The long-awaited Ethereum Exchange-Traded Funds (ETFs) are finally live, registering over $100 million in volume in the first 15 minutes. Investors expect to see the launch’s impact on the crypto market, while some market watchers believe ETH ETF’s performance will kickstart the Altcoin season.

Ethereum Spot ETFs Are Officially Live

On Monday, the US Securities and Exchange Commission (SEC) gave the final nod to Ethereum spot ETFs, setting the launch date for Tuesday, July 23. After the approval, investors raised the alarm following some online reports.

Per Whale Alert, Grayscale has transferred $1 billion in ETH to Coinbase Institutional. This led many investors to fear that the digital asset manager’s transaction would add selling pressure to the asset and affect its price performance ahead of the launch.

However, ETF expert Eric Balchunas offered some relief to investors after pointing out that Grayscale didn’t move the tokens to dump them. The firm transferred the 292,262 Ethereum “from $ETHE to its mini-me = $ETH.” Balchunas considers it “a new variable in this race that we didn’t have in the btc race.”

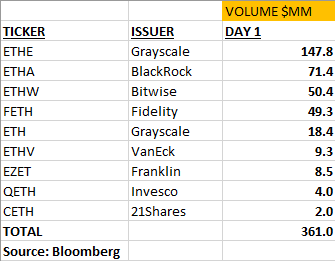

The initial numbers have been released now that the highly anticipated products are live. Balchunas shared on X that the Ethereum ETFs saw $112 million in the first 15 minutes of trading. This number increased to $361 million total after 90 minutes.

The Bloomberg expert praised the volume, calling it a “solid showing” regardless of being 20-25% of Bitcoin (BTC) ETFs numbers. Despite the healthy performance, ETH remains hovering between the $3,440 and $3,540 price range.

Are ETH And Altcoins About To Take Off?

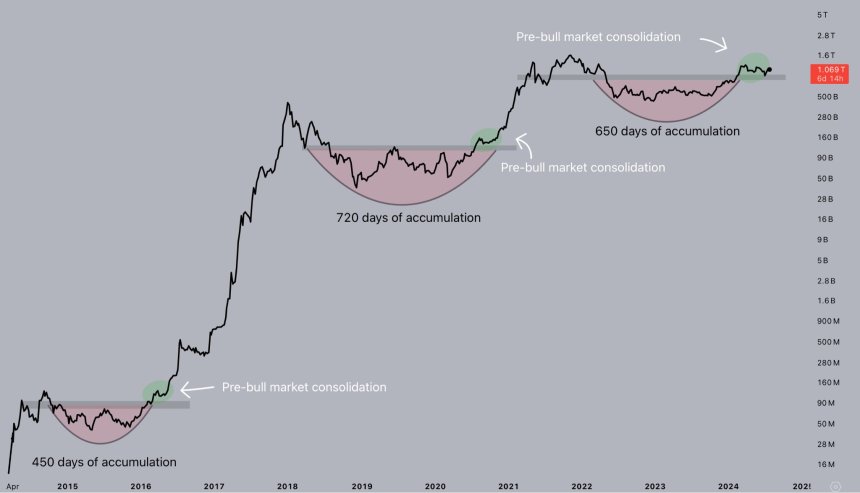

Ahead of the launch, some market watchers anticipated that the ETFs’ performance could kickstart an upswing for Altcoins. According to several analysts, the Altcoins chart shows similarities to the 2016-2017 performance, suggesting that the Altseason is “brewing.”

To Crypto Jelle, “Altcoins are still following the traditional bull market preparation playbook.” Per the macro chart, altcoins broke from the accumulation zone and chopped around key support levels during previous cycles.

The “pre-bull market consolidation” was followed by a take-off that propelled cryptocurrency prices to new highs. Jelle pointed out altcoins are currently in the consolidation zone, similar to past cycles. He also suggested a new take-off “shouldn’t take long” after Ethereum ETFs’ launch.

Crypto trader MikyBull also highlighted the similarities between the previous cycles, which suggest that a “huge Altseason is brewing.” To the trader, the recent “fake out” made investors believe that this cycle’s Altseason “has been written off,” but he expects altcoins to “pull a 2017 kind of explosive” rally that follows the same PA path.

The trader considers Ethereum’s price might be positively affected by ETH spot ETFs. This performance will be the primary driver for the “huge rally in the coming months.” Additionally, he set a band price target of $10,000 for ETH.

Other market watchers suggested that investors must remain serene if a price drop occurs. Pseudonym analyst and trader Moustache called for patience as “it’s only a matter of time.” “Ethereum chart looks like it did in the last cycle, just before the Altcoin bull market started,” he added.

As of this writing, the second-largest cryptocurrency by market capitalization is trading at $3,419, a 1.1% decline in the last 24 hours.