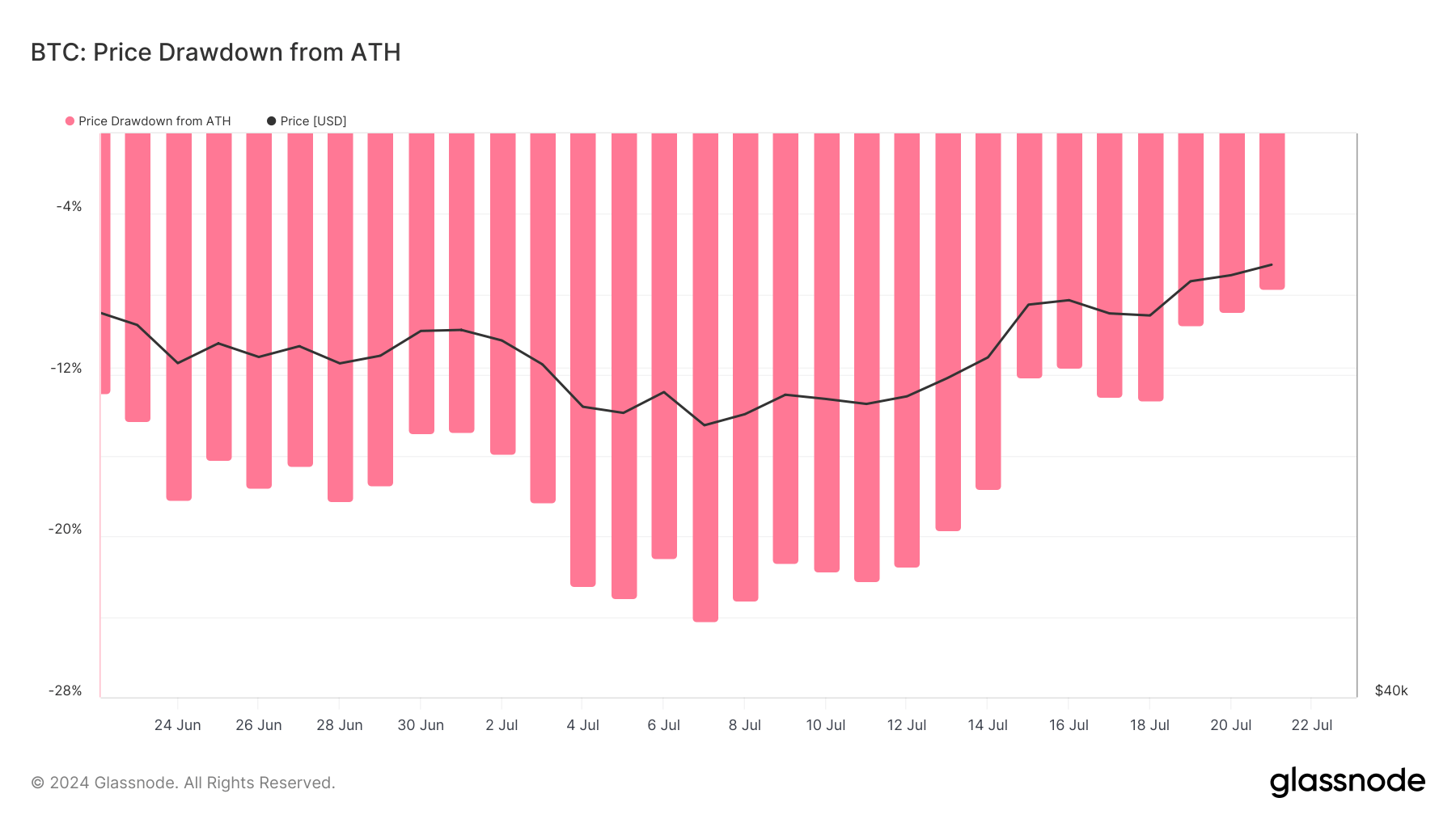

Bitcoin crossed the $68,000 mark during the weekend after President Joe Biden announced his exit from the presidential race for the upcoming elections in November 2024.

The event showed just how sensitive the global crypto market is to US political events. The discrepancy between America’s influence on the global crypto market and its share of the global market becomes evident when analyzing trading volumes.

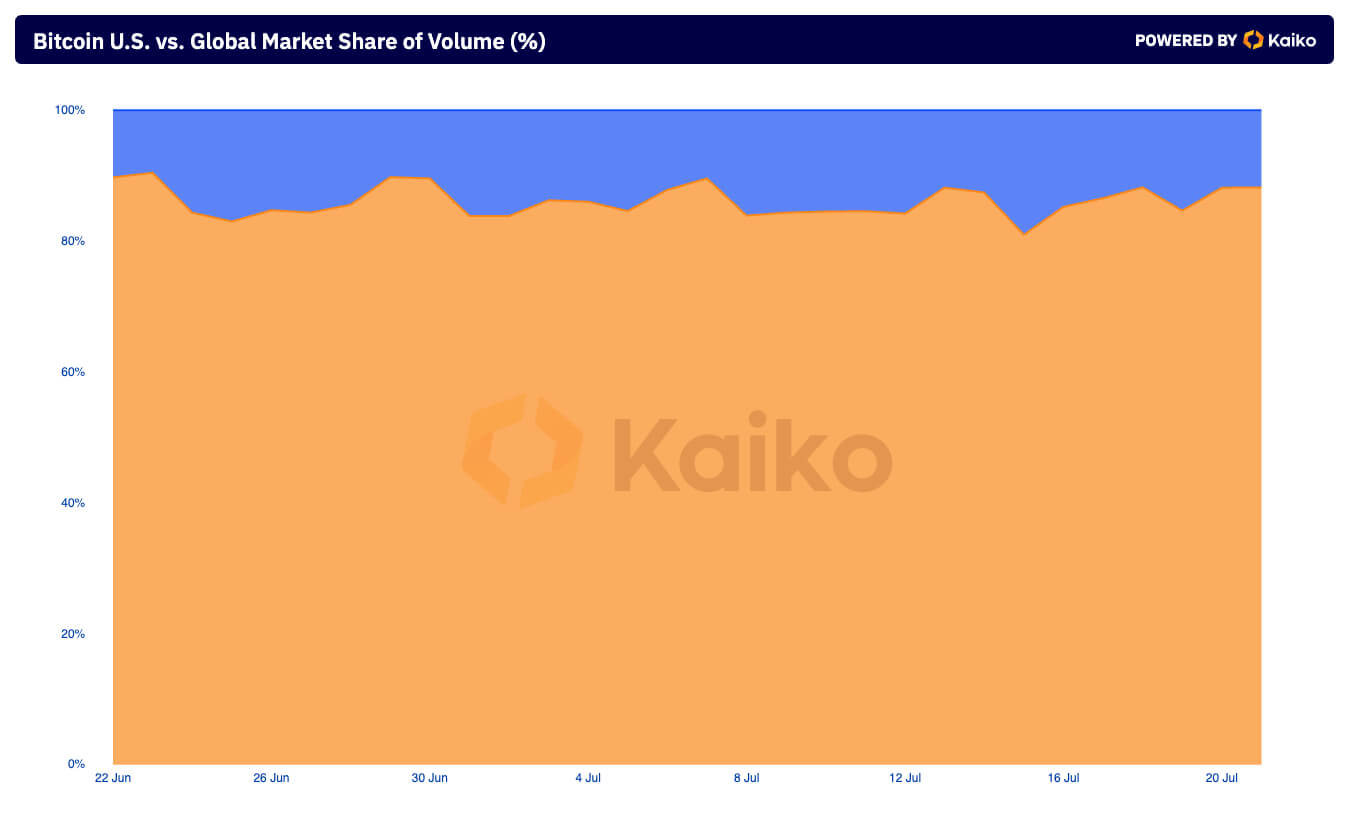

Kaiko data shows that the market share of US exchanges in terms of trading volume currently stands at 11.79%. Global exchanges, on the other hand, dominate with 88.12%.

The disparity shows that almost all crypto trading activity on centralized exchanges happens outside the US. While numerous reasons have contributed to this discrepancy, the regulatory environment in the US stands out as the most significant factor.

The regulatory landscape in the country is much harsher compared to other regions. The SEC’s strict oversight and enforcement actions have led to cautious participation by retail and institutional investors. US-based exchanges have had to implement rigorous compliance measures that differ from state to state, deterring a large portion of retail traders.

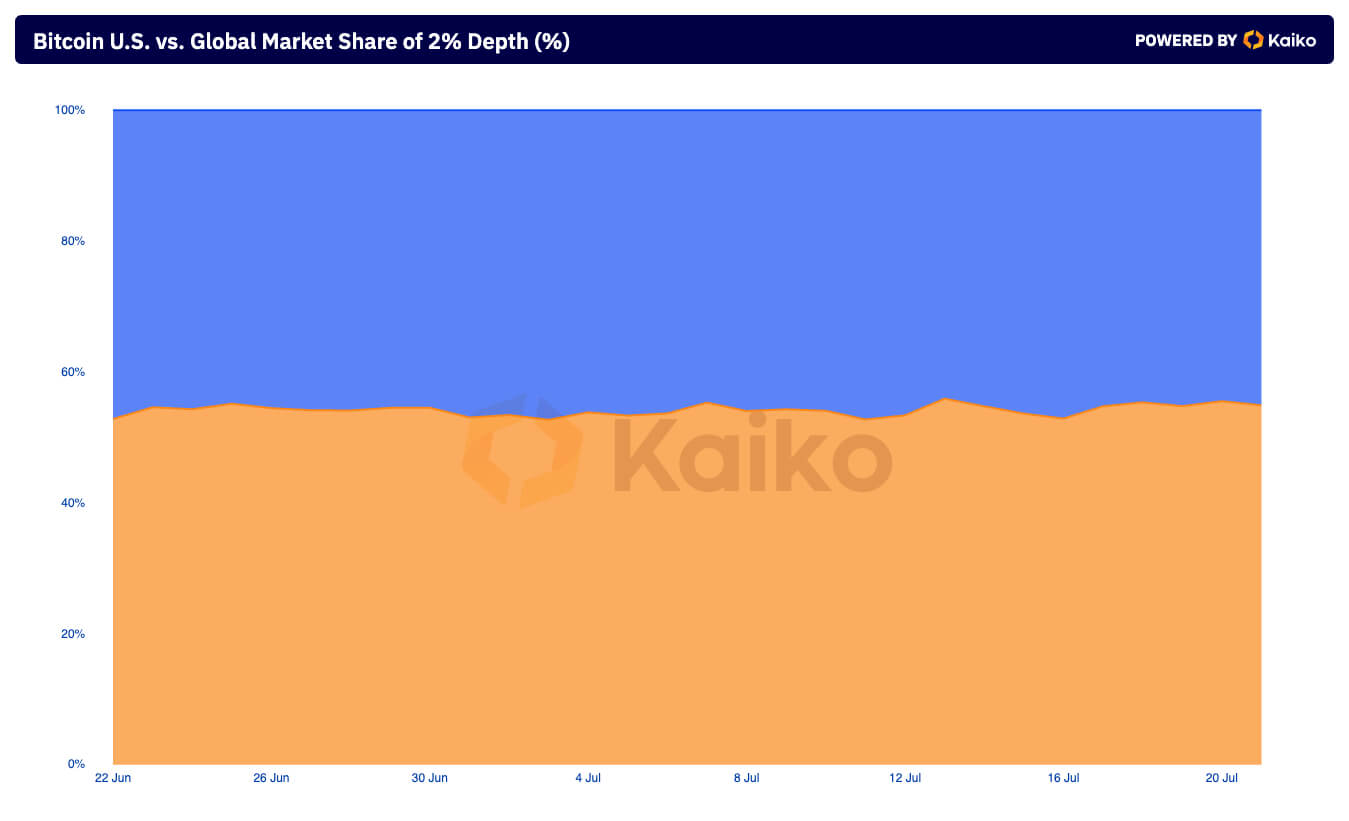

However, despite the low volume share, the US accounts for almost half of the market’s liquidity. Kaiko data shows that US-based exchanges account for a substantial 45.09% of the global market depth at the 2% level.

Market depth shows the market’s general ability to sustain relatively large orders without significantly impacting price. This is an important metric as it acts as an indicator of overall liquidity. A deep market with substantial orders within the 2% range shows that large orders can occur without causing significant price fluctuations. This high liquidity then helps reduce price volatility, which is particularly important for institutional investors who deal with large buy and sell orders.

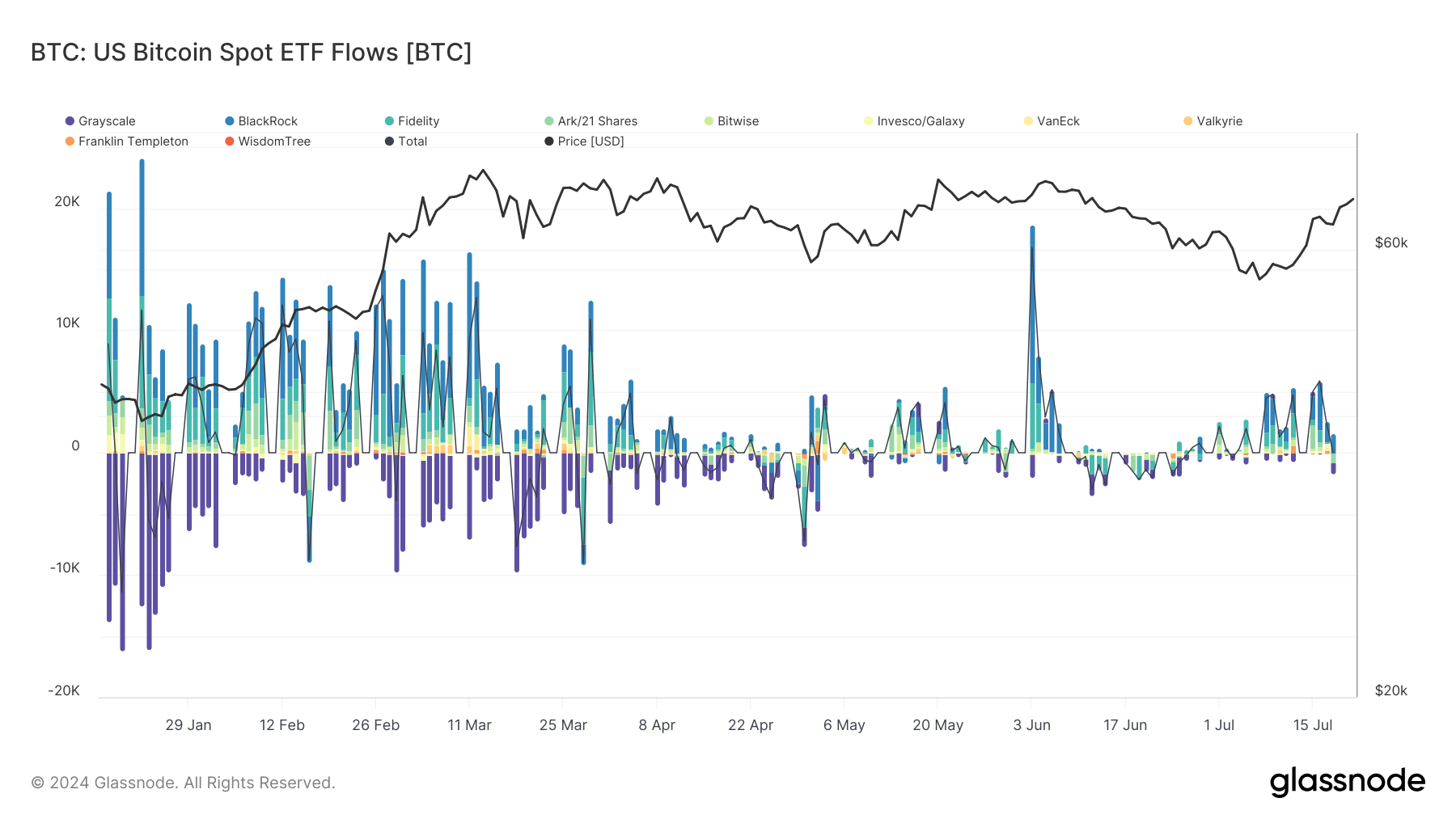

High liquidity in the US can be attributed to the large presence of institutional investors. Their presence has increased drastically since the launch of spot Bitcoin ETFs this year, as these products contribute to higher liquidity and deeper order books on exchanges where these ETFs are traded or tracked.

The creation and redemption processes of spot Bitcoin ETFs involve large-scale transactions in the underlying Bitcoin market. When new ETF shares are created, authorized participants (usually exchanges like Coinbase) purchase the equivalent amount of Bitcoin from the market, contributing to market depth. Conversely, when ETF shares are redeemed, the underlying Bitcoin is sold, further adding to the liquidity and depth of the market.

The sheer size of this market is why news coming from the US can move Bitcoin’s price less than 8% away from its ATH despite accounting for such a small share of volume.

The post US moves global markets because of liquidity, not volume appeared first on CryptoSlate.