Quick Take

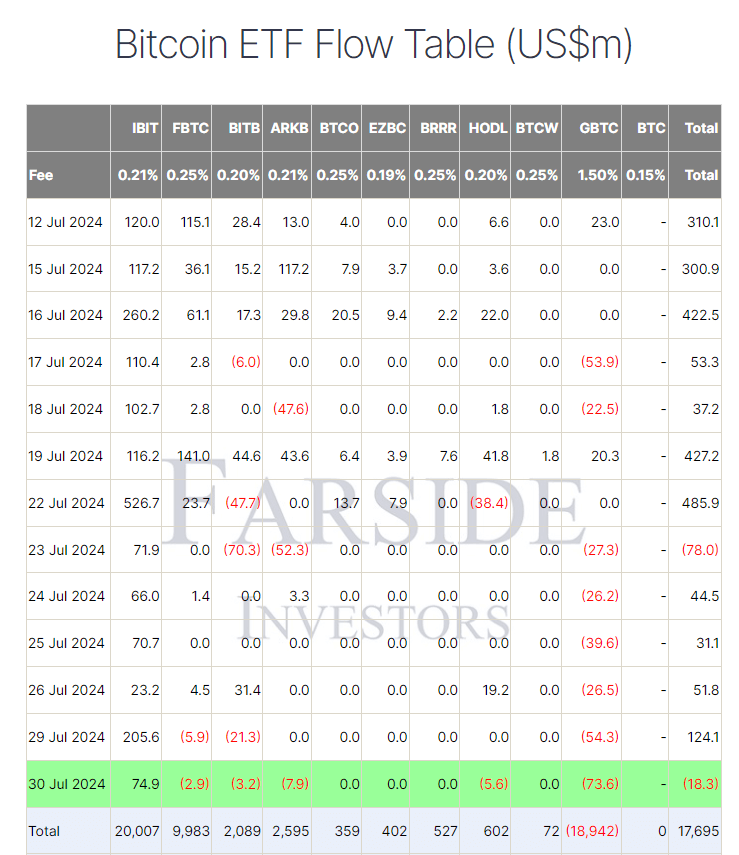

Farside data shows that on July 30, Bitcoin exchange-traded funds (ETFs) experienced an $18.3 million outflow, marking the first outflow since July 23. Outflows occurred across three of the four largest ETF issuers, including Bitwise’s BITB, ARK’s ARKB, and Fidelity’s FBTC. In contrast, BlackRock’s IBIT ETF stood out as the only ETF issuer recording inflows for the second consecutive trading day, adding $74.9 million and pushing its total net inflow past the $20 billion mark. Meanwhile, Grayscale’s GBTC saw its largest outflow since June 24, with $73.6 million exiting, bringing its total outflow to $18.9 billion. Despite these fluctuations, total ETF inflows amounted to $17.7 billion.

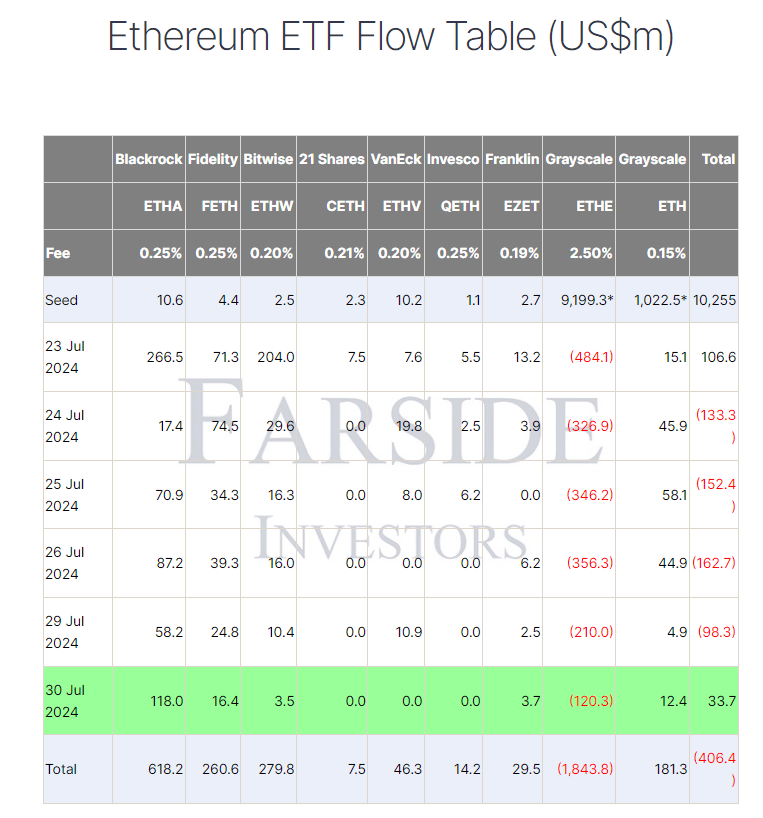

Farside data shows that the Ethereum ETF market recorded a net inflow on July 30, amounting to $33.7 million, for the first time since July 23. Grayscale’s ETHE had its smallest outflow at $120.3 million, while BlackRock’s ETHA achieved its largest inflow since July 23, with $118.0 million. This brought the total outflows in Ethereum ETFs to $406.4 million. Interestingly, BlackRock’s ETHA inflow surpassed its Bitcoin counterpart, IBIT.

The post BlackRock’s Ethereum ETF inflow surpasses its Bitcoin ETF inflow appeared first on CryptoSlate.