Quick Take

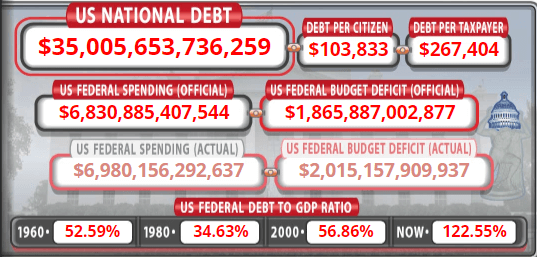

According to the US Debt Clock, the US national debt surpassed $35 trillion on July 30. This is a significant increase from $28.5 trillion recorded in July 2020 and $5.5 trillion in July 2000.

The rising debt has become a major political concern in the US and was discussed at the recent Bitcoin conference in Nashville. During last week’s conference, Senator Cynthia Lummis proposed the Bitcoin Reserve Bill, which aims to reduce national debt by holding a Bitcoin reserve for at least 20 years.

According to the US Debt Clock, interest on the debt, now at $906 billion, is nearly as high as the defense budget, which stands at $912 billion. This substantial interest payment limits funding for other critical areas, such as education. One reason the Federal Reserve should be cutting interest rates is to alleviate high-interest debt payments; however, this is complicated by persistent inflation, which remains above the 2% target.

Additionally, the M2 money supply continues to grow as the Federal Reserve has scaled back its quantitative tightening efforts. The next interest rate decision, scheduled for July 31, is highly anticipated as it could significantly impact the nation’s economic strategy. The market is largely expecting a pause, with the Fed funds rate likely to remain at 5.25-5.50%.

The post US national debt surpasses $35 trillion appeared first on CryptoSlate.