Quick Take

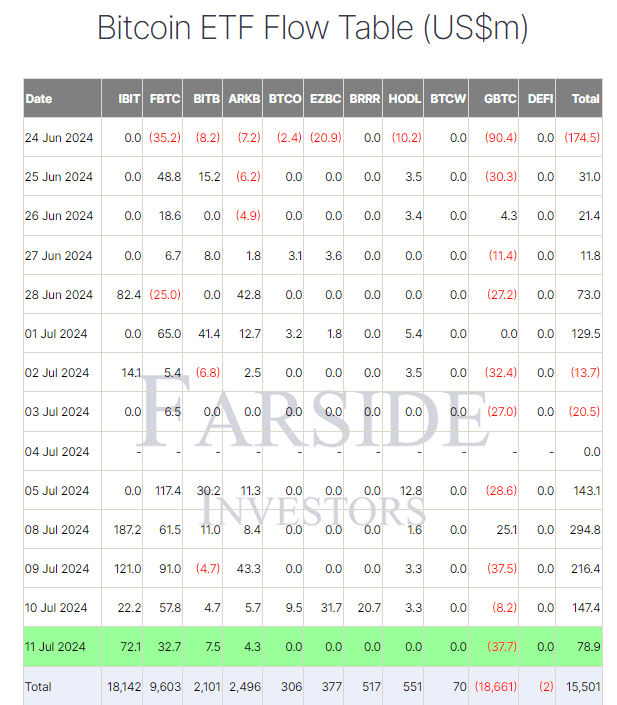

Farside data shows that Bitcoin Exchange Traded Funds (ETFs) experienced another inflow, marking the fifth consecutive trading day of positive inflows. Bitcoin ETFs saw an inflow of $78.9 million. This trend was observed among the four largest ETF issuers, excluding Grayscale, which reported an outflow.

BlackRock’s IBIT led the inflows with a substantial $72.1 million, bringing their total net inflows to an impressive $18.1 billion. Fidelity’s FBTC followed with an inflow of $32.7 million, raising its total net inflows to $9.6 billion. Bitwise’s BITB attracted $7.5 million, pushing its net inflows to $2.1 billion. ARK’s ARKB recorded an inflow of $4.3 million, resulting in total net inflows of $2.5 billion. In contrast, Grayscale’s GBTC experienced an outflow of $37.7 million, increasing its total outflows to $18.7 billion. Despite this, the overall picture for Bitcoin ETFs remains positive, with total inflows reaching $15.5 billion, according to Farside data,

The post Bitcoin ETFs achieve $15.5 billion in total inflows appeared first on CryptoSlate.