Quick Take

This past week, there has been significant activity involving governments selling and moving Bitcoin, notably the German government selling and the US government moving some of its Bitcoin to an exchange. Observations reveal that the US government tends to sell Bitcoin during local market lows. Similarly, the German government’s recent sale of Bitcoin at around $60,000 could potentially indicate another market low.

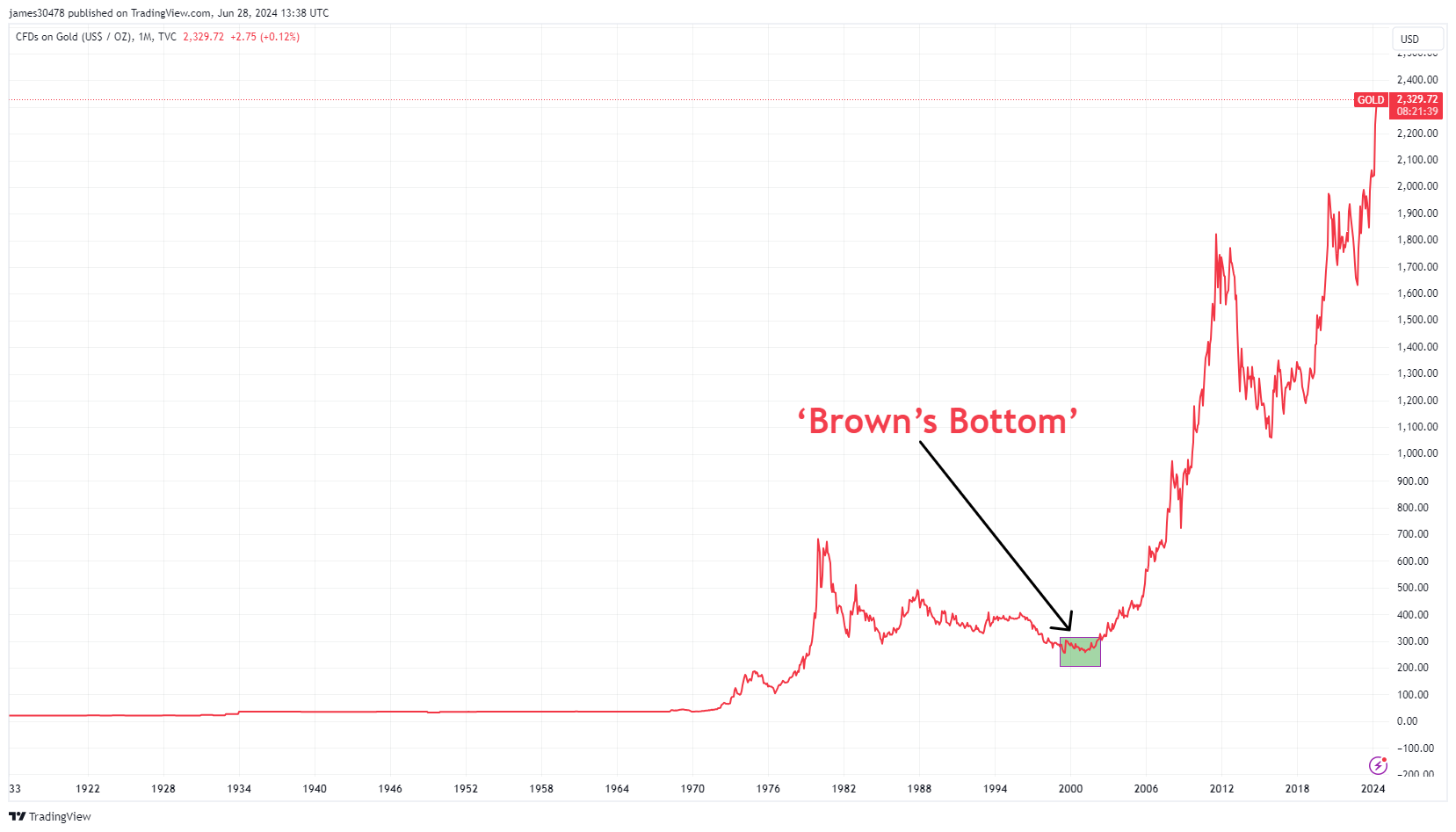

This trend isn’t exclusive to Bitcoin. Historically, governments have struggled with timing market cycles. A notable example is former UK Chancellor of the Exchequer Gordon Brown, who sold over half of the UK’s gold reserves between 1999 and 2002, when gold was trading at around $275 an ounce, according to Bullionbypost. This sale occurred at the bottom of the market cycle, missing the opportunity to capitalize on higher prices, as gold had previously traded at approximately $400 an ounce and is now trading at over $2,300 an ounce.

The German government’s recent Bitcoin sale near $60,000, rather than at an all-time high in March, emphasizes that governments or high authority positions often misjudge market timings. This pattern highlights the challenges that even experienced entities face in predicting market movements accurately.

The post Government Bitcoin sales echo historic gold mistimings appeared first on CryptoSlate.