The following is a guest post from Shane Neagle, Editor In Chief from The Tokenist.

Half a year after Bitcoin ETFs launched, it is safe to say that they have been the most successful ETF launch in history, having generated a $309.53 billion volume. Just within the first day of trading, spot-traded Bitcoin ETFs pulled in $4 billion, crushing the previous record holder, Gold ETF (GLD), which took 3 days to top $1 billion in inflows.

This is all the more impressive as Bitcoin is a novel asset compared to ancient gold. The trend clearly points to Bitcoin being more fit for purpose in the digital age. But what is that purpose?

BlackRock’s Head of Thematic & Active ETFs, Jay Jacobs, recently noted that Bitcoin is a “potential hedge against geopolitical and monetary risks”. By now, most people are aware that central banks’ ability to tamper with the money supply brings many moral hazards, from record-breaking budgetary deficits to inflation as an extra layer of taxation to cover those wild spending sprees.

Gold is less suited to counter that ability because it is physical, confiscatable, and not truly limited. Because Bitcoin is one-tenth the size of the gold market, its price is more volatile, but it is also a more attractive gains machine.

Now that Bitcoin ETFs have simplified and institutionalized access to more exciting digital gold, which steps are needed to ensure that trend continues?

Ensuring Network Reliability

Owing to its proof-of-work (PoW) consensus mechanism, Bitcoin is dual-natured. It is a digital asset anchored into the physical reality of energy and hardware. This underlying foundation gives Bitcoin its value as a decentralized counter to central banking.

In turn, the components of that foundation, the Bitcoin network, have to scale up to continue the institutional intake. Presently, the Bitcoin network handles around 412k transactions per day, nearly double from two years ago. Although the median transaction fee oscillates depending on network load, it rarely exceeds $5 per transaction.

In parallel, their networks have to scale to ensure the Bitcoin network handles orders of magnitude greater load coming from institutions. To increase their stability and robustness, they have to tackle multiple network components, from software and servers to hardware and internet connection.

Scalable Blockchain Solutions

Just as IBM made significant contributions to developing current large language models (LLM), the legacy computer company also made a strong case for blockchain scaling with IBM Blockchain. This immutable ledger is based on an open-source Hyperledger Fabric framework with a complete set of tools for building blockchain platforms.

Such a framework could interface with the Bitcoin ecosystem via atomic swaps, such as virtual vaults with timed smart contracts. Similarly, Visa proposed an experimental Universal Payment Channel (UPC) framework as a hub for blockchain network interoperability. International banking network SWIFT had already completed the second test phase for atomic settlement capability.

Zooming out, a picture emerges of enterprise-grade blockchain solutions for institutions, interlinking with international hubs and intermediating with institutions that handle exposure to Bitcoin, such as Coinbase.

Dependable Servers

Powering scalable blockchain solutions comes in the form of hardware. These can either be internal servers, via customized solutions offered by Broadcom, or offloaded to external options like the Canton Network.

As a decentralized infrastructure, the Canton Network is a network of networks, building on Daml smart contract language and micro-services architecture. The latter allows for each service plugged in to to have its own server, expandable with more CPUs and storage.

Using atomic settlements, the Canton Network makes real-time settlement possible across different blockchain apps. By outsourcing services to such networks, businesses and institutions can focus on core features rather than IT infrastructure management, including the maintenance of CPUs, dedicated GPU hosting to diversify into AI support, and other essential hardware.

Internet Connectivity

Nodes in any blockchain network have to communicate continuously to validate transactions and execute settlements by adding them as the next block on the blockchain ledger. In other words, internet connectivity necessarily involves redundancy and failover strategies.

For example, when Solana experienced network downtime problems, co-founder Anatoly Yakovenko hired Jump Crypto to develop Firedancer as a secondary network validator client to fortify network throughput and stability.

With broader solutions like the Canton Network, enjoying support from the Big Tech and Big Bank, redundancies, multi-channels, backup systems, and load balancing are already baked into the DLT cake.

Enhancing Network Performance

It is inherent in all types of computer networks to suffer from some level of packet loss and jitter. Packet losses can happen due to overwhelming demand, causing congestion, network interference, faulty software or hardware, and data corruption on hard drives.

Transmission Control Protocols (TCP) deal with packet losses by retransmitting data, which causes delays, or by Forward Error Correction (FEC), which adds redundant data to packets, removing the need for retransmission. The Bitcoin Relay Network uses FEC to this effect, as does the Blockstream Satellite network, as an alternative avenue to receive Bitcoin blockchain data.

As for jitter, certain data packets can arrive at different intervals. When this jitter happens, packets land in different orders, disrupting data stream. The jitter problem is typically handled with buffers that temporarily store streamed packets to ensure their correct order arrival.

Another way to handle jitter is to introduce quality of service (QoS) network configurations that prioritize critical traffic. This can also be applied to reduce packet loss. Network design itself is a big factor in reducing jitter by making sure the network has as few hops as possible.

The Bitcoin network benefits from its decentralized design because each transaction requires multiple confirmations. If jitter occurs, later confirmations offset the delays. Most importantly, the Bitcoin mainnet has an auto-adjusting difficulty mechanism that maintains the average block time at 10 minutes.

In practice, the management of the network’s data packet loss and jitter lands on on-site vs. ISP solutions.

On-site vs. ISP Solutions

On-site solutions require organizations to handle their IT infrastructure. While this gives institutions total control, including regulatory data compliance and faster personnel response, the upfront costs for hardware and storage are significantly higher.

On the other hand, ISP-hosted solutions are easier to scale as specialized companies are likely to be well-oiled machines, handling both maintenance and network uptime. On the clients’ end, this requires a reliable internet connection and the selection of the best packet loss and jitter metrics.

Case in point, Amazon Web Services (AWS) gives clients a Global Accelerator tool to enhance and balance network performance. Alongside Amazon Managed Blockchain and Quantum Ledger Database (QLDB), such services propelled AWS to become one of the infrastructure pillars of the blockchain space.

As for ISPs themselves, they are typically less forthcoming on their jitter/packet loss metrics, as they rely on several factors. To that end, there are many tools to track network latency, packet loss and jitter, such as PingPlotter.

Jack Dorsey’s Block (former Square) opted to build its own Bitcoin mining network, utilizing its 3 nm chip design, likely built by TSMC foundries. With an in-house, open-source mining hashboard, which is compatible with Raspberry Pi controllers, Block is heading to set up new standards for the Bitcoin ecosystem.

The other piece of the Bitcoin scalability puzzle revolves around energy.

Sustainable Energy Solutions

It is often said that Bitcoin is digital energy, or better yet, tokenized energy. Ultimately, Bitcoin’s proof-of-work sets it apart from thousands of copypasta cryptocurrencies, making it virtually unassailable from a network security standpoint. And that consensus algorithm exerts energy, as expected from any work.

But how much and what kind of energy? Bitcoin’s energy expenditure is often compared to a nation’s footprint, such as the Netherlands or Argentina. It is sufficiently high for Greenpeace to call for a campaign to change Bitcoin from proof-of-work to proof-of-stake.

BRÆKING: @greenpeaceusa continues its SEXIST anti-#Bitcoin campaign, releasing new video about “Bitcoin BROS.”

NEWSFLASH to Greenpeace misogynists: there are WOMEN in Bitcoin, & Bitcoiners will not stand by while you ERASE them.

Please retweet if you think Greenpeace is sexist. pic.twitter.com/qX3emR8TaL

— Walker

(@WalkerAmerica) June 22, 2024

Yet Greenpeace itself could launch such a shift, given that Bitcoin’s open-source code is available to all. The problem is that without a network and market interest, such a tweak would be meaningless.

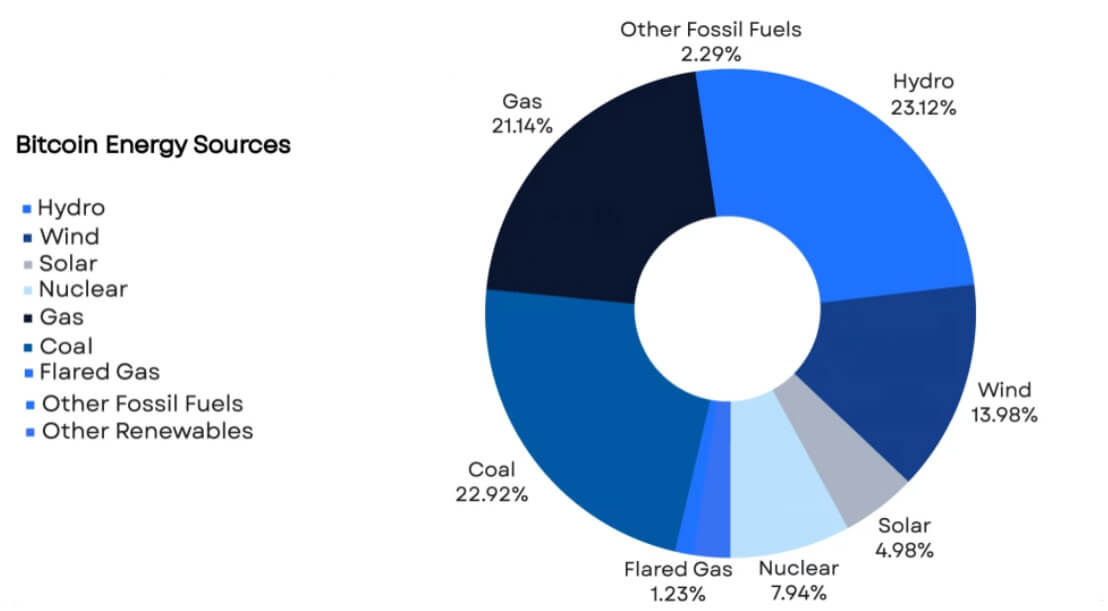

In the meantime, over 50% of the Bitcoin network draws power from renewable sources. According to Daniel Batten’s research via Batcoinz, most of it comes from hydro, wind, solar, and nuclear.

Not only did Bitcoin step onto the majority-green territory, but it has been acknowledged as a key ingredient in balancing power networks. Namely, the Electric Reliability Council of Texas (ERCOT) pays large Bitcoin mining companies, such as Bitdeer and Riot Platforms, to stabilize the grid during anomalous conditions such as heat waves.

As recently as June 13th, ERCOT recommended that Bitcoin mining be directly integrated as a Controllable Load Resource (CLR) to boost power grid balancing. Additionally, there is an increasing trend for Bitcoin miners to use flared gas from oil drilling operations. Otherwise wasted and burned off, this byproduct can be captured to power Bitcoin mining rigs.

Now that BlackRock, the main driver of the ESG framework, is pushing Bitcoin, this is a clear signal to institutional investors that the “dirty Bitcoin” narrative is a bygone concern.

Block has yet to reveal its 100% solar-powered mining facility in West Texas. However, multiple Bitcoin mining companies, such as Bitfarms, Iris Energy, TeraWulf, and CleanSpark, have already transitioned to near-zero carbon footprints.

With nuclear power on the horizon due to AI data center demands, investors should expect even greater greening of Bitcoin operations. And in the likelihood of Donald Trump’s victory in the next presidential elections, Bitcoin sustainability concerns will further fade away.

Conclusion

In 2022, Messari noted that gold mining produces three times as many carbon emissions as Bitcoin. Since then, Bitcoin has outperformed gold ETF capital inflows by an even greater magnitude.

It turns out that there is great value to be found in an asset that cannot be tampered with on a practical level and is not controlled by anyone. Rather, Bitcoin is enforced by ingenious cryptography, tethering code to hardware assets and energy.

With capital damn broken, and access to Bitcoin exposure put on the same level as any other stock, it is a race to new highs and new lows to buy the dip. Building from the experience of other blockchain networks and mining companies, the tech is readily available to tap into this growing ecosystem.

The post How institutional networks are preparing for Bitcoin integration appeared first on CryptoSlate.