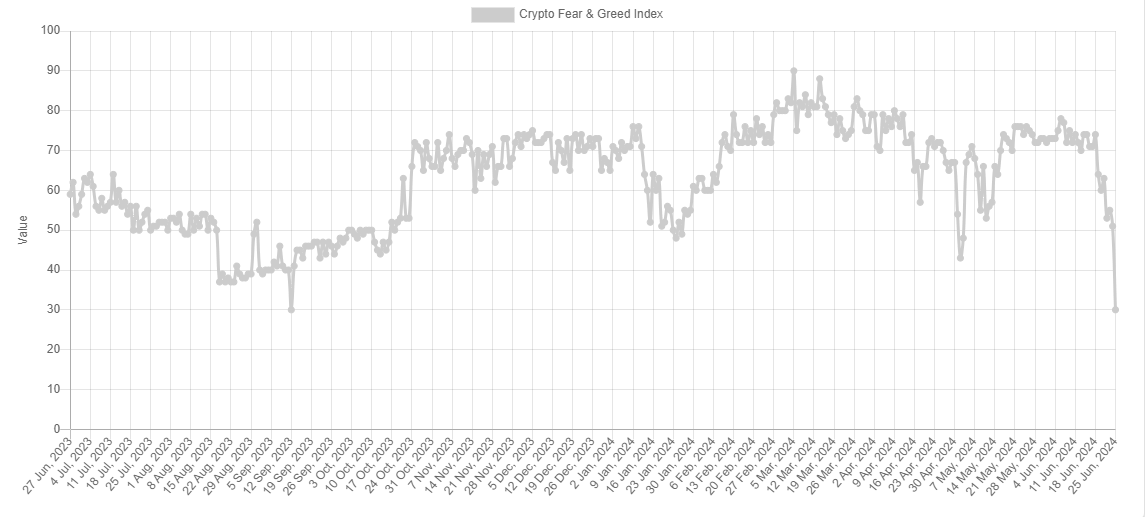

Coinglass data shows that the crypto Fear and Greed Index has dropped to 30, indicating a shift towards fear in the market. This decline follows a period of relative stability, with the index hovering in the neutral to greed range for much of the past year. The index measures market sentiment and reflects the recent volatility in Bitcoin’s price, which has seen significant fluctuations since the halving in April.

Data from Alternative.me shows the index peaking at around 70 in late March 2024, aligning with a bullish market trend. However, the recent downward trend began in early June, correlating with a broader market correction. This drop in sentiment illustrates the heightened caution among investors, likely influenced by macroeconomic factors and regulatory developments. The index hit 40 in September 2023 and hasn’t sen 30 since January 2023.

The shift towards fear suggests potential buying opportunities for some investors, though it also indicates a cautious outlook. Monitoring this index can provide insights into market psychology, helping investors make more informed decisions.

The post Crypto fear and greed index plunged to 30 amid market volatility, lowest since January 2023 appeared first on CryptoSlate.