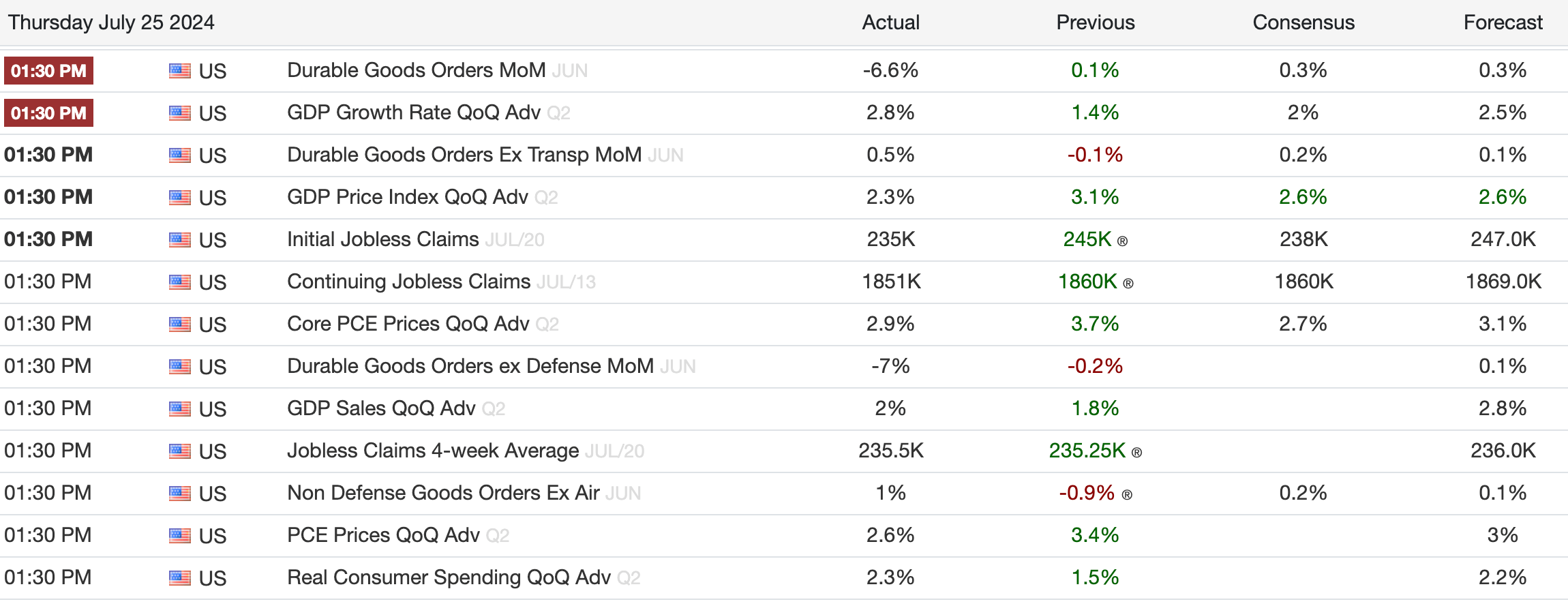

Bitcoin maintained stability at around $64,000 after the recent economic data showed that the US GDP Growth Rate for Q2 increased by 2.8% QoQ, surpassing the previous quarter’s growth of 1.4% and the consensus forecast of 2%.

This stronger-than-expected economic growth signals a robust recovery, potentially influencing investor sentiment positively toward assets like Bitcoin. However, Bitcoin has since started to decline to around $63,500, and as of press time, it is just 16% below its all-time high.

The GDP Price Index for Q2 advanced by 2.3%, below 3.1% from the previous quarter, yet aligned closely with forecasts, missing by 0.3%. This moderation in inflationary pressure may contribute to the Federal Reserve’s less aggressive monetary policy stance, a factor that crypto investors closely monitor due to its potential impact on liquidity and market conditions.

Durable Goods Orders for June presented a mixed picture, with a notable decline of 6.6% MoM, contrasting sharply with the slight increase of 0.1% in May and consensus of 0.2%. However, orders excluding transportation saw a modest rise of 0.5%, indicating some underlying strength in other sectors. These figures reflect ongoing economic uncertainties, which may play into Bitcoin’s appeal as a hedge against traditional market volatility.

Bitcoin’s stability amidst these economic indicators emphasizes its role as a resilient asset in fluctuating economic data and investor sentiment.

The post US GDP growth beats expectations at 2.8% as Bitcoin dips below $64,000 appeared first on CryptoSlate.