As Bitcoin dips below the $55,000 mark, the implications for cryptocurrency mining are quite significant, raising concerns across the industry. Particularly, the recent drop in Bitcoin’s value has pushed the operational viability of many mining machines to their limits.

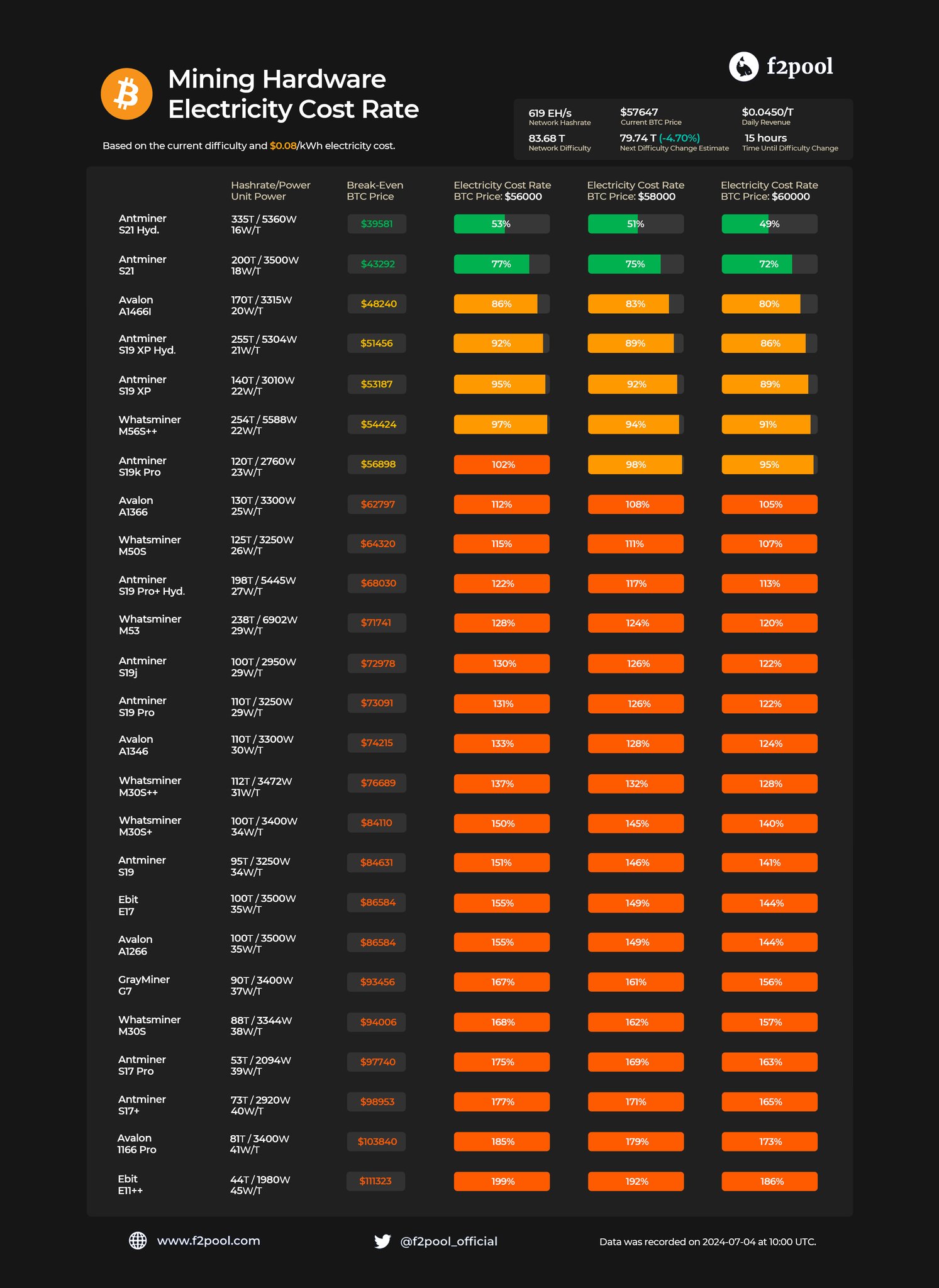

A report from F2Pool, a leading Bitcoin mining pool, highlights that of the many mining machines on the market, only a handful remain profitable under the current economic conditions.

Adjusting to New Realities: Market Conditions Strain Miners

F2Pool’s analysis reveals that just five ASIC (Application-Specific Integrated Circuits) models can still profit at the current Bitcoin price levels. These include the Antminer S21 Hydro, Antminer S21, Avalon A1466I, Antminer S19 XP Hydro, and Antminer S19 XP.

These machines have break-even points ranging from $39,581 to $53,187, making them the last bastions of profitability in the ongoing price dip.

On the other hand, models like the Whatsminer M56S++ hover just at the brink, with a break-even price dangerously close to the current BTC price, emphasizing the narrow margins within which miners are operating.

With #Bitcoin trading below $58k, what is the current profitability for mining?

At a rate of $0.08/kWh, ASICs less efficient than 23 W/T operate at a loss.

For more details on mainstream miners, please refer to the table below. pic.twitter.com/hJS1lsVnmK

— f2pool

(@f2pool_official) July 4, 2024

Meanwhile, the BTC network reflects these challenges with a notable decrease in hashrate, a measure of the total computational power used to mine and process transactions.

This reduction can be attributed partly to less efficient miners shutting down or downsizing their operations in response to reduced rewards following BTC’s latest Halving event, which saw block rewards decrease from 6.25 to 3.125 BTC.

Friday witnessed a negative difficulty adjustment of 5%, aimed at making it easier for the remaining miners to find blocks. This adjustment could directly respond to the decreased competition and help stabilize mining revenues for those still in the game.

Despite these adjustments, the overall profitability for miners remains pressured, with significant impacts visible not only on individual operations but also on the broader market.

Bitcoin Plummets 10%

BTC has experienced a sharp 10% decline in the past week, falling to a current trading price of $55,177. This significant drop has contributed to a 4.1% decrease in the global crypto market cap, shedding over $100 billion over the past day.

This downturn has heavily impacted traders, resulting in widespread losses. Data from Coinglass indicates that within the past day, 207,067 traders were liquidated, leading to total liquidations of $580.18 million. BTC liquidations account for $186.99 million of this amount, predominantly from long positions.

Featured image created with DALL-E, Chart from TradingView