Post the Spot Ethereum ETFs launch, the ETH price has continued to struggle unexpectedly, proving that the launch of the Spot ETFs were a ‘sell the news’ event. So far, the second-largest cryptocurrency by market cap has lost around 10% of its value since the Spot Ethereum ETFs trading began on Tuesday, July 23, and could see further decline from here, according to an analysis from Matrixport.

Spot Ethereum ETFs Triggers Selling

Following the launch of the Spot Ethereum ETFs, there was a lot of excitement in the market, especially around the fact that investors could now gain exposure to ETH without having to directly buy the underlying token. However, this excitement has been short-lived as days after the launch, the ETH price continues to struggle.

In a report released on Thursday, Markus Thielen, Head of Research at Matrixport, outlined a number of reasons why the ETH price was declining. As Thielen explains, while the inflows crossed $100 million on the first day, the Grayscale Ethereum fund had been suffering outflows.

Just like with the Spot Bitcoin ETFs launch, the Grayscale ETH fund, which holds around $9 billion in ETH, began recording outflows. This is due to the fact that Grayscale’s management fees remain high with competitors offering fees as low as 0.19%. On the first day alone, $481 million flowed out of the fund, and $326 million followed the next day.

In addition to this, the Mt. Gox distributions began around the time of the Spot Ethereum ETFs launch, so this even also put extra selling pressure on the crypto market. Just as the Bitcoin price did with the Spot Bitcoin ETFs, the ETH price has responded negatively to these outflows, leading to a price decline below $4,200.

Will The ETH Price Recover From Here?

Outflows from the Grayscale ETH fund since the launch of the Spot Ethereum ETFs have been one of the major factors driving the ETH price decline. However, it is not the only bearish development that has emerged for the cryptocurrency.

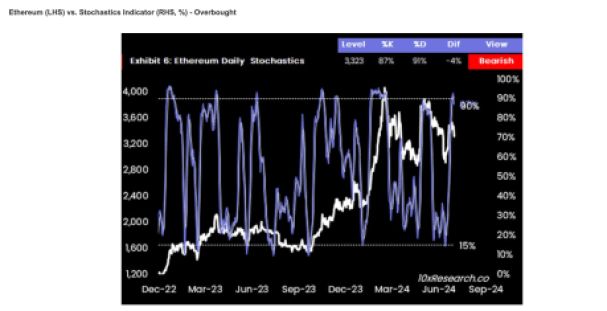

Thielen points out that the ETH price may have reached the top, using the daily stochastics indicator as a guide. Now, when the value of this indicator is low, it often means a buying opportunity and the price is hitting a low. Meanwhile, the value being high suggests that the ETH price may have hit its top.

According to the report, the ETH price had hit a score of 92% in the days leading up to the Spot Ethereum ETFs launch. Usually, a score above 90% is bearish for the price as it means the cryptocurrency is currently in overbought territory. Subsequently, the value of the stochastic indicator is expected to decline as investors offload their holdings.

So far, there have been a 5% decline from 92% to 87%, suggesting that there is still a long way to go before the ETH price stops bleeding. “Considering the recent rally and the potential overhang from Mt. Gox, the US earnings season, and the weak seasonals for August and September, it might make sense to press the Ethereum short a bit longer,” Markus Thielen said in closing.