Quick Take

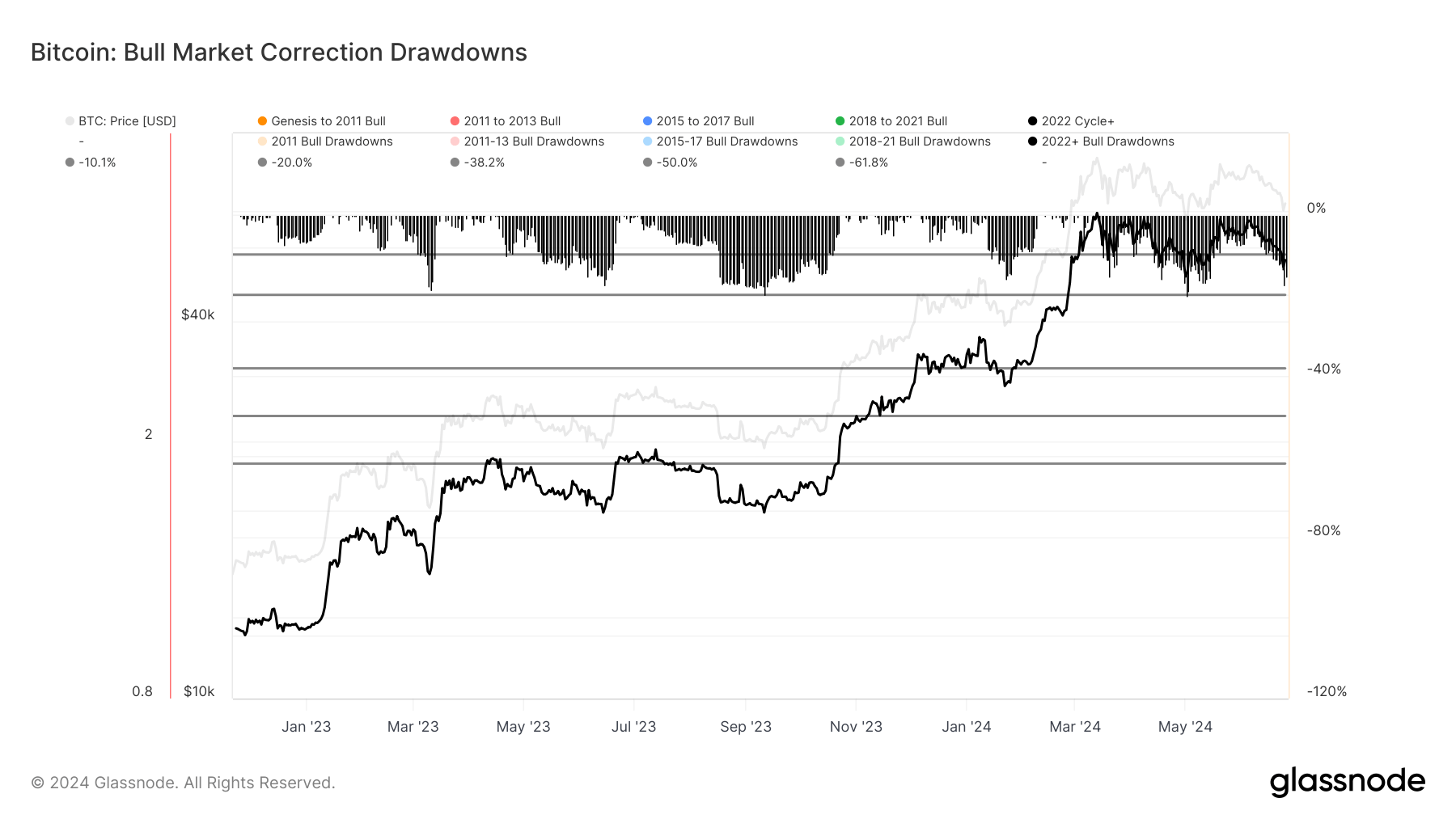

Bitcoin has recently experienced a correction of nearly 20%, marking the sixth since the low following the FTX collapse in November 2022. These corrections are common in bull markets and are essential for maintaining market health by flushing out leverage.

The first notable correction in this cycle occurred during the Silicon Valley Bank (SVB) collapse in March 2023, with Bitcoin falling from just over $25,000 to below $20,000, a roughly 23% drop. A subsequent 17% correction happened between April and May 2023, with prices dropping from over $31,000 to $26,000. In the summer, Bitcoin saw a more than 21% decline from July into August 2023.

Following the ETF launch In January, Bitcoin corrected over 21%, dropping from approximately $49,000 to below $40,000. Another significant correction occurred from March to May 1, 2024, with Bitcoin falling roughly 24% from an all-time high of over $73,000 to around $56,500.

The most recent correction, nearly 19%, started on June 7, 2024, with Bitcoin declining from roughly $72,000 to below $59,000. While concerning for some investors, these corrections are a natural part of Bitcoin’s market cycles.

The post Bitcoin endures sixth major correction since FTX collapse, dropping nearly 20% appeared first on CryptoSlate.