Bitcoin is shaky at spot rates, looking at the formation in the daily chart. The leg-up to spot rates meant the world’s most valuable coin shot by roughly 30%, rising from the pits of $53,500 to around $70,000 over the weekend.

Mt. Gox Overhang Gone, A Relief For Bitcoin

As prices cool off, rapidly finding rejection from the critical round number and roughly $2,000 from June 2024 highs, Glassnode analysts think Bitcoin is entering a new era. Citing the recent distribution of BTC by Mt. Gox creditors, Glassnode observed that the “overhang” that had held the industry ransom for roughly 10 years is easing.

After initial fears that the distribution of billions of BTC by Mt. Gox creditors would wreak the market were proven otherwise, prices rose. While there was success as the market showed how robust it had grown over the years by easily absorbing those coins, what’s important to note is the psychological milestone this event was.

Glassnode observed that slightly over 59,000 BTC have been distributed to hack victims via designated exchanges Kraken and Bitstamp. This batch was from the 141,686 BTC recovered from hackers, and Mt. Gox creditors plan to distribute the remainder in the days to come.

While some are relieved that a portion of the Mt. Gox haul has been distributed, it remains to be seen how prices will react in the coming sessions. So far, Bitcoin is within a narrow range, stuck primarily between $60,000 and the all-time high of approximately $74,000. A level deeper, there are key resistance levels to watch at $70,000 and $72,000.

If bulls manage to push prices higher, a break above $72,000 would be crucial. This line represents resistance of May and June, and is the last barrier before the rest of all-time highs.

The United States Government BTC Scare

Optimism is high, but prices fell yesterday after the United States moved approximately $2 billion worth of BTC, according to Arkham Intelligence data. The on-chain transfer of 30,000 BTC, later split into two batches, sent shockwaves across the BTC market, forcing prices lower.

While there were initial fears that the government planned to liquidate them hours after Donald Trump pledged to hold BTC as a strategic reserve, others speculate that these coins were being moved to a custodian. According to one user on X, the United States Marshals Service recently contracted Coinbase Prime to “safeguard and trade its large-cap digital assets portfolio.”

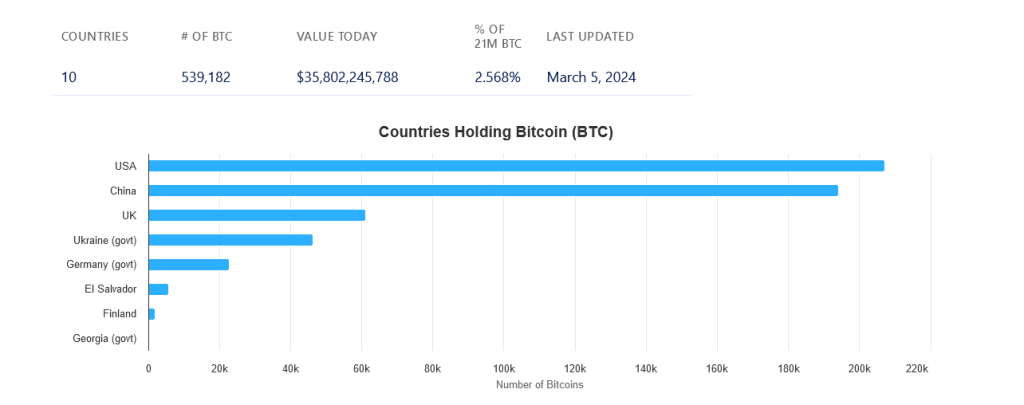

Bitcoin Treasuries data as of July 30 shows that the United States had over 207,000 BTC. This stash was mostly confiscated from criminals and other lawbreakers. China comes second, with 194,000 BTC held.