Solana (SOL) is currently one of the high-flyers in the crypto market. The crypto token recently recorded one of the most gains following the market-wide rebound. Crypto analyst Rekt Capital, however, suggested that the crypto token is just getting started, revealing key levels to watch as Solana eyes higher prices.

Key Levels To Watch For Solana’s Price

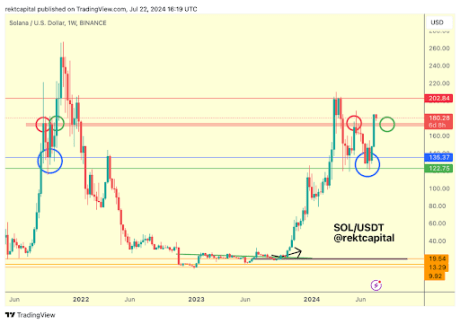

In an X (formerly Twitter) post, Rekt Capital highlighted $180 and $202 as key price levels to watch for Solana’s price. The analyst claimed that a successful retest of the $180 price level as new support could continue an upward trend over time for Solana. SOL could rise above $200 in the short term as it moves further to the upside. However, the crypto token would need to break the resistance at $202 as it looks to break its all-time high (ATH) of $260.

Following the recent market-wide rebound, Solana had risen above $180, a three-month high for the crypto token. Although the crypto token has dropped below this price level again, another rise above $180 will help SOL establish that price range as new support and prime it for further moves to the upside. As highlighted by Rekt Capital, the $135 and $122 price levels have already been established as solid support for the crypto token.

Rekt Capital’s analysis follows crypto analyst Ali Martinez’s recent prediction that Solana could skyrocket and rise to as high as $1,000. Martinez stated that early signs of a breakout from a bull pennant suggest a potential 900% rally ahead for Solana.

Crypto analyst Javon Marks also offered a bullish prediction for Solana, stating that the crypto token will rise to $233 and then $450. He made this prediction based on SOL’s bullish structure, which he noted also recently confirmed a hidden bullish divergence.

Marks explained that this divergence could send Solana’s price back above $204 and lead to a price rally of over 40% to $233.8 as prices “hold broken out of a much larger resisting structure.” The analyst also suggested that this bullish divergence will cause Solana’s price to rise to $450.

Enough Reasons To Be Bullish On Solana

There are enough reasons to be bullish on Solana, especially considering how the crypto token has earned the status of being among the ‘big 3’ alongside Bitcoin and Ethereum in this bull run. Solana’s dominance in this market cycle is one reason market participants anticipate that a Spot Solana ETF will likely be approved next.

Solana’s price appears to be reacting to such expectations, with fund issuers VanEck and 21Shares filing to offer Spot Solana ETFs. If they eventually launch, these funds could contribute to more parabolic price gains for SOL, considering the Spot Bitcoin ETFs’ impact on BTC’s price.

The steady rise in Solana’s total value locked (TVL) also paints a bullish picture for the crypto token. Data from DeFiLlama shows that Solana’s TVL has been rising significantly since the start of the year and has continued to hit new highs. The network’s TVL currently stands at $5.21 billion, the third highest among all chains.

At the time of writing, Solana is trading at around $173, down over 1% in the last 24 hours, according to data from CoinMarketCap.