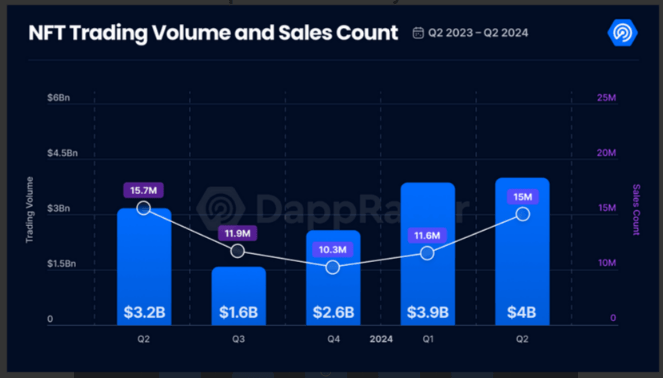

The once-frigid market for NFTs has thawed in a surprising turn of events, defying the recent slump in Bitcoin prices. Data from DappRadar reveals a robust Q2 2024, with a 28% increase in NFT sales compared to the previous quarter, reaching levels last seen in early 2023. This surge comes as Bitcoin experiences its fourth consecutive day of decline, leaving many scratching their heads about the resilience of digital collectibles.

Blur Muscles Past OpenSea In A Changing Marketplace Landscape

The NFT landscape itself is undergoing a transformation. OpenSea, the former king of the castle, has been dethroned by a new contender – Blur. With its focus on professional traders and lower fees, Blur has captured a dominant 31% market share, leaving OpenSea with the bronze medal at $369 million in trading volume. This power shift signifies a maturing market catering to more sophisticated users.

Beyond the changing guard, the report highlights a diversification within the NFT space. While blockchain gaming remains a significant player, NFT and social sectors are experiencing a surge in interest. This could indicate a broader adoption of NFTs beyond just in-game assets, potentially encompassing social media avatars, digital art communities, or even exclusive online experiences.

Ordinals Ignite Bitcoin, Runes Cast A Meme-Fueled Spell

A driving force behind the NFT resurgence appears to be the rise of Ordinals and the memecoin protocol Runes. Ordinals are inscriptions embedded directly onto individual Satoshis (the smallest unit of Bitcoin), essentially creating NFTs on the Bitcoin blockchain. This innovation has revitalized interest in Bitcoin and opened up new possibilities for NFT applications.

Runes, on the other hand, is a protocol enabling the creation of memecoins on Bitcoin. This playful twist on traditional finance has captured the imagination of collectors, with the Runestones collection experiencing a staggering 93% growth in Q2. The rise of memecoins within the NFT space injects a dose of fun and virality, potentially attracting new demographics to the market.

Open Questions And A Cautiously Optimistic Outlook

Despite the positive sales figures, some uncertainties remain. The report acknowledges that popular collections like Bored Ape Yacht Club are experiencing declining sales and prices. This suggests that not all corners of the NFT market are thriving, and the long-term value proposition of certain collections remains debatable.

Furthermore, the reason behind the overall surge in trading volume isn’t entirely clear. While DappRadar suggests continued investor enthusiasm, it’s possible that short-term speculation or opportunistic buying could be playing a role. It’s crucial to monitor future trends to understand if this growth signifies a sustainable shift in the NFT market or a temporary blip.

Overall, Q2 2024 paints a picture of an NFT market in flux. New players are disrupting the established order, and innovation is driving fresh avenues for digital collectibles. While some questions linger, the resilience of the NFT market in the face of a broader crypto winter offers a glimmer of hope for its future.

Featured image from Aquifer Motion, chart from TradingView