Quick Take

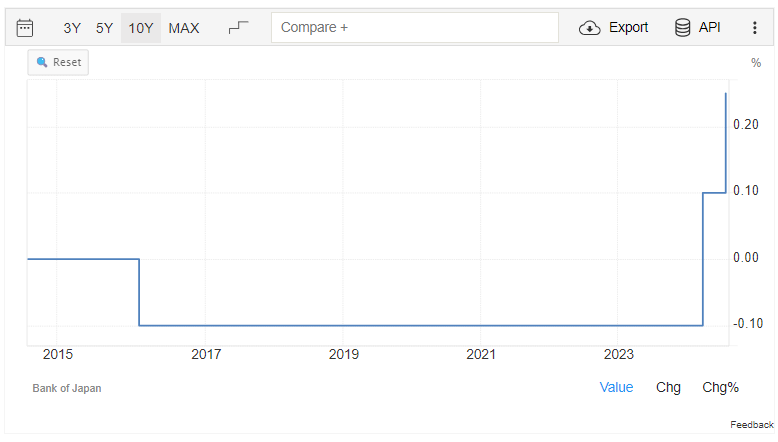

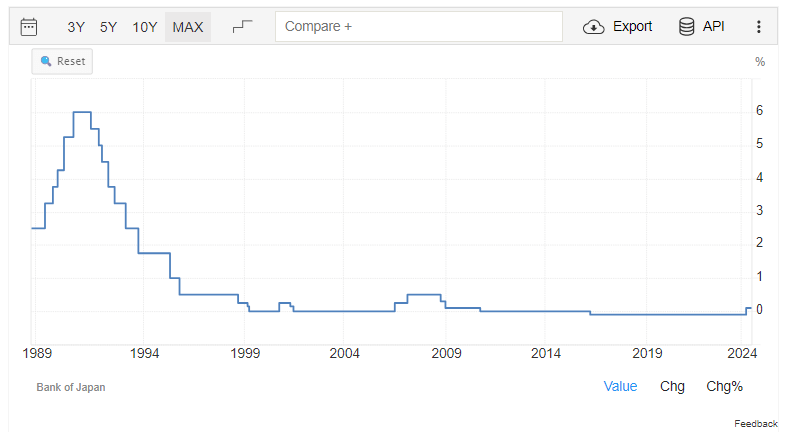

As reported by Trading Economics, the Bank of Japan (BoJ) has raised its interest rate to 0.25%, up from 0.1% in March. This is the highest rate since 2008. From 2016 until early 2024, the BoJ maintained negative interest rates at -0.1%.

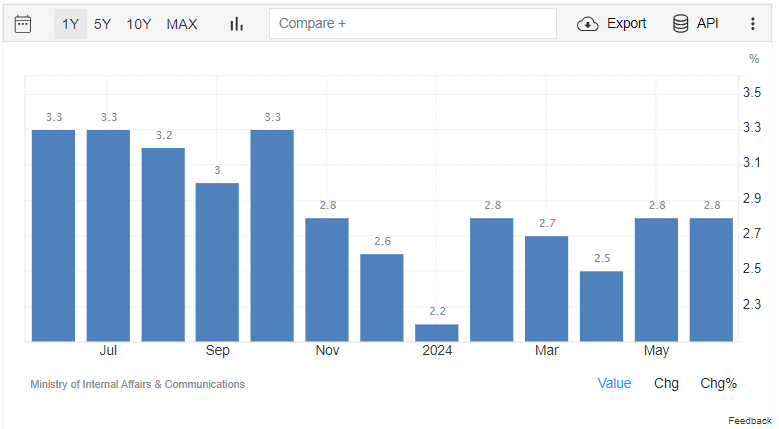

According to Trading Economics, the BoJ has indicated a plan to reduce its monthly bond purchases, aiming to shrink its substantial balance sheet, currently around $5 trillion. This move aligns with the central bank’s efforts to tighten monetary policy amidst inflation higher than the 2% target.

Historically, the BoJ’s interest rate hikes have preceded or coincided with official recessions since 1990, with notable increases in March 2007, September 2000, and September 1990, followed by recessions in March 2001, December 2007, and July 1990, respectively. The most recent hike on July 31, 2024, could echo this pattern, raising concerns about potential economic slowdowns.

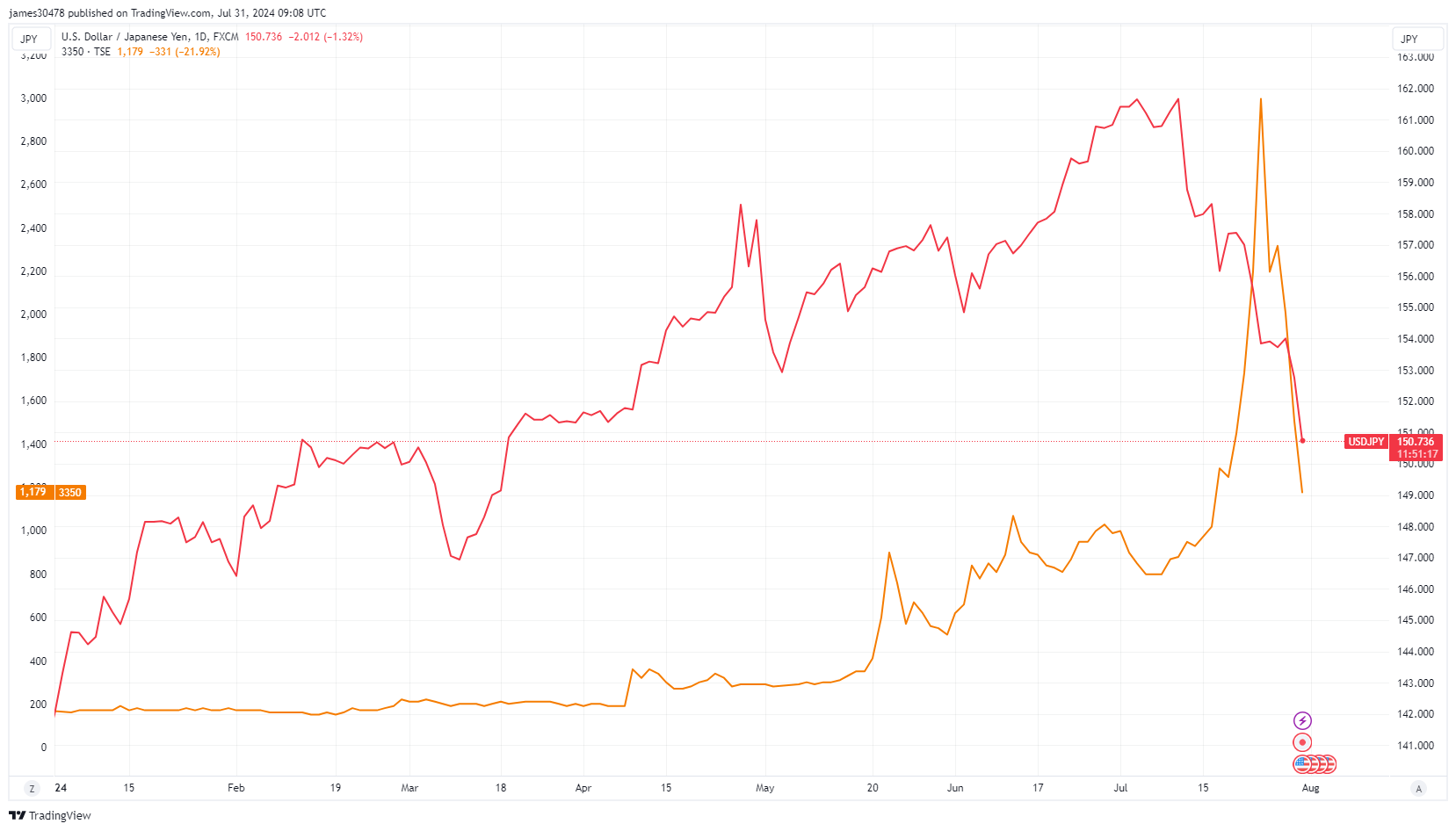

The USD/JPY exchange rate has also experienced significant fluctuations, currently at 150, down from 162 at the start of the month. Additionally, Metaplanet has seen its stock plummet by 22% on July 31, now trading at 1,179 JPY, less than half its peak value of 3,000 JPY.

The post Bank of Japan’s rate hike hits highest since 2008, Metaplanet shares drop 22% appeared first on CryptoSlate.